Seizing offshore wind investment potential in Southeast Asia

Vietnam and the Philippines have been gaining traction among offshore wind developers and investors. About half of electricity generation in these economies still comes from coal, while growth in electricity demand is among the highest in the region. Offshore wind is well positioned to cater to the rising demand or displace old coal-fired power plants owing to their large capacity and high capacity factor relative to solar or onshore wind. Yet, offshore wind in both markets is nowhere close to reaching a commercial stage—no single de facto offshore wind project is in full operation yet, the permitting process in many development stages is still obscure, and mobilizing resources from the international capital market remains challenging. Developers need to be wary of various challenges in permitting, supply chain, and financing when crafting a go-to-market strategy.

Vietnam and the Philippines have raised their ambition for offshore wind, capitalizing on their vast resource potential

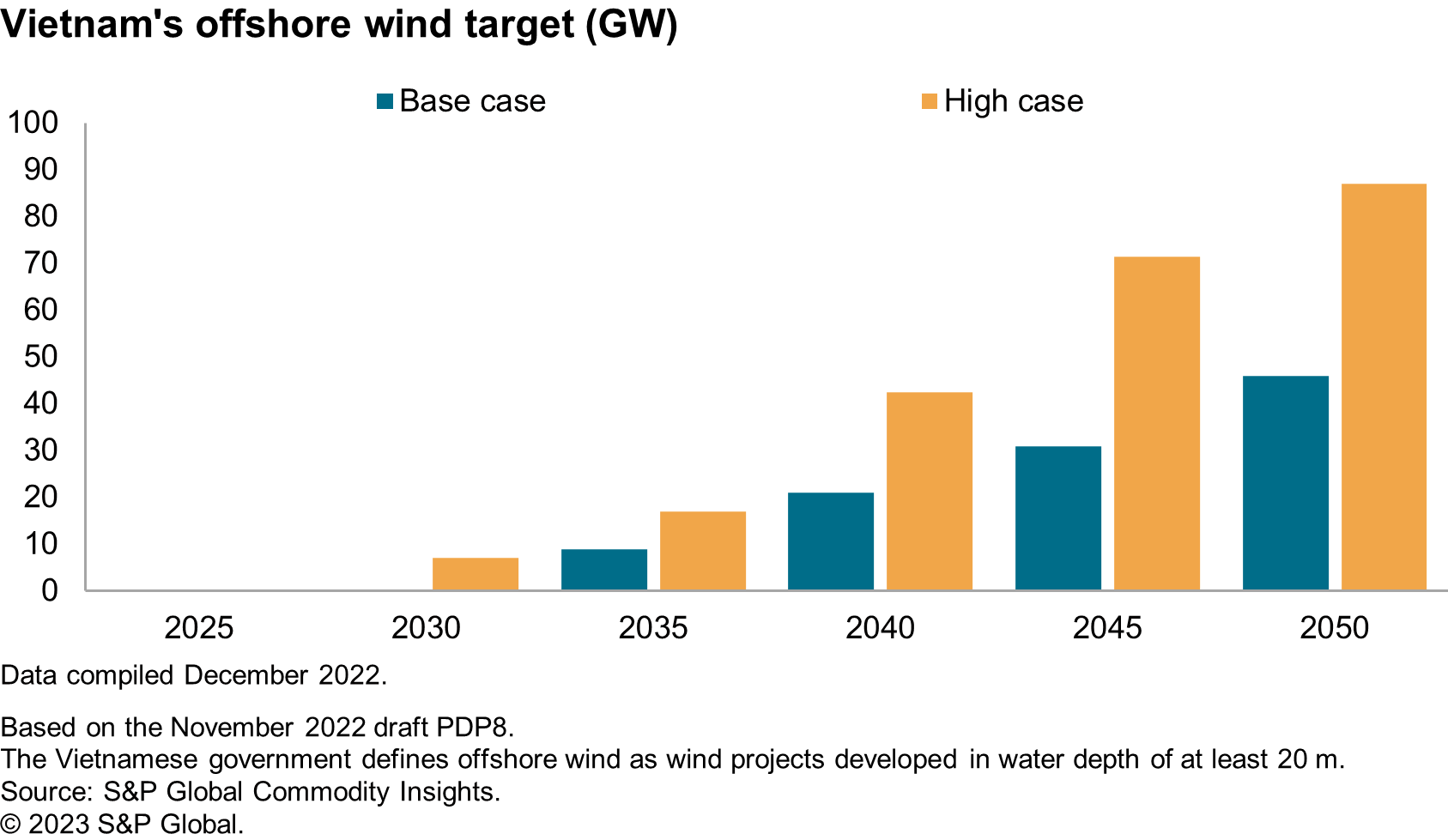

Vietnam has an ambitious offshore wind capacity target of adding between 46 GW to 87 GW by 2050, with the first tranche of up to 7 GW planned to come online between 2026 and 2030.

