GHG intensity of US Gulf of Mexico production in 2022

For more than 70 years, beginning with the first offshore well drilled in 1947 (Ship Shoal Block 32), the US Gulf of Mexico (GOM) has been a hub of oil and gas production. Today, the vast network of offshore platforms, pipelines and subsea wells that dot the GOM are a key driver for economic activity, jobs, and energy security.

GOM oil and gas production involves resource extraction from either deepwater or near-shore shelf terrains. Historically, production has shifted from the shelf to deep water, which comprised 86% of 2022 production. To provide insight into the greenhouse gas (GHG) intensity of US GOM upstream operations, data from Commodity Insights' Vantage was used to analyze upstream scope 1 emissions profiles of all major producing assets in the US GOM in 2022. For this study, all assets were consolidated into primary asset hubs, where a hub defines a production area or facility that is central to one or more surrounding fields. GHG estimates include carbon dioxide, methane, and nitrous oxide (CO2, CH4, N2O) and sources, including fuel gas and diesel combustion, flaring, fugitives, and venting.

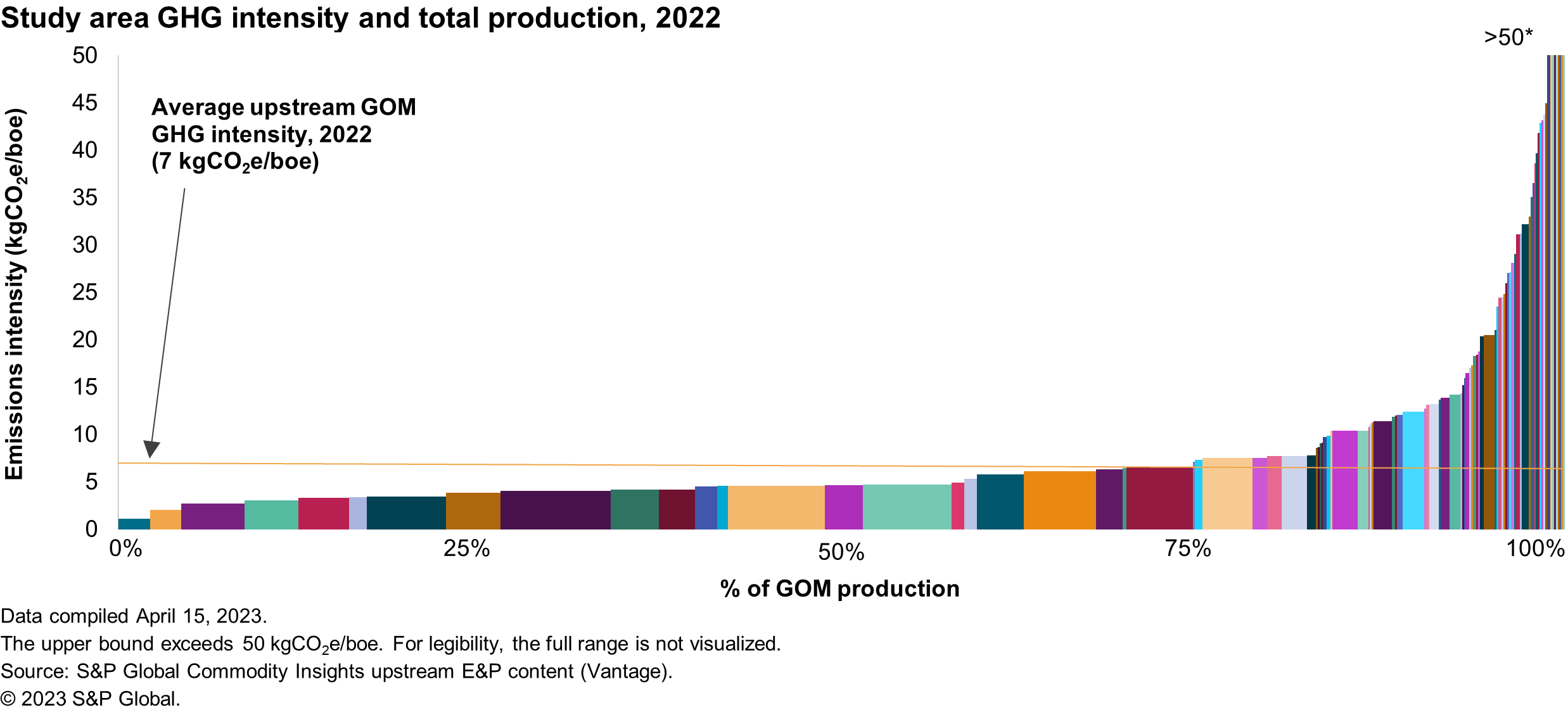

Our analysis found that the estimated production weighted average GHG emissions intensity for the GOM in 2022 was 7 kgCO2e/boe. Comparing this to other producing regions analyzed by Commodity Insights, the GOM lies below the production weighted average emissions intensity of 12 kgCO2e/boe for total North Sea production in 2021[1], however, the production weighted average emissions intensity for the GOM in 2022 and Norwegian North Sea production in 2021 is roughly comparable. Caution is advised when linking basin-wide averages to any individual operations as they can deviate significantly from the average. In the GOM, for approximately 99% of the total production, emissions intensity across all asset hubs ranges from 2 kgCO2e/boe to 50 kgCO2e/boe (see Figure 1). Asset hubs which exhibit an emissions intensity greater than 100 kgCO2e/boe (not visualized in Figure 1 for legibility), comprise less than 0.5% of the total production.

Figure 1.

