Mainland China and the United States drive a record year for wind turbine ordering activity in 2019

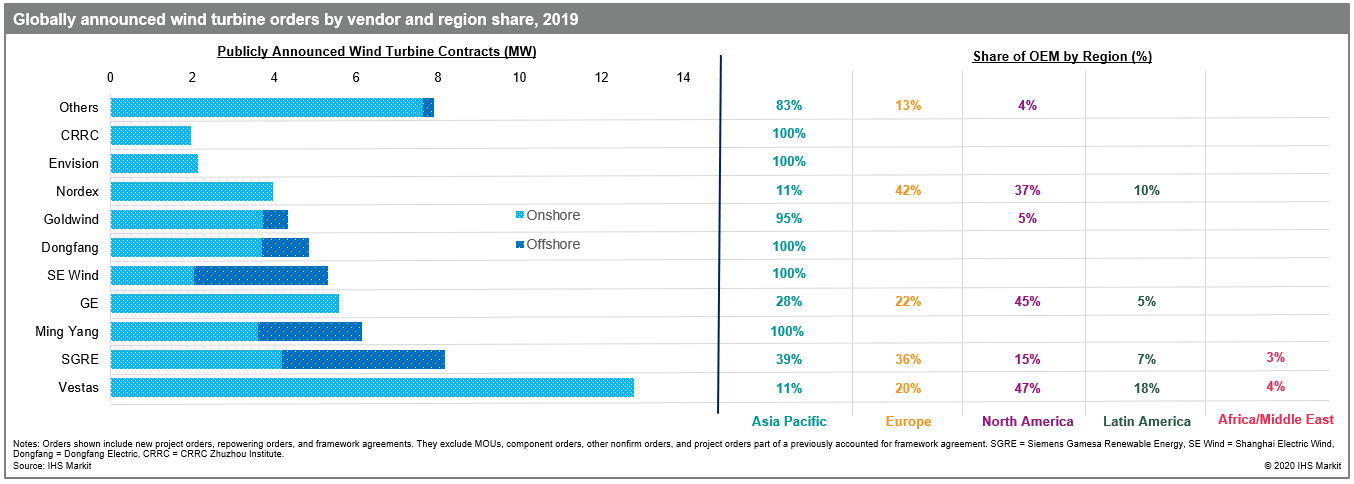

IHS Markit tracked 63 GW of firm wind turbine contracts globally in 2019, growing by over 60% compared to the year before. Of this, 42 GW or two-thirds of the total were scored from Mainland China and the United States where imminent subsidy expiries have sparked a development rush. Vestas maintained its position as the largest supplier globally with nearly 13 GW in firm orders scored last year.

With only a handful of global markets offering stable annual demand, Western turbine OEMs have sped up both regional and technology diversification strategies to mitigate supply risk. For instance, GE, which had been heavily dependent on the United States for volumes, scored over half of its orders from other markets in 2019. In contrast, Mainland China's market size means there's plenty to go about for its twenty something local OEMs who retain a near exclusive focus on the domestic market. Although western vendors have had limited success in the country, this may change going forward as the Chinese wind supply chain struggle to keep up with the sudden spike in demand.

Figure 1: Globally announced wind turbine orders by vendor and

region share, 2019.

Global offshore demand remains bullish with nearly 12 GW ordered globally in 2019, which doubles if non-firm contracts are included. The Asia Pacific drove demand with nearly 8 GW in orders placed from Mainland China alone. Offshore orders from Europe were modest, however given the current trend of European offshore megaprojects, contracting activity from the region is expected to remain lumpy. Prominent European offshore activity in 2019 include Siemens Gamesa's (SGRE) firm order for the Dutch Hollandse Kust Zuid project, and GE's preferred supplier agreement for U.K's Dogger Bank project. The United States has also quickly built up a multi-gigawatt offshore pipeline despite its modest installed base of just 30 MW now.

The demand for larger high-yield wind turbines continues to accelerate globally, more so as competitive auctions lower wind prices while severely compressing margins on turbine sales. In 2019 the first orders for the latest generation of 5 MW turbines started trickling in, most of which was limited to Europe, especially the Scandinavian markets. In total, only five turbine suppliers have announced turbines sized at 5 MW and above globally, with SGRE currently offering the largest variant equipped with a 170-meter rotor.

The size race has further intensified in offshore. In Mainland China, three local vendors have announced 10 MW turbines in 2019 which brings the total global tally of OEMs capable of supplying this technology to six. Among Western players, GE landed its maiden preferred supplier agreement for the 12 MW Halidade-X turbine in September 2019, quickly building up to nearly 5 GW in commitments by the end of the year.

IHS Markit closely tracks wind turbine orders globally and publishes data and key insights in its Global Announced Wind Turbine Order Tracker report on a half-yearly basis. For more information on recorded orders, please visit our global power and renewables page.

Indra Mukherjee is a Global Wind Power Analyst for IHS Markit.

Posted 02 March 2020.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.