Global Power and Renewables Research Highlights, April 2023: Evolving global energy policies and energy transition efforts and challenges

The following provides a brief overview of selected reports in the Global Power and Renewables service from April 2023. Learn more about our Global Power and Renewables Service and the reports featured in this post.

As countries worldwide accelerate their green energy transitions amid geopolitical and pandemic disruptions, Europe's "Fit for 55" regulation sets ambitious 2030 goals, and the US Inflation Reduction Act (IRA) addresses a large portion of solar and onshore wind's "missing money" revenue shortfall. Meanwhile, renewable energy growth is accelerating worldwide, raising questions about maintaining grid reliability and energy security. Indeed, 2022 marks a unique year with global power market developments and record-breaking renewable additions worldwide.

The following reports showcase the evolving global energy policies, global energy transition efforts and challenges, as well as key trends for global power and renewables.

Navigating evolving global energy policies

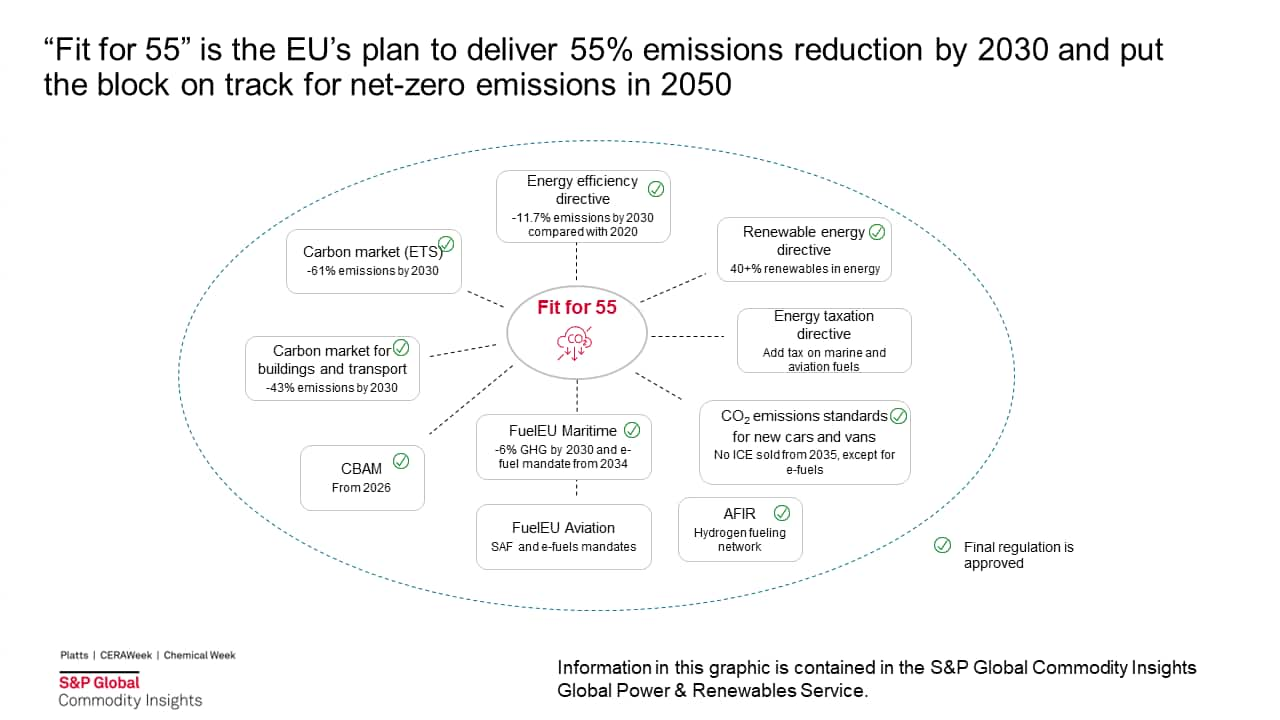

Amid the Russia-Ukraine conflict and the US IRA, Europe reaffirmed its decarbonization commitment by adopting the "Fit for 55" regulation, which significantly impacts power, gas and hydrogen markets. According to "Fit for 55": Final package clarifies path for transformation of Europe's energy mix by 2030, the regulation sets ambitious 2030 goals: a 50% increase in carbon market ambition, a 30% higher renewable energy mandate and the extension of carbon pricing to additional sectors and importers to reach net-zero emissions in 2050. The European Union's 2030 targets are lofty, and meeting them is not guaranteed as numerous "policy gaps" still need to be addressed despite recent acceleration in policy deployment. Clients can view the detailed discussion here.