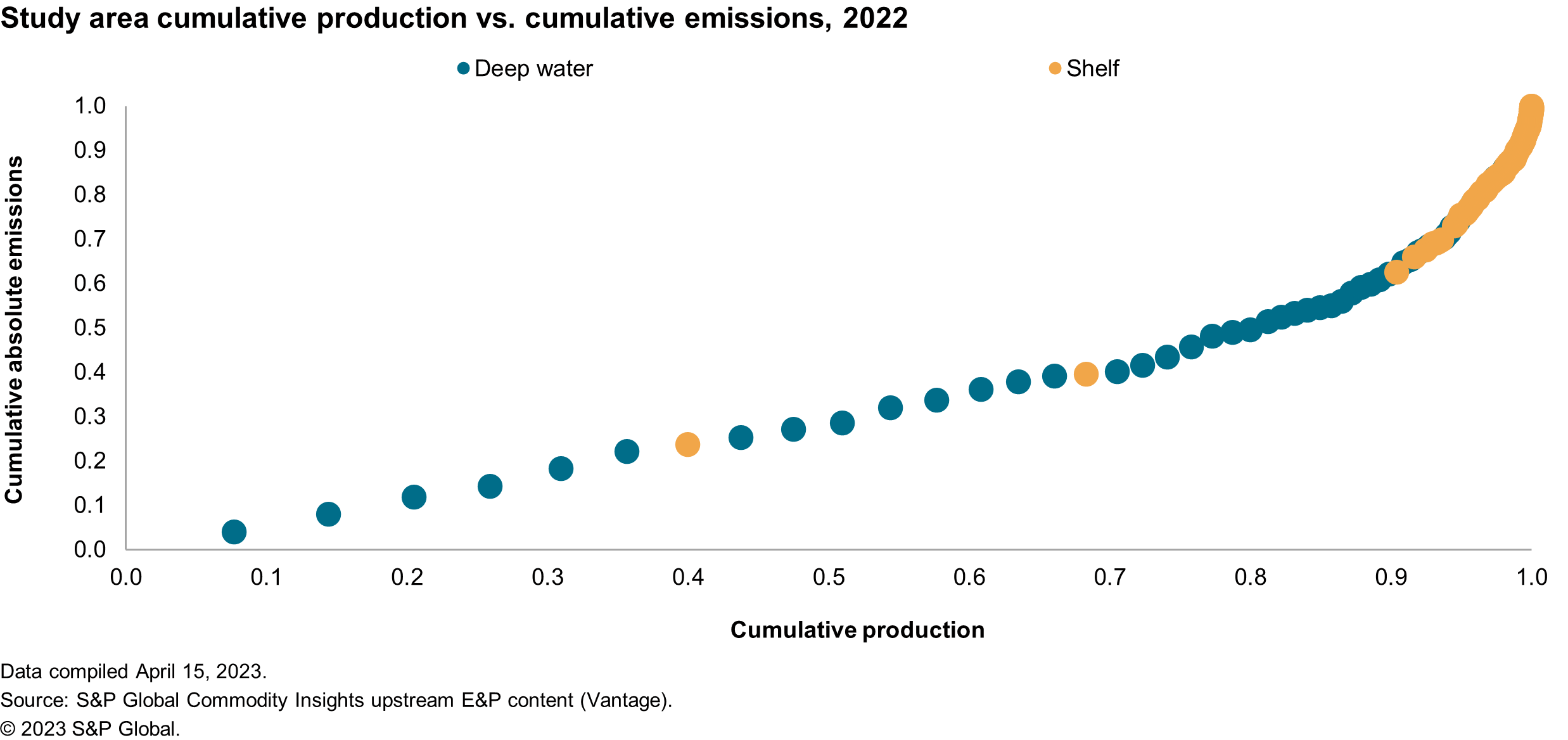

Visualizing emissions in an absolute sense shows a clear trend of the more productive asset hubs accounting for a smaller proportion of the emissions (see Figure 2). Notably, 10% of production, primarily associated with shelf asset hubs, produced approximately 35% of the emissions. On average, shelf production was more than twice as GHG intensive as deepwater production. This is, in part, explained by shelf production contributing significantly less of the total production volume (14%) and differences in production maturity, where shelf production has declined significantly from its peak in contrast to deepwater production. Additionally, the higher complexity associated with deepwater production often requires more advanced and efficient technologies to extract reserves.

Figure 2.

Assessing the total proportion of emissions by source (fuel gas combustion - 76%; diesel combustion - 9%; venting - 9%; flaring - 6%) reveals the venting intensity is higher for shelf than deepwater production. On a production-weighted average basis, this translates to a venting intensity of less than 1 kgCO2e/boe (methane intensity of 14 metric tons of CH4/million boe) for deepwater production and approximately 3 kgCO2e/boe (methane intensity of 130 metric tons of CH4/million boe) for shelf production. This finding aligns with previous studies in the GOM stating that venting for shelf production is generally higher than deepwater production owing to differences in the production technology and regulatory requirements[2].

Commodity Insights' comprehensive and rapidly evolving GHG modeling capabilities enabled analysis of the Scope 1 emissions profiles of all major producing assets in the US GOM in 2022, providing timely insight into the GHG intensity of one of the world's most productive basins. You can view our webinar Contrasting Upstream Emissions - Offshore Gulf of Mexico on-demand. This Insight is part of a series of regional analyses drawing on our global Upstream Emissions dataset, where we have discussed regions such as the North Sea, the Williston Basin and the Permian Basin.

[1] See Greenhouse gas intensity of the North Sea

[2] See US Department of Energy, " Natural gas flaring and venting: State and federal regulatory overview, trends, and impacts, June 2019", retrieved April. 15, 2023.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.