Exploring upstream emissions intensity in the Bakken

Understanding an oil & gas producing region's greenhouse gas (GHG) intensity requires analyzing what drives differences in economic performance. The Williston Basin's history of technical struggles, breakthrough results, infrastructure constraints, and regulatory changes make this an interesting region to explore the entwined paths of upstream performance and GHG intensity.

Though initial oil discovery was in 1951, the Bakken at first faced geologic and engineering difficulties tapping into what everyone agreed was an almost unimaginably large resource base. But once hydraulic fracturing unlocked its potential at the turn of the century, the Bakken became synonymous with the Williston. In fact, over seventy-five percent of the Williston Basin's total historical GHG emissions are from the Bakken Shale.

As development continued, operators identified and focused on the most core sub-regions, leaving the less productive fringe areas. Importantly for this analysis, the natural variability inherent in the rock drives not only a wide range of economic results, but also a material divergence in emissions intensity. The cause is similar: the number of barrels produced is the denominator of both measures. Amortizing fixed costs and fixed emissions over more barrels in a core well beats the performance of a non-core well.

On a more granular level, there is also a distinct difference in emissions metrics between top and bottom performing wells, even within the same sub-region. In order to fully capture this variability within the Bakken, it is necessary to utilize a model which reflects these real differences by estimating well-level emissions. In the Bakken, differences in flaring and venting also widen the range of results.

Using an entirely new and proprietary emissions modelling capability, built atop the most comprehensive global upstream database globally, it is now possible for S&P Global Commodity Insights to model the totality of Williston Basin upstream emissions—from initial operations through to the end of their natural life. For the purpose of this study, we focused on horizontal wells in the Bakken Shale and their evolution through time.

The study found that the average GHG intensity in the Bakken Shale during 2019 was 24.5 kilograms of carbon dioxide equivalent per barrel of oil equivalent (kgCO2e/boe). Taking a closer look shows that the highest intensity areas were in the Fairway sub-region and the lowest in Elm Coulee. This directly correlates to activity and production, with the top producing Fairway sub-region also being the most active and the bottom producing Elm Coulee the least active. This trend illustrates production's role in a GHG intensity metric. GHG intensity, after all, is a simple ratio of emissions over productivity—so as productivity declines, emissions intensity tends to increase somewhat, though the rate depends on important elements such as water cut and the life stage of production.

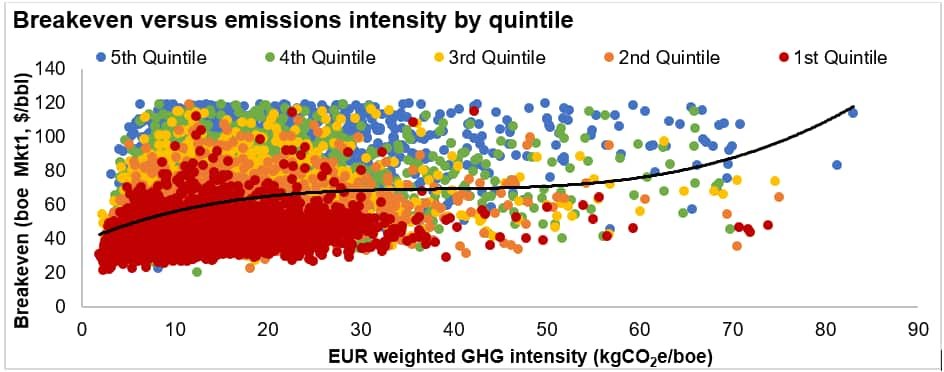

It is beneficial to look at production's impact on GHG metrics, to capture the variation that productivity yields. This study uses quintiles, or groups that each represent twenty percent of producing wells based on peak month productivity per lateral foot. Despite top performing (or first quintile) wells having the highest cumulative emissions, the emissions intensity is overall lower. With this tie to production expected, there is a need to introduce an alternative to the previous straight line average intensity: a metric called EUR weighted emissions intensity. By taking estimated ultimate recovery (EUR) into account in the GHG intensity calculation, it considers each month's contribution to total well-life pre-production emissions. The plot below shows the EUR weighted emissions intensity vs the breakeven, by quintile. As this chart illustrates, higher-breakeven wells also have higher EUR weighted emissions intensity. As both metrics rely on productivity, the acreage that is top-tier for production is also lowest in emissions intensity. That is to say: the best areas of the play continue to win.

As is the case with every other basin/play we have examined, the "flaw of averages" applies, and caution is advised in interpreting play wide averages to any individual operations as they can vary wildly from the average. In the Bakken Shale we found considerable variation with the GHG intensity of wells ranging from less than 2 kgCO2e/boe to nearly 83 kgCO2e/boe. The availability of more granular data allows for more of the true nature of the play to be captured.

S&P Global Commodity Insights' GHG estimation capability is shedding new light and understanding on the true nature of upstream GHG emissions. The ability to take a comprehensive view of an entire region or basin enables a complete statistical analysis of the weighted average from a range of emission intensities that, in this study, span nearly 82 kgCO2e/boe. The detail available through this new modelling approach allows for detailed exploration across the region and elsewhere globally, enabling an analysis of production at multiple scales, including national level and basin level, as well as providing data rich enough to drill down to individual assets, emission sources, and greenhouse gases.

You can view our webinar Contrasting Upstream Emissions in the Williston Basin on-demand. This Insight is part of a series of regional analyses drawing on our global Upstream Emissions dataset, where we have discussed regions such as the North Sea, the Gulf of Mexico and the Permian Basin.

The GHG intensity estimates provided in this study make use of a new proprietary upstream model developed by S&P Global Commodity Insights. The estimates are based on 2010 through 2022 annual averages and cover the entire Bakken Shale. These estimates are different from Platts carbon intensity of crude assessments in terms of model, system boundaries, data inputs, and temporal period.

Data was sourced from Energy Studio Impact, and is available for direct delivery via Snowflake/API.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.