The Peak Challenge: The role of natural gas in decarbonizing US lower-48 residential and commercial heating demand

Though the structure of residential and commercial heating demand supplied by natural gas in the US Lower 48 has been relatively stable for many years, that may be set to change owing to federal, state, and local policies aimed at decarbonizing the US building sector.

Achieving building decarbonization targets requires low- or zero-carbon heating systems to replace fossil-fuel-based heating systems. Increasingly, heat pumps have been favored as a solution to decarbonize building heating by electrifying fossil fuel furnaces on top of providing increased energy efficiency.

However, S&P Global Commodity Insights research shows that fully electrifying residential and commercial building heat would likely require massive investment in power generation, transmission, and distribution capacity to reliably serve customers, and that investment would be just for a few cold days each year.

An alternative to blanket electrification - especially in colder climates - that could minimize the peak demand impact on the power grid and still aim to decarbonize space heating in existing buildings is to utilize existing natural gas infrastructure and pair air-source heat pumps (ASHPs) with existing gas furnaces under a hybrid configuration. Our latest North American Natural Gas and Power Market Outlooks acknowledge the growing interest and likelihood of ASHP and hybrid adoption for the building sector.

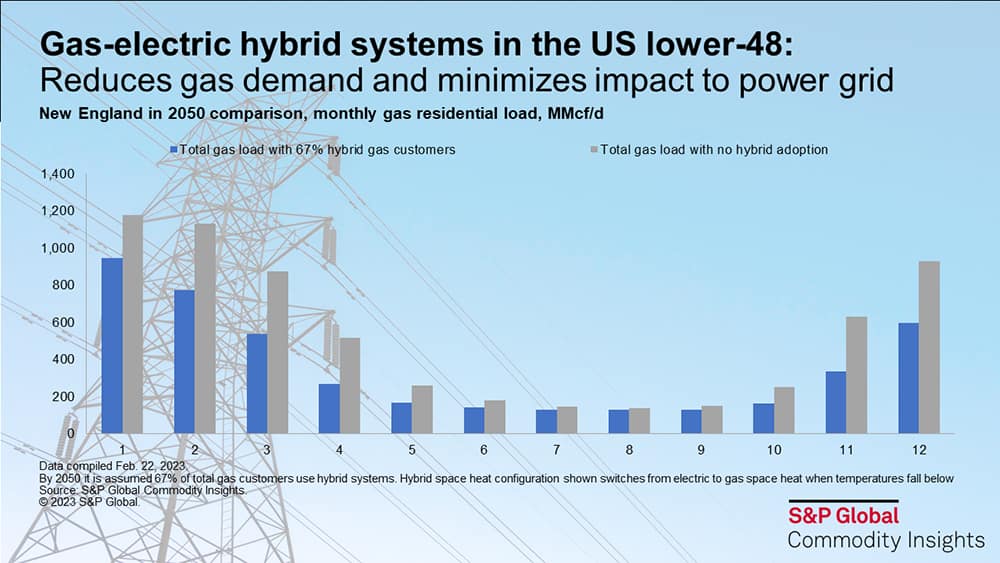

Importantly, in cold climates, widespread adoption of hybrid heating systems would have only a limited impact on peak monthly natural gas demand, requiring the existing gas grid to remain operational at its current capacity to allow reliable gas deliveries during the coldest months

Electric-only building heat increases winter peak power demand, requiring expansion of power infrastructure capacity

To illustrate, of New England's roughly 6 million homes, only 15% of households currently have electric heating, with natural gas providing 40% and mostly fuel oil providing the rest. Assuming an average-sized ASHP with an average efficiency rating, a typical home in New England is roughly estimated to consume 6-7 kWh per hour for space heating on a very cold winter day. Based on this example, in aggregate, the New England electrical peak winter capacity would need to meet nearly 40 GW of residential space heating demand alone on a cold winter day. By comparison, currently, the New England grid all-time winter peak demand sits at just over 22 GW with over 31 GW of installed electricity generating capability.

Gas-electric hybrid systems enable building decarbonization goals to be realized while not overwhelming power system capacity

A complement to full electrification that could minimize the peak demand impact on the power grid and still aim to decarbonize space heating in existing buildings is to utilize existing natural gas infrastructure and pair ASHPs with existing gas furnaces in a hybrid system. In such hybrid gas-electric configuration, the ASHP would be the primary space heater, but peak heating needs would be provided by the gas furnace when outdoor temperatures fall below user-defined thresholds, typically during the coldest hours of the year.

S&P Global Commodity Insights research shows that on an aggregate level, the widespread adoption of gas-electric hybrid systems would cap the level of electric power demand needed by calling on gas as a backup source of heat and thereby mitigating the need for additional electrical infrastructure. Assuming an average-sized ASHP with an average efficiency rating, and with a user threshold set at a conservative 30 degrees F during a relatively mild winter, we estimated that the heat pump would be used for about two-thirds of the total heating load (figure below).

In our latest North American Natural Gas Long-Term Outlook, we estimate that by 2050, a moderate 11% of the total residential natural gas customers across the US Lower 48 will utilize a hybrid gas-electric heat pump that only uses natural gas as a backup on the coldest hours of the year. The rate at which hybrid gas-electric heat pumps are assumed to be adopted varies by location and is driven by climate differences and the varying degrees to which states/provinces and localities have addressed electrification policy.

Transitioning to gas-electric hybrid systems requires the existing gas grid to remain operational at its current capacity to allow reliable gas deliveries during the coldest months

Widespread adoption of hybrid heating systems would have only limited impact on peak monthly natural gas demand in cold climates. The New England residential natural gas market, with currently roughly 2.8 million gas customers, typically has peak monthly gas demand of of 1.2 Bcf/d during winter. Under an aggressive case for hybrid gas-electric heating where 67% of residential gas customers adopt hybrid gas-electric space heating systems by 2050, monthly average peak gas requirements during the winter fall by 17%, or from 1.2 Bcf/d to 1.0 Bcf/d (see figure under the title section). At the same time, residential gas demand under this scenario would be cut by nearly 40% from its current levels, significantly helping to meet decarbonization goals. Since peak monthly gas demand levels do not fall to the same extent, this would require capacity to be held on existing gas infrastructure to reliably meet peak demand even though that peak pipeline capacity would only be utilized on the coldest hours of the coldest days.

A combined natural gas-electricity approach to building heat also sets the stage for conversion of the gas infrastructure to lower or zero-carbon fuels when they become available

Gas-electric hybrids and decarbonization goals are not exclusive concepts. Over time, the use of conventional natural gas can transition over to hydrogen or renewable natural gas to provide fuel for low-carbon heat. In a decarbonized future, gas-electric hybrid systems can be a complementary alternative to full electrification in locations where the capacity for additional strain on the electric power system is limited

Learn more about our North American gas and power research.

Callie Kolbe, a director at S&P Global Commodity Insights, has a decade of experience covering North American natural gas markets, including recent research related to building decarbonization policy and its impact on regional gas markets.

Benjamin Levitt, associate director for the North American Power and Renewables research team at S&P Global Commodity Insights, covers Canadian power markets, focusing on Alberta and Ontario, and follows regional policy, technology, and generation trends.

Posted 3 May 2023

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.