India energy sector: Key questions for 2021

The socio-economic impact of COVID-19 considerably affected energy markets during 2020. Negative electricity demand, lower utilization of coal-fired capacity, growing financial stress in the distribution and generation segment, reduction in power prices, and challenges for renewable and thermal additions marred the performance of the power and renewables sector. Similarly, the domestic coal market witnessed demand constraints, which resulted in higher inventory costs and a lowering of imports. On the other hand, natural gas demand remained buoyant as it was supported by lower LNG spot prices, making it attractive in the power and fertilizer sector.

Year 2021 is full of hope. Hope for a rapid recovery and hope of getting relieved from the effects of pandemic. At the outset of the year, there are numerous questions that run through us as sector enthusiasts. Below are the some of the pressing questions that are likely to determine the energy markets' trends in India for 2021.

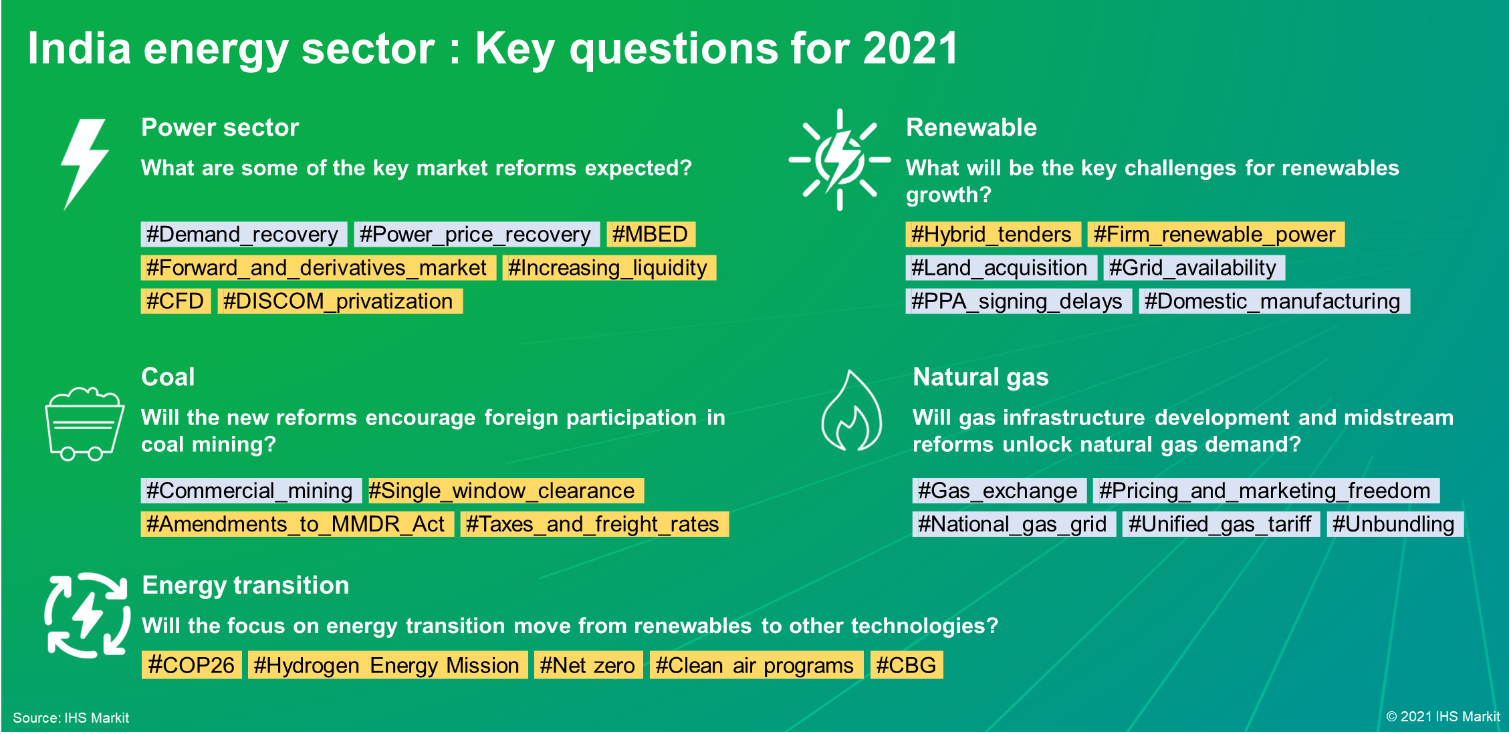

Will the power sector recover from the damage done by COVID-19? What are some of the key market reforms expected in 2021?

