From vision to reality: Uncovering the strengths and challenges of India's National Electricity Plan 2023

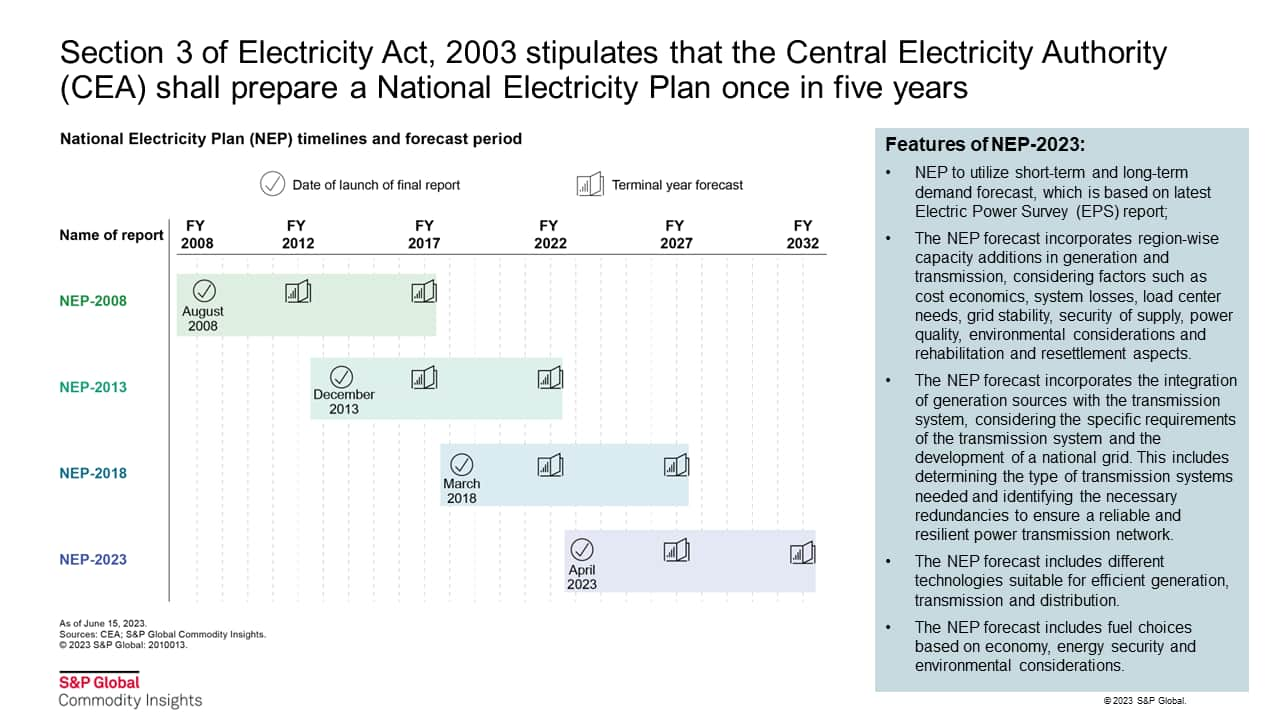

In April 2023, India launched fourth iteration of its National Electricity Plan (NEP) providing electricity supply mix projections for the terminal years FY 2027 and FY 2032. S&P Global Commodity Insights analyzed and compared NEP projections to its own outlook to highlight the challenges in meeting the NEP projections.

The NEP serves as a comprehensive framework for India's long-term electricity sector development. It encompasses various power generation options, including conventional sources like coal, natural gas and hydro, as well as renewables such as solar, wind and biomass. The current iteration of the NEP emphasizes the importance of storage systems, including pumped and battery storage, in meeting electricity demand and ensuring reliability. It provides insights into each generation source's potential contribution to the overall electricity mix and assesses their dispatch at an hourly level.

In order to assess the NEP's projections and strategies, a critical analysis has been conducted, comparing them with the latest forecasts from S&P Global Commodity Insights and alternative perspectives.

Key highlights of analysis:

- Demand growth remains aggressive: NEP-2023's demand forecasts have been consistently 4%-5% higher than that of Commodity Insights-2023 forecast driven by various factors.

- Insufficient model structure: NEP-2023 forecast and analysis is based on five-node all-India model. The approach does not capture sufficient intricacies of inter-state transmission framework. This may lead to conservative estimates on renewable generation curtailment and inter-state transmission congestion.

- Significant capacity absorption gap for renewables: Although NEP-2023's planning acknowledges the shifting market dynamics with a rapid transition to renewable energy along with storage but NEP-2023's forecast for renewable capacity addition reflects a significant disconnect from the system's actual ability to source, install, connect and utilize renewable capacity (primarily wind and solar).

- Adding renewable capacity when existing coal capacity is underutilized: NEP-2023 forecasts an average capacity factor of 58% for coal plants in FY 2027 and FY 2032. Further, NEP-2023 forecasts that instead of improving coal capacity factors from the FY 2027 to FY 2032 period, more renewable capacity gets added. This is an expensive proposition given that variable cost of operational coal plants is lower than total cost of building a new renewable plant. This may also lead to larger stranded coal capacity and unwanted burden of fixed cost on DISCOMs.

- NEP-2023 projecting very high peak reserve margins (of more than 35% in FY 2032) for system, indicating high potential of stranded thermal capacity.

- Increasing renewable curtailments: In FY 2032, NEP-2023 forecasts curtailments of 39 TWh (3.3%) of total renewable generation, which could be as high as 10% for renewable-rich states.

- Scenario analysis by NEP-2023 leaves a number of unanswered questions for stakeholders.

- Increasing role of storage technologies: NEP-2023 and Commodity Insights-2023 forecasts a growing role for storage technologies to facilitate the integration of renewable energy into the grid. However, the quantity of storage installed differ significantly.

- Pumped storage prevails over battery in short to medium term: Levelized cost of electricity (LCOE) analysis (by both Commodity Insights-2023 and NEP-2023) indicates that pumped storage is a more cost-effective solution in the short-to-medium term compared with chemical battery storage system, however, pumped storage additions are marred with other challenges.

- Role of imported coal: Contrary to NEP-2023, Commodity Insights-2023' forecast indicates imported coal is expected to play a significant role in meeting India's electricity requirements.

- Declining role of gas-based generation, in line with Commodity Insights-2023' forecast: With declining domestic gas supply to power sector, gas-based generation is anticipated to limit its role as a peaker generation.

- Similar to Commodity Insights-2023' assessment, NEP-2023 forecast infrastructure and technology challenges pose hurdles in the short-to-medium term for the development and scale-up of renewable energy, requiring urgent attention.

This analysis aims to equip industry stakeholders with valuable insights to make informed investment decisions in the power sector. By comparing the NEP with Commodity Insights forecasts and considering market dynamics, technological advancements and regulatory developments, this critical analysis seeks to provide a deeper understanding of the NEP's strengths, weaknesses and alignment with market realities. This assessment will assist industry stakeholders to make informed investment decisions, mitigate risks and capitalize on opportunities.

Learn more about our APAC energy research.

Ashish Singla, an associate director with the Gas, Power, and Climate Solutions team at S&P Global Commodity Insights, covers power and renewables research for South Asian countries.

Posted 12 July 2023

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.