From Fuels into more Petrochemicals

Most of last year was relatively quiet in terms of large public announcements from downstream operating companies around investment decisions for refining and petrochemical assets. The lack of announcements was understandable since more important geopolitical events were taking place in many regions around the world. In addition, refineries were enjoying record margins producing transportation fuels, so there was little need for changes - especially changes requiring investment capital.

However, current bumper refinery margins aren't expected to last. The energy transition will continue impacting the downstream industry both in expected and unexpected ways. Longer term, the reduced need for transportation fuels will impact refinery utilization around the globe, ultimately resulting in refinery closures as industry consolidates.

With lower demand, lower crude oil refinery runs result in less available supply of petrochemical feedstocks - such as naphtha. It is uncertain how exactly the industry reconfigures to meet demand of petrochemical feedstocks. While there has been a lot of excitement from announcements surrounding potential bio-feedstocks and plastics circularity through recycling - we believe novel technology processing applications in 'crude oil to chemicals' also have an important role in meeting the petrochemical feedstock supply gap.

A couple recent public announcements illustrate, what we believe to be an emerging long-term trend. Towards the end of last year, November 2022, Saudi Aramco and S-Oil announced the $7 billion Shaheen project in South Korea to convert crude oil into petrochemical feedstock representing the first project to commercialize a new design and application of crude oil to chemicals. Then last month, March 2023, Aramco announced an investment in a 300,000 b/d refinery facility and 1.65 million tons steam cracker along with 2 million metric tons of paraxylene, making more petrochemicals from crude oil.

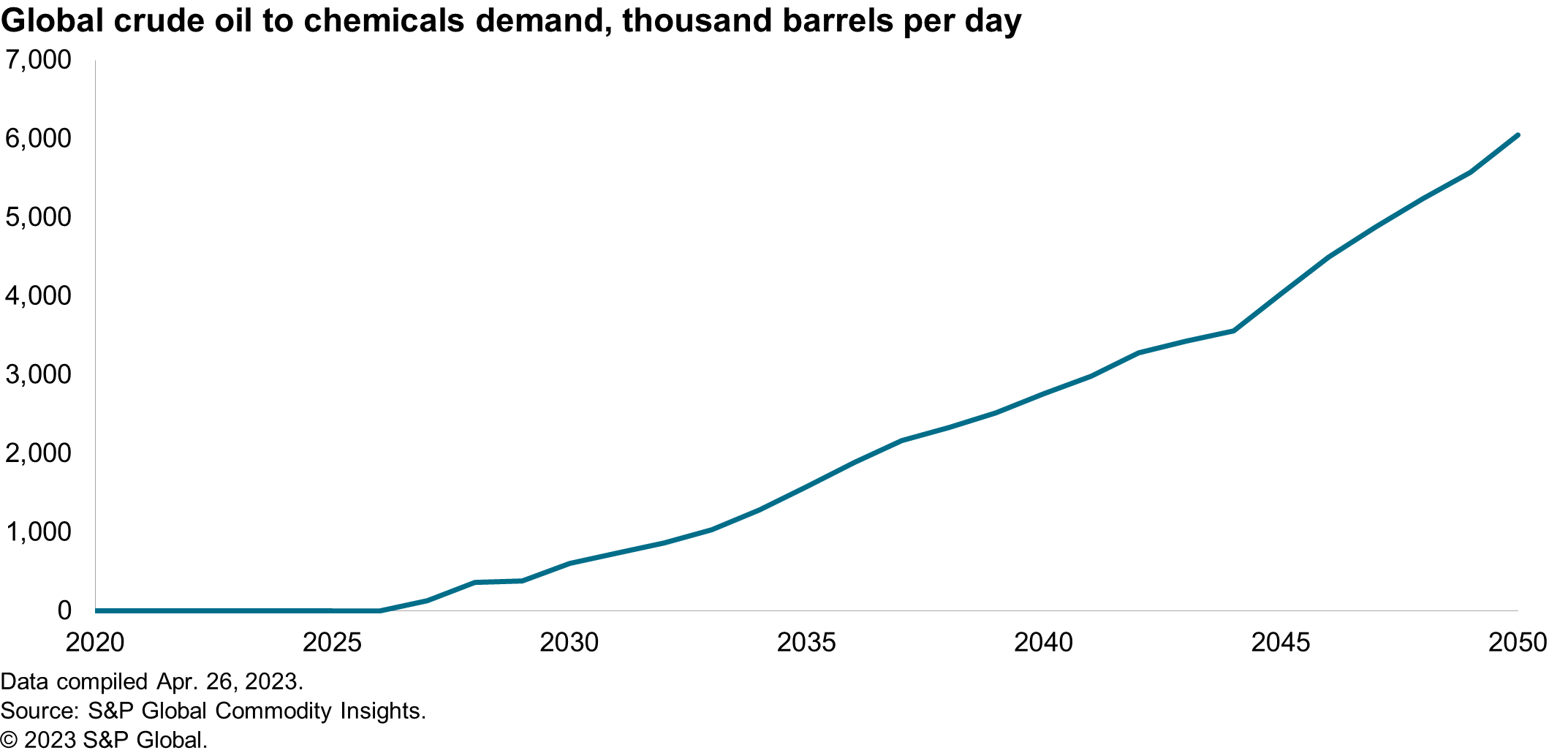

One of the potential avenues for refineries in the future is to shift product slates more from fuels into petrochemicals, so we expect similar public announcements to continue. Our latest long-term forecasts, published in April 2023, show slightly over 6 million b/d of crude oil consumption to chemicals by 2050 in new 'crude oil to chemicals' specific configurations. For some downstream operators, 'plastics are the future' again.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.