IHS Markit forecasts 2021 to be a banner year for solar PV in the United States

Despite the supply and demand challenges that PV faced in 2020, the US solar market had its largest installation year to date. Over 22 GWdc of PV installations were completed in 2020, with utility-scale projects representing 77% of that volume. A renewable-friendly administration, an extended ITC schedule, increasingly competitive pricing, and a massive late-stage project pipeline will drive strong growth for the United States in 2021.

IHS Markit forecasts that the united states will install over 20 GWdc of utility-scale PV installations in 2021, making it another banner year for solar. Notably, the utility-scale segment already has over 11 GWdc of projects already under construction in 2021. Other contributing factors to the growth of solar this year is the transition of coal states to renewable generation in the near-term; states like Illinois, Virginia, Pennsylvania, and Kentucky have large PV pipelines in 2021 through 2025. Moreover, continued corporate procurement for PV generation and aggressive net zero goals by large utilities across the country will ensure growth will be maintained for solar in the next five years.

ITC extension's effect on residential and non-residential installations

On 21 December 2020, both houses of Congress passed a large COVD-19 and funding bill that included a two-year extension of the solar Investment Tax Credit (ITC), a one-year extension on wind production tax credits (PTC), and funding for energy research and development programs, among other provisions. The extension of the ITC will likely reshuffle the demand for PV projects from 2022 through 2025 as investors seek to capture the ITC 26 and safe harbor provisions at a price point that is beneficial to their returns. Allowing two additional years for the 26% credit will improve the economics of solar overall as the credit will now be coupled with a smaller tariff for solar cells and modules, assuming the tariff is not extended.

For the residential market, homeowners across the country had been rushing to secure the ITC 26 by installing solar in their homes in 2020, despite challenges posed by the COVID-19 pandemic. However, the residential segment is more sensitive to tax credits than the non-residential segment; the extension will drive an immediate spike in demand followed by declines that are correlated to the ITC step-down.

The two-year solar tax credit extension is expected to spur more demand for residential and commercial systems in several emerging markets—2021 will be an important year for residential installers, but demand from consumers from 2022 onwards will taper off as mature markets reach saturation and net metering and distributed solar programs continue to be challenged and modified across the United States.

New markets, continued growth

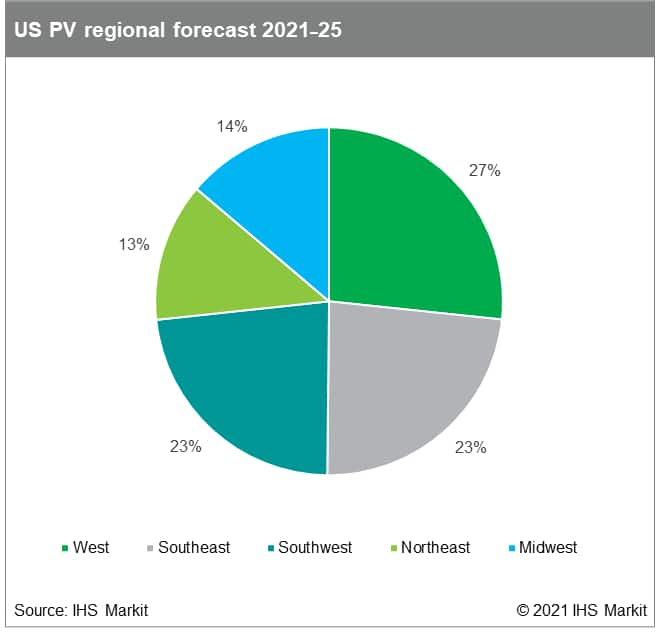

In 2021, the Midwestern and Southern regions of the United States will be responsible for 60% of PV installations in the country. States like Illinois, Ohio, Georgia, Florida, and Texas will contribute to a large portion of installation volumes in these regions. Demand for PV in the Midwest is forecast to be primarily driven by the utility-scale market as utilities seek to comply with varying levels of renewable energy and emission reduction goals.

Similarly, in the Southeast, large utilities such as Duke Energy, Georgia Power, Dominion Energy, and Florida Power & Light are driving demand for utility-scale PV through cost competitive, voluntary procurement mechanisms. These utilities, amongst others, have set aggressive net-zero, renewable energy generation targets that will require solar PV procurement in the near term. Moreover, utility partnerships with large corporations are driving further demand for utility-scale PV.

In the Southwest, IHS Markit forecasts the utility-scale PV segment will drive demand, with most of the installations attributed to Texas' massive PV growth that is expected to continue through 2025. Although utility-scale installations will dominate the market in Texas, the residential segment also gained momentum in 2020 and will sustain similar levels in the short-term as consumers take advantage of the extended ITC and utility incentives like rebate programs.

New York's ambitious green goals

Historically, the residential and commercial PV segments have driven most of the demand in the Northeastern region and will continue to do so. However, due to New York's aggressive utility-scale goals, the large-scale segment will account for over half of PV demand in the region. Recently, the State announced 23 utility-scale project that have a combined capacity of 2.2 GW. Additionally, the New York State Public Service Commission (PSC) have approved to build a 55-mile transmission line that aims to enhance reliability and speed the flow of energy from upstate NY to the lower parts of the state.

New Jersey, Massachusetts, and Maryland will also help drive most of the PV growth in the Northeast US in 2021. Lawmakers across the region have been putting forth policies that could help PV growth, though some have been more successful than others. Earlier this year, Governor Charlie Baker of Massachusetts vetoed legislation that required the state to achieve net-zero emissions by 2050, more recently, the Governor has suggested amendments to the bill and is awaiting a response from state's Legislature.

Storage capitalizing on PV policies

IHS Markit forecasts that installations of energy storage capacity in the United Sates will account for over 5 GW in 2021. The extension of the ITC will likely improve solar-plus-storage system economics and enable energy storage projects to be co-located with PV to benefit from a reduced tax burden through 2025.

The Federal Energy Regulatory Commission's (FERC) Order 2222 that was passed in 2020, opens wholesale markets to behind-the-meter- energy storage, but it may take longer than expected for this ruling to become a strong market driver. Order 2222 aims to allow distributed energy resources (DERs) to participate in wholesale power markets by bundling together as a single bidding entity. Recently, regional transmission organizations and other stakeholders have requested an extension to FERC Order 2222 citing too short of a timeline to implement the ruling.

While the United States will continue to extend its dominance in the storage market, incentives for storage are still lacking in the country, with a stand-alone storage tax credit not easily guaranteed as Democrats control the Senate by a small margin. In the near-term, the most consequential federal policies benefitting the energy storage industry will likely be in the form of executive actions.

For more information about our solar PV research, visit our Global Clean Energy Technology service page.

Maria Jose Chea is a solar market analyst for the Clean Energy Technology team at IHS Markit.

Posted on 29 March 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.