The European energy crisis in 2022 once again brings the economics of power generation into sharp focus. According to From "missing money" to taxation: The highly political and swinging economics of European power generation, prior to the energy crisis, owing to the rise in renewable subsidies and stagnating power demand, the low wholesale power price led to the "missing money" problem for thermal and nuclear plants. However, the energy crisis turned this situation upside down. With record-high power prices, the power sector went from a decade of "missing money" to a unique situation of extreme potential profits. This upswing in Europe's wholesale power bill provoked a strong political response. In addition to a revenue cap for inframarginal generators, the European Commission also launched a review of the electricity market design. According to EU power market redesign: Tweaks only - Power Market Edge, the proposed changes include mandating two-way contracts for difference (CFDs) for state-supported renewable investments, requiring states to redistribute CFD revenues to end users and supporting private power purchase agreements (PPAs). Although some topics, such as capacity markets and locational value and pricing, are absent from the draft regulation, the European Commission aims to adopt the regulation by the start of 2024, following discussions at the European Council and European Parliament.

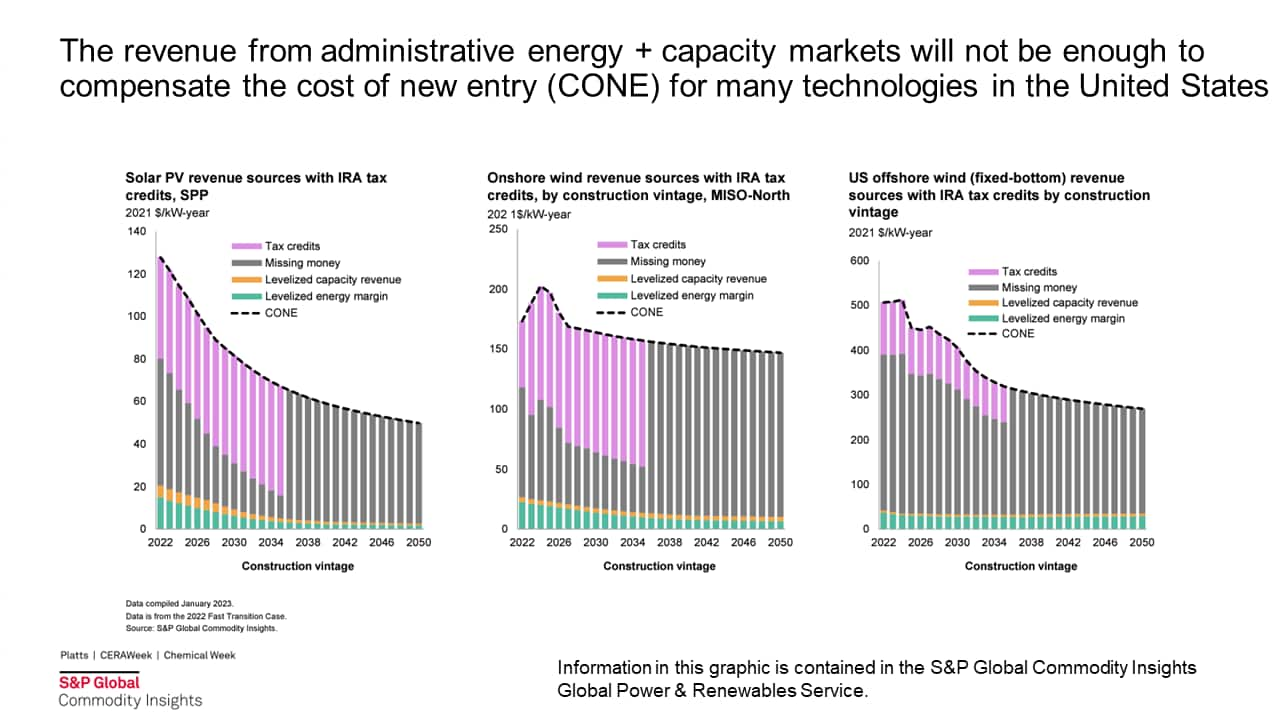

The United States, on the other hand, is facing an emerging "missing money" revenue shortfall that limits the new entry of selected renewable technologies. According to S&P Global Commodity Insights Webinar: Net zero's missing money challenge and US power market implications, as the power sector largely uses wind and solar to achieve net-zero, depressed wholesale energy market prices result in total market revenue that is too low to incentivize construction of new technologies. While the IRA addresses a large portion of solar and onshore wind's missing money issue for the first 10 years of the assets' life, tax credits will not be available after the mid-2030s in the S&P Global Commodity Insights fast transition case. Much of the missing money is likely to be compensated via payments outside the competitive wholesale power markets, particularly PPAs tied to clean energy resource procurements. Clients can view the detailed discussion here.

