Five major trends to observe in the energy sectors of the smaller South Asian markets in 2024

2024 expected to bring moderate economic growth and some consumer relief across the three South Asian markets. GDP growth slowed down in in Bangladesh and Pakistan, while Sri Lanka witnessed a contraction in 2023. Inflation and depreciating currency amid declining reserves led to tough austerity measures as the IMF stepped in to tide over the crises. In 2024, a moderation in Bangladeshi and Pakistani GDP growth and a strong rebound in Sri Lankan GDP is expected. Consumers, manufacturers, and service providers will get some relief from high inflation and plummeting currency as the foreign exchange crisis recedes.

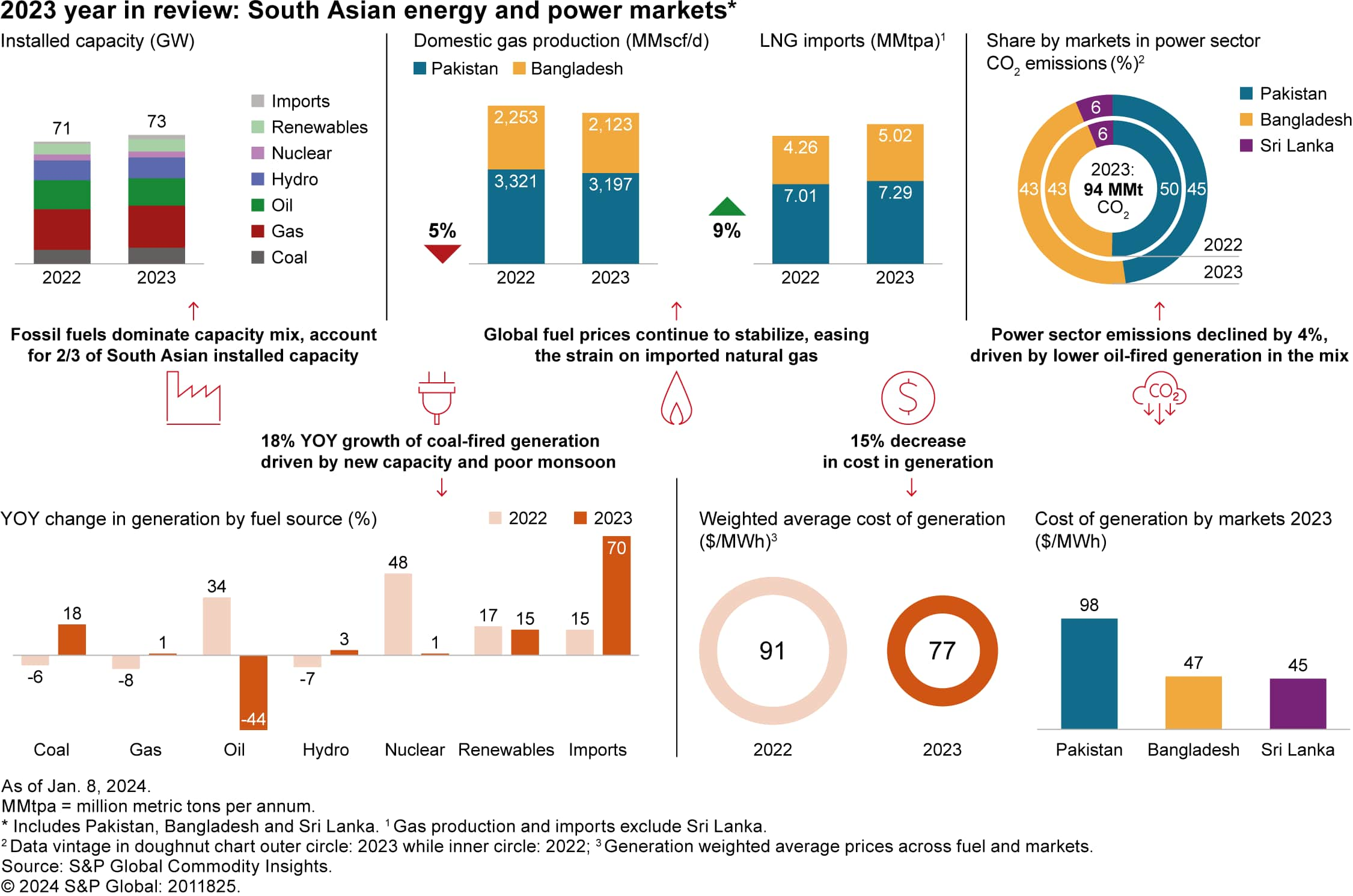

Fossil fuel will dominate capacity addition with increased share of gas and coal. Following a contraction in 2023, electricity demand is expected to rebound by 5% in 2024 owing to easier access to fuel markets and relatively stable financials compared to 2023. Regasified liquified natural gas (RLNG) generation is set to witness a second year of resurgence while oil will continue to be displaced from the mix. Coal-based power will occupy a prominent position due to its low price and good availability. About 75% of the capacity added in 2024 is estimated to be fossil-fuel based. Hydropower generates nearly 30% electricity for Pakistan and Sri Lanka, and both countries remain vulnerable to delayed monsoons that may spike peak power deficits. Despite an impressive pipeline, renewable penetration remains unimpressive across the three markets due to weakness in infrastructure and governance. About 1.3 GW renewable capacity additions are expected in 2024, and 650 MW of large hydropower.

Gas demand growth will remain muted owing to infrastructural and balance of payment bottlenecks. Overall gas demand is expected to remain constrained by slow infrastructure development, decreasing domestic gas production, and fiscal limitations. Nevertheless, a surge in LNG market activity is anticipated in 2024 due to expected price moderation. Despite a 5% decline in domestic gas production, Bangladesh and Pakistan are preparing for international bidding for exploration in 2024. Bangladesh is likely to achieve greater success as compared to Pakistan due to its relative financial and political stability. To alleviate budgetary concerns in these markets, there is an anticipation of a further increase in natural gas retail tariffs. Sri Lanka has recently entered the LNG arena and continues to face delays in establishing its inaugural LNG terminal.