There is strong interest from major players such as Ørsted, Mainstream Renewable Power, Copenhagen Infrastructure Partners (CIP), and Equinor to preempt the vast market potential in Vietnam. However, frequent restatement of near-term targets and unclear rules in permitting, as well as a lack of a road map for the transition from FIT to tender, are posing uncertainty to many developers.

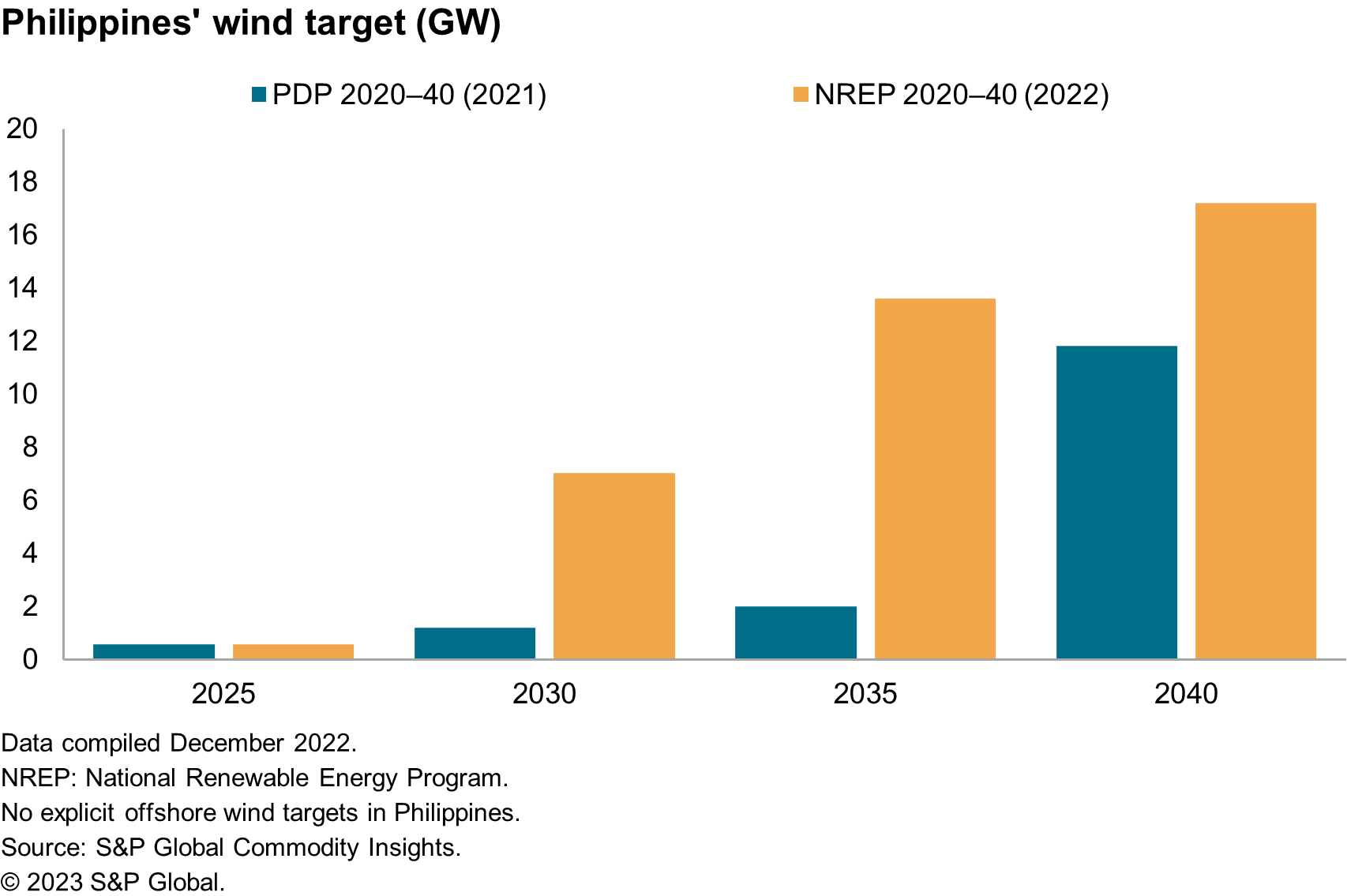

While there is no explicit offshore wind capacity target set in the Philippines, the DOE raised the wind capacity target for 2040 from 12 GW to 17 GW in the latest National Renewable Energy Program. The DOE is also responding to a growing interest from predominantly local players in offshore wind, with a draft executive order issued in November 2022 to strengthen and rationalize the regulatory framework for the immediate development of offshore wind projects. The market demand will also remain robust—the current Renewable Portfolio Standard (RPS) stipulates a minimum 1% increase in renewable generation per annum (and this is likely to be increased to meet the 50% of generation from renewables by 2040), underpinning the growth potential for offshore wind. Developers can explore various route-to-market options, including RPS, utility/corporate power purchase agreement (PPA), and merchant, capitalizing on a favorable market environment for companies.

International developers are actively seeking a partnership with Vietnamese firms

