Higher natural gas prices and renewables growth are expected to suppress US gas demand for power generation in 2021

After two record years in 2019 and 2020, US lower-48 gas-fired power generation is expected to retreat in 2021 owing to higher natural gas prices and changes to the electric fleet. Many of the trends taking place within the US generation stack are a continuance of activity from prior years, like coal plant retirements and capacity additions for solar- and wind-powered projects, but the latter is picking up the pace.

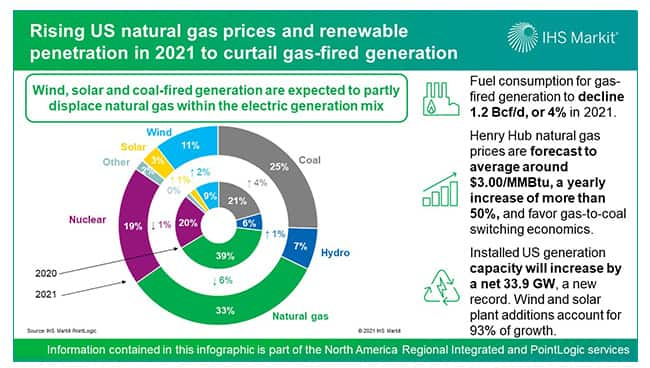

For 2021, one market disrupter to note will come from economic-driven gas-to-coal switching within the electric generation stack. Henry Hub spot market prices are forecast to average around $3.00/MMBtu in 2021, an annual increase of more than 50% from 2020's average.

Another key development is the scheduled retirement of 9.3 GW of generation capacity in 2021, including nuclear, and the addition of 43.2 GW, mostly from solar and wind. The net capacity addition of 33.9 GW in the US Lower 48 will be the largest annual increase on record.

The net expected effect on gas-fired power generation is a 6% year-on-year decline within the electric generation stack. This result equates to an estimated 1.2 Bcf/d, or a 4% downshift in US lower-48 power sector gas demand in 2021.

During 2020, the COVID-19 pandemic negatively impacted domestic natural gas demand and prices. Henry Hub prices averaged an annualized record low of $1.99/MMBtu in 2020, which put natural gas firmly in the money over coal across all power regions, absent other constraints or considerations. Gas demand for power generation hit a new annual record last year, gaining 0.7 Bcf/d on the year to reach an average of 31.6 Bcf/d and represented approximately 39% of the electric generation mix.

In general, if Henry Hub gas prices are $2.25/MMBtu or higher, then in some power markets coal begins to displace gas on the economic dispatch curve. Gas prices above $2.50/MMBtu, as we expect for 2021, tend to favor gas-to-coal switching for all types of coal across most power markets. The volumetric potential of gas-to-coal and coal-to-gas switching is less than it was in years past owing to the volume of coal plant retirements and the installation of highly efficient gas-fired power plants, but it is still present.

We expect 2021 average natural gas prices to average near $3.00/MMBtu and as a result natural gas-fired power generation will decline to 33% of US net generation. Increased generation from coal, solar, and wind should make up the shortfall. There are multiple market forces at play that are causing the rise in gas prices, namely a tightening of the market due to declining production and a slight increase in total demand.

The regional implications of higher natural gas prices in 2021 and power market capacity changes vary. Most regions in the United States are expected to have decreased gas burn this year, some more than others. We expect gas-fired power generation in Texas to be the most negatively affected, declining 10%, owing to robust solar and wind capacity additions coupled with the favorable gas-to-coal switching economics. Conversely, we expect power burn to increase by 14% in New York/New Jersey. This region is scheduled to retire a highly utilized nuclear power plant in April, while also adding capacity from solar, wind and battery storage this year. Solar, wind and battery generation operate at lower utilization rates, however, creating an opportunity for natural gas to fill the consumption gap left by the plant retirement.

2021 will be a unique period for installed nuclear power generation throughout the lower 48. Scheduled for retirement are three nuclear plants totaling 5.1 GW of capacity, a 5% reduction to the operating nuclear fleet and a record removal of nuclear capacity in a single year. On the other hand, for the first time in the last 30 years, there is a nuclear expansion set to go online in November which will add 1.1 GW to an existing plant located in Georgia. The impact of these atypical changes to the US nuclear fleet on regional natural gas markets are material in 2021, but likely be most keenly felt in 2022.

Continue to monitor natural gas demand and prices with our PointLogic service.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.