Major reform activities to take shape as tariff rationalization emerges as the key intervention area. The IMF-driven agenda has generated a strong impetus towards structural reform in the three markets, notably seen in the string of tariff hikes ranging 15-35% across the markets in 2023. Governments will likely moderate the pace of these hikes in 2024 due to popular dislike and anticipated easing of conditions in the fuel markets. On the other hand, little has been achieved in terms of re-negotiation of power purchase agreements with independent power producers. Major policy announcements and notifications have been made towards systemic changes. In Pakistan, for example there is a National Electricity Plan (2023-27) to improve the efficiency of power system with the objective of 24x7 electricity supply by 20230. A landmark reform bill in Sri Lankan cabinet aims at unbundling system functions to promote private investment. Progress on such systemic reforms will continue, albeit cautiously in an era of increasing political and geopolitical uncertainties.

Multiple hindrances the adoption of renewables in the near term as captive users get set to lead innovation. Cumulatively across the markets, capacity additions expected in 2024 are less than half of the annualized targets, with ongoing administrative issues hampering the introduction of tendering process. Renewable pipeline has reached 25 GW as investors target developing markets, however more than 90% of this pipeline is in early stages of development and at risk of delays and cancellations. Rising electricity tariffs have been driving more commercial and industrial consumers towards rooftop PV (RTPV) and captive units, despite high initial investment required for such systems. Green hydrogen and ammonia projects have been announced by captive players in Pakistan, which will stimulate broader renewables deployment. Bangladesh and Sri Lanka are scheduled to kick-off their offshore wind feasibility studies with initial pilots targeted by 2028-30.

Customers can read the full report on the 5 major trends in the South Asian energy markets or log on to our Connect platform to view our full range of offerings on the South Asian energy markets. for moe information on our Asia-Pacific gas, power and renewables coverage, please click here.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.