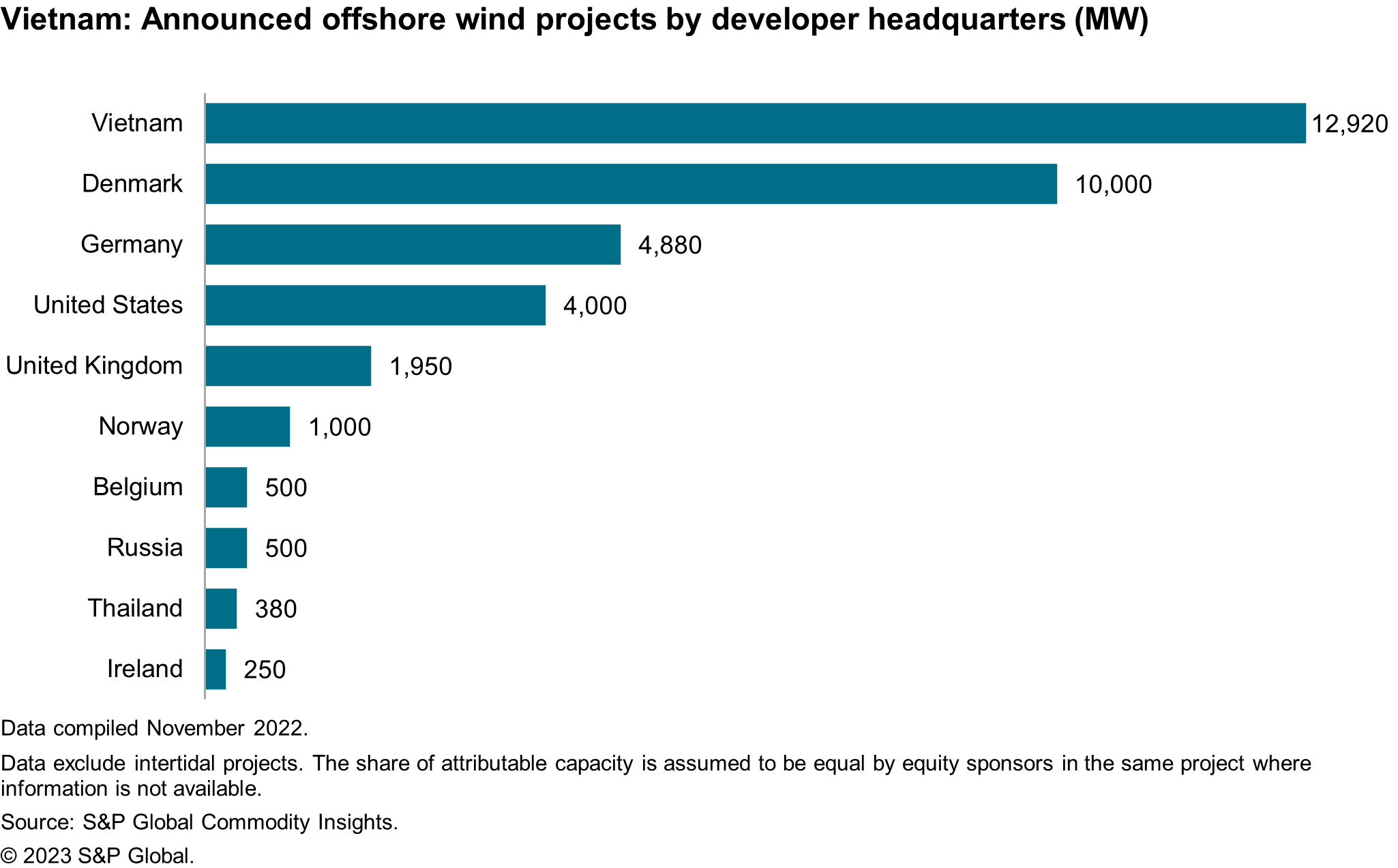

International developers are actively seeking a partnership with Vietnamese firms, with two-thirds of offshore wind project pipelines jointly owned by international and local companies. Companies headquartered in Europe make up 52% of total attributable capacity for offshore wind projects in a preconstruction stage, with firms from Denmark taking 10 GW in net capacity.

It is also worth noting that the role of regional players—mainly Singapore-, Philippine-, or Thai-based developers and independent power producers (IPPs) holding power assets across Asian markets—is not prominent in offshore wind projects, unlike their active role in solar or onshore wind projects. This is primarily owing to their limited experience in offshore wind relative to their European peers.

The new tariff proposed by EVN will make most transitional wind projects unprofitable

In Vietnam, the initial FIT of 9.8 cents/kWh, which expired on 31 October 2021, brought a couple of intertidal wind projects into commercial operation. These projects are often constructed with concrete foundations and do not require subsea foundations, thus their capex is 30-70% lower than the equivalent offshore wind projects in a deep-sea on a unit-capex basis. Based on S&P Global Commodity Insights analysis, these intertidal wind projects are expected to achieve 11-15% post-tax equity IRR, a range that is deemed commensurate with the hurdle rate of many developers.

However, there are other intertidal wind projects with 3.5 GW capacity that had signed PPAs but missed the deadline for FITs. On 7 January 2023, MOIT approved a price framework for transitional offshore wind projects alongside ground-mounted solar, floating solar, and onshore wind (Decision No.21/QD-BCT), with an FIT for offshore wind at 7.7 cents/kWh (1,816 Vietnamese đồng/kWh). This FIT is about 20% lower than the previous FIT at a time when many developers are faced with rising cost inflation, making almost no projects commercially viable.

