Florida’s natural gas market to see aggressive challenges from solar PV

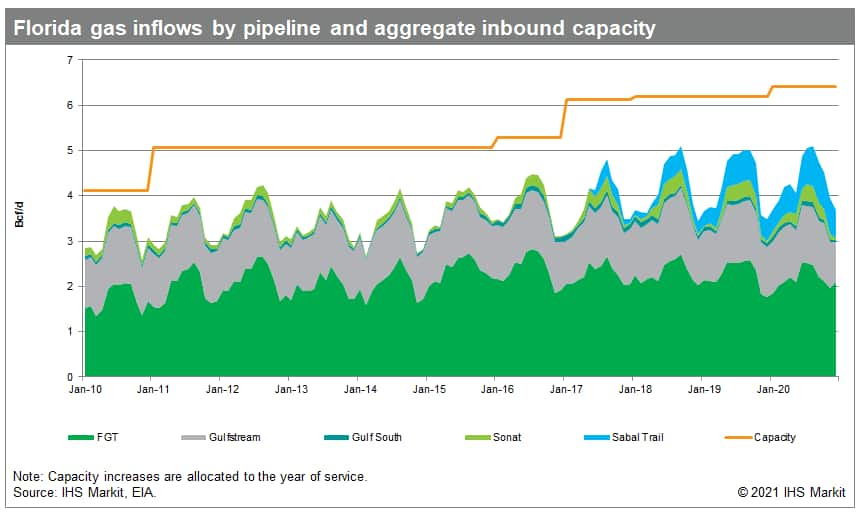

Natural gas has long had a captive market in Florida's power sector - marked by dependence on a handful of highly utilized pipeline systems running near capacity to serve the state's growing base of gas-fired power plants (see Figure 1). But a seismic push from the state's main utilities to decarbonize and expand renewable fuels will test the entrenchment of gas in the power generation mix.

Figure 1

Figure 1

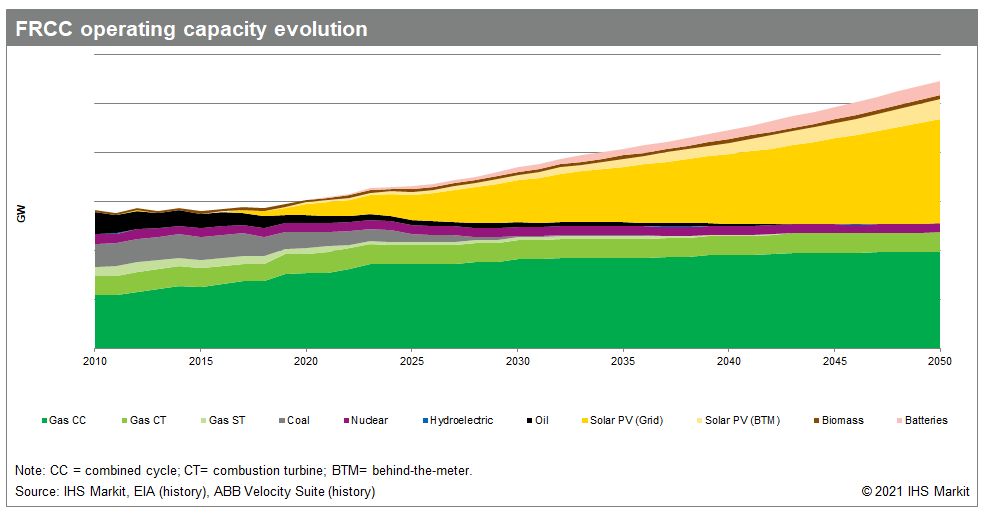

Florida already has about 5 GW of operating solar photovoltaic (PV) capacity between behind-the-meter (distributed generation) and grid-facing assets, capping off four years of rapid solar expansion driven by improved panel performance, significant cost declines and the national Investment Tax Credit (ITC) available to residential, commercial, and utility solar energy developers.

In the absence of a binding state renewable portfolio standard or a renewable target, large Florida investor-owned power utilities (IOUs) Florida Power and Light (FPL) and Duke Energy Florida (DEF), whose service territories encompass much of the state, have been constructing many large solar farms. Those farms have increasingly qualified as the least costly resource option for new generation capacity. These efforts have recently been accelerated by the companies' enhanced decarbonization ambitions set by their corporate parents. Even with the ITC declining to 10% for solar projects completed after 2023 based on the current legislation, IHS Markit projects that the solar build-out in the Florida Reliability Coordinating Council (FRCC) will continue at a brisk pace. Eventually, FRCC's power generation mix will be almost evenly split between natural gas and renewables, with nuclear and batteries playing important supplementary roles (see Figure 2).

Figure 2

Figure 2

Despite the massive projected renewable penetration in Florida, natural gas is well matched against solar PV in the battle for the power market. FRCC net on-grid electricity demand growth should remain fairly robust through 2050 with a compound average growth rate that's slightly higher than the US lower-48 average on a strong economic outlook and rising population. Rising solar power generation will slowly challenge natural gas' market share as solar output displaces some gas generation in the midday hours. However, there will remain a need for some alternative source of generation when solar output is limited or nonexistent, particularly in winter mornings and summer evenings. Absent a massive deployment of (still costly) utility-scale integrated battery storage, gas-fired generation will fill that role.

FRCC will also eventually retire the remaining coal-fired power plants by the late 2030s, amounting to about 6 GW of capacity. Utilities will seek to procure at least some firm and readily dispatchable gas-fired resources to replace these assets too.

Given Florida's projected demand trajectory, IHS Markit does not anticipate that major additional inbound pipeline capacity will be needed. Regulatory and environmental hurdles to costly greenfield construction could be high, while brownfield expansions along existing corridors will be more feasible. Three small initiatives with in-service dates slated for 2022-23 are already advancing through the FERC approval process and are expected to come online, only one of which expands inbound interstate capacity.

When Sabal Trail Phase 3 comes online in summer 2021, Florida's aggregate inbound pipeline capacity will reach approximately 6.5 Bcf/d, nearly a 60% increase from 2010 levels. Sabal Trail Phase 1 started in July 2017 with 0.8 Bcf/d of capacity. Phase 2 began in May 2020, increasing throughput capability to just over 1.0 Bcf/d via compression upgrades, and Phase 3 is on track to add another 76 MMcf/d by May 2021. Monthly inflows peaked at 5.1 Bcf/d in August 2020, suggesting that some headroom for flow growth is generally available, absent localized pipeline constraints and service area limitations.

For more about our natural gas and power research, visit our service page for our North America Regional Integrated Energy service.

Suzanne Edwards, senior research analyst with the Climate and Sustainability team at IHS Markit, focuses on regional natural gas supply and demand fundamentals, analyzes transportation infrastructure, storage, and the outlook for gas prices.

Nikolay Filchev, an associate director in the Global Gas team at IHS Markit, is an expert in North American natural gas markets with a focus on regional dynamics and exports.

Posted on 29 March 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.