In Southeast Asia, a policy gap of carbon pricing has been identified in response to the European Union's CBAM. One missing key enabler: How to price carbon in Southeast Asia points out that only three Southeast Asian countries — Malaysia, Singapore and Thailand — have implemented carbon pricing mechanisms. Despite the benefits provided by carbon pricing, challenges including the incompatibility of the regulated power sector with voluntary emission trading and the affordability issue persist.

Energy transition efforts and challenges

Despite geopolitical and pandemic disruptions, many countries have been pacing up the green energy transition toward their emissions peaking and net-zero goals. Efforts to ramp up clean energy investments continued while challenges lie ahead.

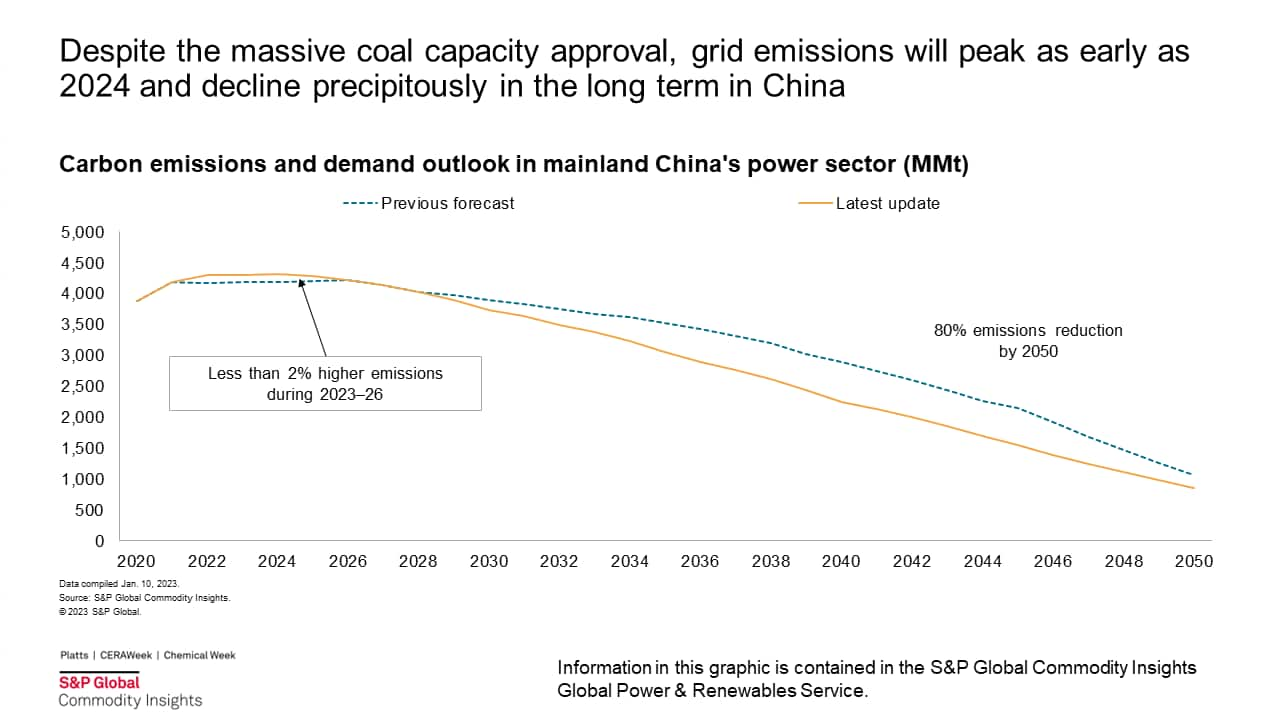

According to China power long-term outlook update: Accelerating green energy transition, the expedited energy transition will bring mainland China closer to its carbon emission targets. Carbon emissions will peak around 2024, two years earlier than previously forecast, driven by the faster-than-expected fossil fuel replacement. Emissions in the power sector will drop by another 20% by 2050 compared with the previous outlook. Renewable additions will take a much more rapid pace than previously forecast, resulting in the largest ever upward revision of our long-term capacity outlook. On the other hand, in 2022, mainland China positioned coal as the backstop to energy security, with 86 GW flexible coal units approved in the year. Upon closer examination, however, Despite record-breaking coal capacity approval in 2022, energy transition in mainland China remains on track finds that as coal switches its role to flexible power source amid rapid growth of clean energy sources, coal utilization will be halved from today to less than 30% by 2050. This in turn will lead to an 80% decline in grid emissions by 2050 compared with current levels, partially thanks to the deployment of carbon capture and storage.

