The surging demand of green energy in Taiwan will drive the T-REC price up in the near term

After several years of regulation amendment, Taiwan's first renewables indirect supply transaction was fulfilled in 2020, signifying the establishment of renewables trading market. Nowadays, developers can trade renewables either on the conventional market to Taiwan Power Company (Taipower) at approved feed-in tariffs (FITs) or auction-awarded prices or on the liberalized market to end users at a bilaterally negotiated tariff without any price restrictions. Switching between the two markets is also legitimate.

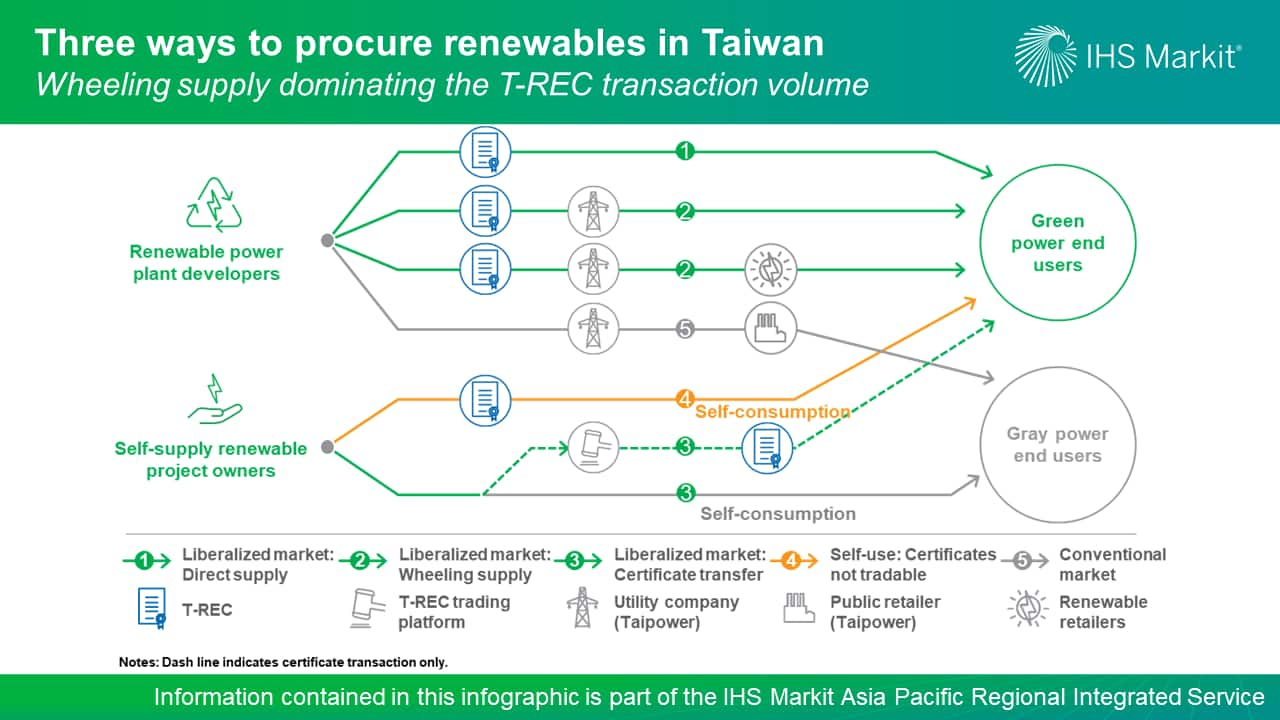

The deregulated renewables trading market provides a sourcing path for green power demanders through the Taiwan Renewable Energy Certificate (T-REC).[1] Purchasing renewables from large power generation farms combined with T-RECs via bundled corporate power purchase agreements (CPPAs) is anticipated to be mainstream in terms of transaction volume. And the demand and supply balance for wheeling renewables will play a decisive role in T-REC price setting.

Demand for renewables is expected to soar driven by both mandatory renewable portfolio standard (RPS) requirements and voluntary green power procurement. From 2021, large electricity consumers with more than over 5 MW contracted capacity are obligated to achieve a 10% RPS renewable portfolio standard within five years by setting equipment or procuring renewable certificates. In fact, to increase long-term industrial competitiveness, many enterprises located in Taiwan have raised more challenging renewables procurement targets than the government's requirements. In 2020, Taiwan Semiconductor Manufacturing Company (TSMC), the world's biggest chipmaker and a giant electricity consumer, joined RE100.[2] and pledged to use 100% renewables by 2050. Given TSMC and other RE100-related companies' commitments, as well as the large user regulation's impacts, IHS Markit estimates the entire market is calling for about 4.5 TWh of renewable energy supply in 2025, translating to 3.6 GW of solar photovoltaic (PV), or 1.2 GW of offshore wind capacity.

According to IHS Markit outlook, cumulative renewable capacity is projected to achieve more than 25 GW in 2025, with solar, offshore wind, and onshore wind accounting for 68.3%, 17.3%, and 3.1%, respectively. However, whether there will be enough supply to satiate the skyrocketing green power demand by 2025 lies in developers' willingness to join the deregulated market. The go-to market strategy may vary by technologies and contract statuses. New project developers and tender winners might be more profitable in the liberalized market owing to shrinking FITs and very low auction awarded prices. However, for most developers already signed utility power purchase agreement (UPPAs), it might not be worthwhile to switch markets considering the costs of terminating contracts, possible financial risks, and complicated legal issues. IHS Markit anticipates this nascent renewable trading market will be tightly balanced until the injection of auctioned awarded offshore wind from 2025. T-REC price, therefore, is predicted to fluctuate at a high level under market forces, with the ceiling at about 4.1 New Taiwan dollars per kWh.

For more on our energy research in Asia Pacific, visit our Asia Pacific Regional Integrated Service page.

Shan Xue is a principal analyst on the Climate and Sustainability team at IHS Markit and focuses on Asian power market modeling.

Posted on 9 March 2021.

[1] One T-REC represents one megawatt-hour (MWh) of renewable energy.

[2] Led by the Climate Group in partnership with Carbon Disclosure Project (CDP), RE100 is a global initiative bringing together the world's most influential businesses driving the transition to 100% renewable electricity.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.