Global demand for replacement PV inverters to account for 7 percent of total global installations in 2020

IHS Markit forecasts that global demand for replacement inverters will grow by almost 40% to reach 8.7 GW in 2020. A large and growing installed base of aging PV installations is driving demand for replacement PV inverters. Demand for replacement PV inverters comes from customers who own old inverters which are beginning to underperform or fail or can no longer easily be serviced with replacement models or spare parts. Demand is also coming from customers who own relatively young PV inverters that are underperforming due to either poor installation, system design, or quality issues.

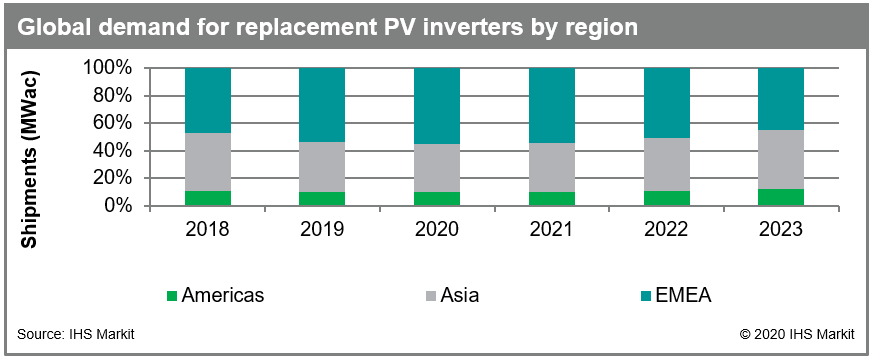

Figure 1: Global demand for replacement PV inverters by

region

EMEA is expected to remain the largest region for replacement inverter demand but Asia is gaining

EMEA has been the largest region for replacement PV inverter demand historically as the region experienced an early boom in solar in core markets such as Germany, Italy, Spain, Czech Republic and Bulgaria and now has the largest installed base of PV systems older than 5 years. Replacement demand in the EMEA region reached 3.4 GW in 2019, driven largely by aging installations between 10.1 kW and 5 MW in size according to IHS Markit's recent report "PV Inverter Replacement Demand Report - 2020". The largest markets are Germany, Italy and Spain, which together accounted for over 70% of replacement demand in the EMEA region.

Asia is the second largest region for replacement inverters due to large PV installations in China historically and continued massive recent growth in China which will continue to fuel demand in the region. Demand for replacement PV inverters is expected to come primarily from utility-scale (>5 MW) installations. Demand will also be driven by residential and commercial installations in Japan which had early growth in solar and now has the largest installed base of residential installations over 5 years old in the world.

Demand for replacement PV inverters in the Americas region is expected to grow rapidly, driven primarily by the United States, its largest market. Replacement demand in the Americas region is forecast to grow at a CAGR (18-23) of 130% and account for 12% of global replacement demand in 2023. The United States has proven to be volatile market for the competitive landscape, with many suppliers having entered and exited the market. Certain suppliers such as Satcon and Advanced Energy who had a large market share but are no longer active in the market have created an opportunity for existing suppliers to provide replacement inverters. Furthermore, evolving technical regulations and import tariffs continue to make the United States a challenging environment for suppliers to keep investing in next generation product and hence, may also cause suppliers to exit the market. However. despite some of these challenges, it remains a highly lucrative market as suppliers fight to capture growing new installations and as customers seek ways to replace a growing installed base of aging systems, particularly in the utility-scale sector.

Developers, EPC's, O&M providers, and PV inverter suppliers are working together to address the market for replacement PV inverters

Developers, EPC's, O&M providers, and PV inverter suppliers are seeking new ways to maximize the value from investing in replacement PV inverter projects. Straight one-to-one replacement of old inverters is the most common route that customers take. For example, an old 1 MW central inverter is replaced with a new, modern 1 MW central inverter. However, as inverter technology develops, new inverter types are being used to replace old-generation inverters with the aim of maximizing yield, simplifying O&M, and reducing LCOE. Customers are increasingly considering changing the overall system architecture, for example, by replacing an old central inverter with string inverters or by introducing string level power optimizers. Overall, modern inverters are being designed with a plethora of advanced features such as higher voltage of 1500V, artificial intelligence, monitoring, and autonomous control functionality. Advanced software capabilities allow customers to upgrade their existing systems by replacing inverters.

O&M providers have stepped up to offer services to ensure that customers reduce downtime and maximize yield and revenue from their PV systems by helping to meet the challenges that come with a growing installed base of aging PV inverters. Firstly, real time monitoring can allow O&M providers to spot potential issues with inverters deployed within a system. On top of that, predictive analytics are starting to help O&M providers and customers get ahead of potential issues. New methods including thermography and aerial photography are also providing new data streams for O&M providers to study for potential inverter issues.

Regardless of these advanced methods of monitoring, O&M providers face a significant challenge regarding sourcing replacement inverters and spare parts. Replacement inverters of old generation inverters may simply not be available anymore. Spare parts may be difficult to source and may require O&M providers and customers to get creative with harvesting spare parts from decommissioned inverters or even other types of power electronics equipment. O&M providers have begun to develop in-house expertise dedicated to inverter repair which involves hiring experienced engineers, seeking advanced training sometimes directly from PV inverter suppliers, and warehousing their own inventory of spare parts and spare inverters.

For their part, inverter suppliers have also begun to invest in their own departments dedicated to addressing the market for replacement PV inverters. For example, SMA has established its own replacement/repowering department which is focused on consulting and selling kits specifically for replacement projects. However, IHS Markit notes that the market is still in its infancy and inverter suppliers that invest time and resources into helping serve this market can capture significant opportunity for themselves in the next five years as the market grows rapidly.

To learn more about the IHS Markit solar research, visit our PV Inverter Intelligence Service page.

Miguel De Jesus is a Solar Market Analyst in the Clean Technology & Renewables team at IHS Markit.

Posted 03 March 2020.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.