Li-ion supply chain volatility puts alternative energy storage technologies in focus

Scale, cost and market access will determine future growth

Accelerated renewable deployment and fossil fuel phaseout are creating a growing flexibility gap that needs to be filled by clean technologies like energy storage.

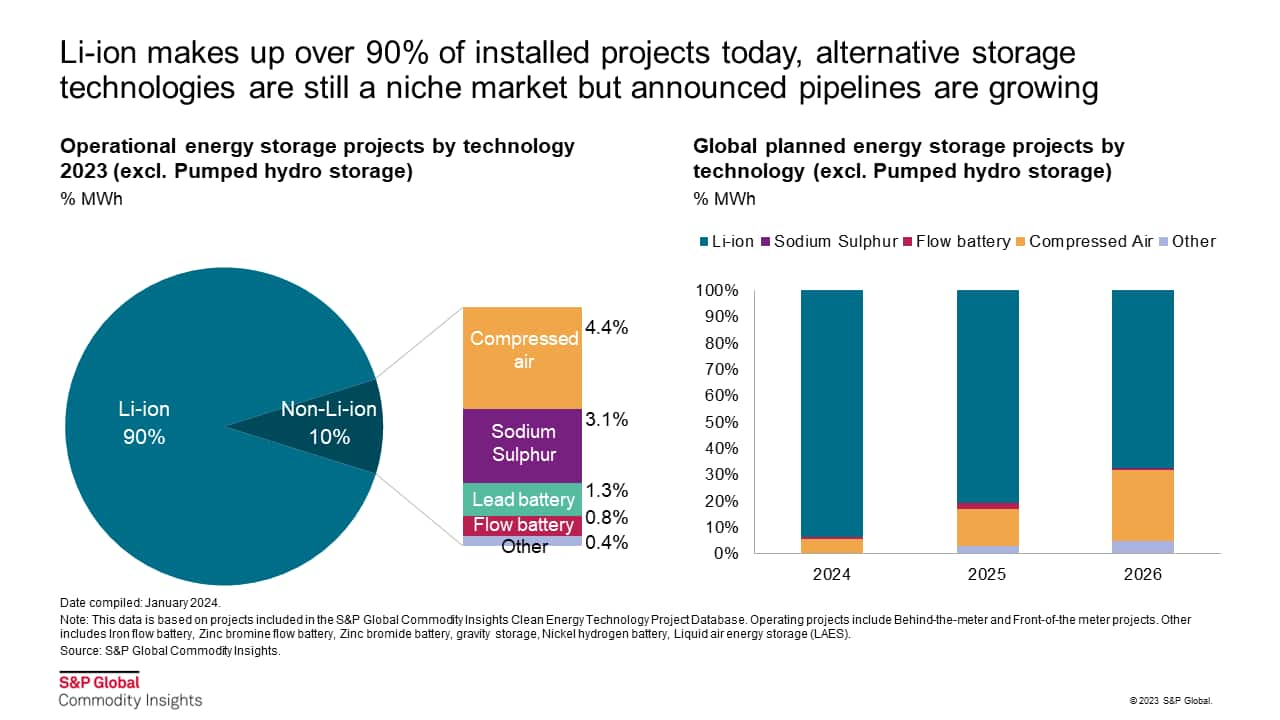

- Compounded by volatile supply chains leading to lithium price and supply shocks and increasing intent to localize supply and diversify technology portfolios, alternative storage technologies are gaining attention.

- Project pipelines of non-lithium storage technologies are growing, driven today mainly by specific procurements and tenders for long-duration storage (>8 hours) where many alternative technologies aim to compete. However, manufacturing and supply chains of many non-lithium technologies need to scale up massively and rapidly to meet a GW scale demand.

- Technologies that already have a proven project track record and can leverage component supply from adjacent industries are best placed to scale production and de-risk financing.

Authors:

Sam Wilkinson is a director within the Clean Energy Technology research team at S&P Global Commodity Insights, specifically responsible for the company's research of battery and energy storage markets, working closely with leading global suppliers to develop detailed analysis on these markets.

Susan Taylor, a research analyst at S&P Global Commodity Insights, provides research coverage on energy storage markets across Europe, the Middle East, and Africa with a particular interest in emerging technologies and cross-sector integration.

Posted 31 January 2024

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.