Compared with those in mainland China, coal plants in South Korea are running at a much higher utilization rate while capacity closure increased. According to Spotlight: South Korea shuts coal plants owing to air quality policy, in March alone, 1.5 GW of coal capacity was closed owing to the air quality policy. A nuclear output increase will compensate thermal power generation decline for the rest of 2023.

Different from South Korea's projected power demand drop, India is preparing for a hot La Niña summer with surging electricity demand. To secure energy supply, various actions have been initiated, including delaying coal retirements and scheduled maintenance, according to India's power sector prepares for another hot summer in 2023. Indian imported coal plants will be running at full capacity, and domestic coal supply will be provided with priority clearance for evacuation of coal from domestic mines.

In the second half of 2022, Bangladesh was facing an energy crisis with elevated imported fuel prices. According to Bangladesh Market Briefing: Second half 2022—Bangladesh: Tackling the energy crisis with short- and long-term strategic reforms, to cope with a heat wave in July 2022, Bangladesh burned more oil and coal in the power sector with limited nuclear and renewable additions. The government also rationed electricity and gas for industrial consumers with power cuts. Pakistan also suffered from an energy crisis during the same time, according to Pakistan Market Briefing: Second half 2022—Energy sector reels under high energy costs and crisis in the political economy, and had declined demand due to flooding, industrial stagnation, high imported fuel prices and low domestic fuel production. While Pakistan's coal consumption shrank 10% in 2022, coal is likely to bounce back on the back of domestic coal-based thermal power capacity additions and slackening imported coal prices.

In Latin America, major power markets are following the global energy transition trend but are starting to face challenges to maintain the growth of wind and solar. One major roadblock identified is access to the transmission network, according to Will transmission infrastructure be a barrier for the energy transition in Latin America?. For example, Chile has most of the renewable resources in the north of the country, and transmission network is critical to support the new expansions. The 1,500-km transmission line that is planned to come online by the end of this decade will be pushing the country toward its 2050 carbon neutrality goal.

2022 was a year like no other: Power market developments and renewable additions

While energy security concerns grew last year, the move toward clean energy accelerated with record levels of renewable capacity additions and momentous new policies worldwide.

In Latin America, interest in offshore wind is heating up. According to S&P Global Commodity Insights Webinar: Is Latin America's wind industry ready to go offshore?, in Brazil alone, more than 176 GW of offshore wind capacity has been proposed by 22 companies, with more than a half of it from the major global offshore wind developers. Despite big announcements and great potential, offshore wind energy markets in Latin America are still at the beginning of their development. More information on renewable projects awarded in regulated tenders across Latin America can be assessed via Latin America: Renewable tender tracker dashboard, March 2023 update.

In Europe, a record number of transactions was recorded in 2022 with a slight decrease in total energy volume contracted for a steady capacity. According to Growth of European PPA market continues in 2022 amid energy crisis: European power purchase agreement (PPA) market review, 15 GW were singed under a PPA contract in 2022, equivalent to 25% of wind and solar additions in 2022 for EU27+3.

In mainland China, 2022 was the first full year following the transition away from catalog retail tariff for industrial and commercial users toward liberalized power market trading. According to China's power market trading made a great leap forward in 2022, annual market-based power transaction volume in 2022 rose 41% year on year, to 5,333 TWh, representing 61% of the total power consumption. While green power only represents 0.5% of the market-based power transaction, it expanded by nearly 40 times since 2021, and such growth momentum will continue in 2023 in response to carbon ambitions and aggressive renewable new builds. Clients can view the detailed discussion here.

According to China Renewable Power Market Profile, mainland China's renewable energy has kept the momentum of growth owing to favorable policy direction support, supply chain robustness and declining costs. By the end of 2022, non-hydro renewables accounted for 31% of total capacity and 16% of total generation. Wind power and solar PV led renewable growth, reaching 365 GW and 392 GW, respectively, of installed capacity by the end of 2022.

While capacity additions continued to set new records in many of the world's largest renewable energy markets, transactions growth has struggled to maintain the same level of momentum in 2022. According to Global Power and Renewables Company Strategies: Taking advantage of prevailing tailwinds requires navigating near-term challenges, rapidly expanding technologies like offshore wind are confronting challenges as developers seek to renegotiate bids that are no longer economically viable. The tailwinds generated by REPowerEU and the US IRA are likely to make 2023 a make-or-break year for companies in the renewables space.