Under this tariff, many projects may not be able to proceed to commercial operation, and some developers and investors may have to hold their projects until the new auction scheme is announced. Corporate PPA, albeit at the demonstration phase, should also be construed as another route-to-market in the absence of the next FIT structure.

Risk mitigation in financial structuring is required to unlock low-cost international capital

Most solar and onshore wind projects in Vietnam have been financed by local banks so far, because current PPA templates do not offer bankability by the international standard. However, Vietnam needs massive financing for offshore wind, which could not be provided by local lenders alone. Based on S&P Global Commodity Insights calculation, as much as $17 billion in lending will be needed to meet the draft PDP8 target of building 7 GW worth of offshore wind projects by 2030. With the benchmark lending rate expected to rise in order to fight inflation, which surpassed 5% last year, the Vietnamese offshore wind industry needs access to low-cost international capital to unlock its potential.

Attracting international lenders in high-risk emerging markets will call for additional risk mitigation, since they have more limited risk appetite than domestic banks. Some innovative financing vehicles have been explored in collaboration with domestic financial institutions to facilitate derisking instruments:

- Credit enhancement through arranging additional sponsor support has become a common approach by multilateral banks to facilitate project financing from international lenders.

- Export credit agency could also unlock international capital in high-risk emerging markets.

- Other debt instruments such as concessional loans and grants from donor nations could also catalyze a diverse pool of capital needed for Vietnam.

This post is an abstract of a featured topic from the S&P Global Commodity Insights series on energy transition in Southeast Asia, where we deep dive into various aspects of the region's power sector energy transition.

Vince Heo (Yoonjae Heo) is a director at S&P Global Commodity Insights, managing the Gas, Power & Climate Solutions team in Seoul, South Korea.

Posted on 18 January 2023

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.