Within North America, capital spending by the largest electric utilities is expected to increase further through the medium term, following a decade of substantial growth. According to Global power and renewables company strategy review — North American utilities, overall capital expenditure for the largest 25 North American utilities rose by 10% in 2022 and is projected to increase at a further 3% compound annual growth rate through 2027. This spending is becoming increasingly focused on regulated business lines, as companies continue to deprioritize and exit nonregulated businesses amid a growing emphasis on opportunities with greater stability of returns. In particular, more than half of the planned medium-term spending from this group of companies will be focused on electricity transmission and distribution.

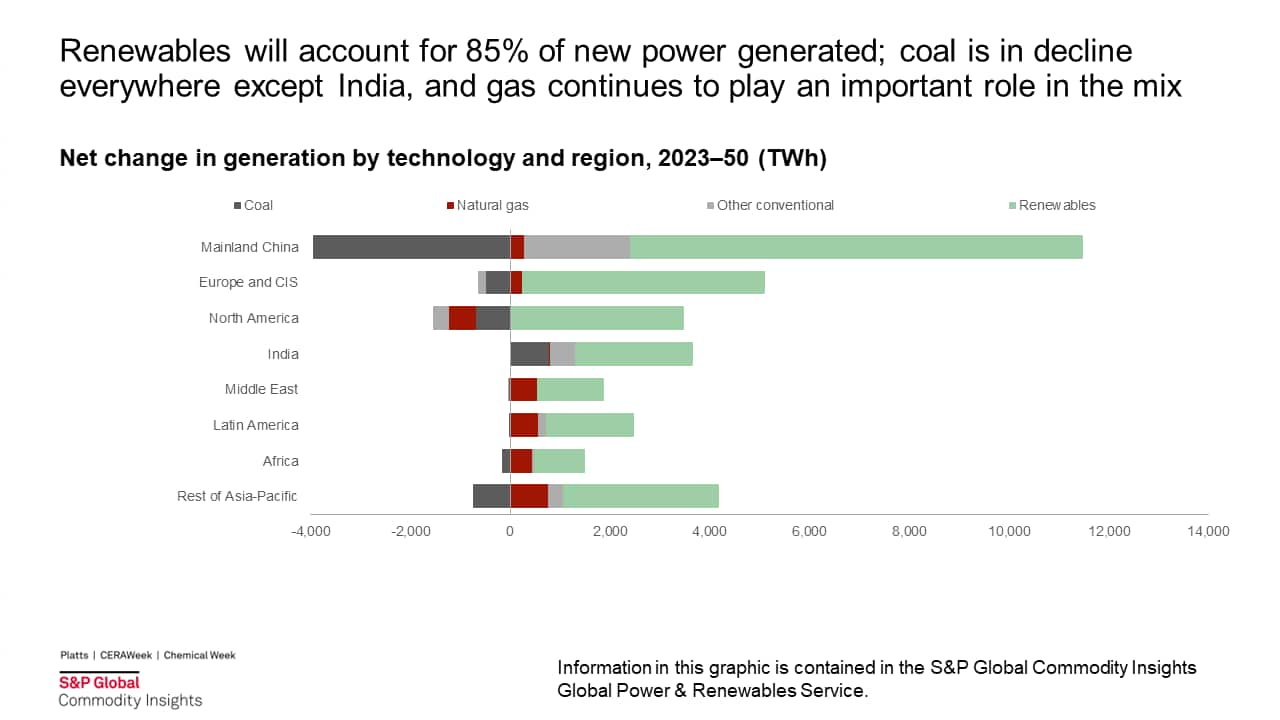

In the longer term, according to the client report Global Power and Renewables Market Outlook, April 2023, non-hydro renewables are projected to account for more than 98% of new power generation capacity globally, capturing more than 85% of all new power generation capacity globally and becoming the dominant source of power by 2050. This outlook includes a considerably upward revision for clean energies compared with the previous release, as a result of the US IRA, Europe's REPowerEU initiative and mainland China's 14th Five-Year Plan.

Coal generation will be in net decline everywhere, except for India, while gas is expected to continue to play an important role. Solar and wind will represent almost all new renewable additions, with offshore wind growing fast. Energy storage, which represents a critical source of flexibility, is also expected to grow strongly while increasing demand for green hydrogen becomes a major driver for further renewable additions. Investments in renewables, storage and green hydrogen will continue to increase, with growth driven by Asia and Europe, at an estimated annual pace of $800 billion to 2030.

Learn more about our global power and renewables research.

Qingyang Liu is a research analyst for the Global Power and Renewables team at S&P Global Commodity Insights.

Posted 22 May 2023

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.