Electricity demand: Electricity demand contracted by 2.6% in 2020. Demand from the industrial and commercial segments dropped significantly, while the demand from the household segment increased, as most of the commercial activity transitioned to the virtual work-from-home setup. In 2021, with the ease in lockdown restrictions and rapid rollout of the vaccination campaign, electricity demand is expected grow aggressively (higher than seen in past years).

Capacity addition: In 2020, India managed to add only 7.2 GW of total capacity against the 20 GW additions in 2019. With the revival of demand, in 2021, coal-fired generation is expected to recover while momentum in the capacity additions will continue at a slower pace given the market challenges and risk—financial health, grid availability, power purchase agreement (PPA) cancellation, import duties, and overcapacity.

Capacity utilization: A decline in demand, coupled with higher gas generation, resulted in lower utilization of coal (52% in 2020, versus 57% in 2019). Further, the month of April registered the lowest utilization of coal plants, averaging about 42%. On the other hand, gas-fired generation improved on the back of lower spot LNG prices and could find off-takers. In 2021, the PLF of coal plants is expected to improve to about 58-60% in 2021, however, gas plants may see drop in PLF.

Power prices: Excess generation availability, lower demand, and lower fuel prices (for both import coal and LNG spot) led to a significant reduction (of ~16%) in the spot power prices on the power exchange. The scenario, however, is expected to improve in 2021, given the demand recovery and boost in coal-fired generation and thus projected to be in the range of $44-46/MWh (3.3-3.5 rupees/kWh), although prices will continue to be under pressure owing to subdued international coal prices.

Policy and regulatory: Despite the unprecedented damage of COVID-19 to the power sector's performance, policy and regulatory development with the implementation of some key market reforms continue to provide an impetus to the market. In 2020, Indian power sector witnessed a number of policy and regulatory changes. IHS Markit expects more sectoral reforms in 2021 with some policy measures taking a more definitive shape. The distribution sector continues to be the Achilles' heel, therefore IHS Markit expects that the majority of reforms in 2021 will focus on DISCOMs with the purpose of improving their financial viability, streamlining their operations, and reducing their cost of power purchase

What will be the future of technology-specific tenders? What will be the key challenges for renewables growth in 2021?

India awarded 2.1 GW of hybrid wind solar capacity in 2020 and an additional 1.6 GW capacity in hybrid tenders with storage requirements. As of January 2021, more than 6 GW of hybrid renewable tenders are open with requirements of storage or thermal bundling to meet assured peak power and round-the-clock supply requirements. It is expected that more such hybrid tenders will be invited in 2021 as the government of India plans to set up ultra-mega hybrid renewable energy parks.

India is slowly emerging from the aftermath of COVID-19, as the pandemic hurt renewable additions significantly in 2020. India has a healthy pipeline of over 50 GW, including about 21 GW of renewable projects with expected commissioning in 2021. However, there are several implementation challenges, which may affect future additions including the challenges in land acquisition, timely grid availability, high policy risk of PPA renegotiation or cancellations, delays in signing PPAs, payment delays, and poor credit rating of state-owned DISCOMs. Additionally, there may be short-term volatilities in the solar photovoltaic (PV) supply chain in 2021 as India plans to impose import duties on solar modules from Chinese and Southeast Asian markets, in order to boost domestic manufacturing.

Will India's thermal coal imports rebound in 2021? Will the new reform measures help encourage foreign participation in the coal mining sector?

COVID-19 constrained India's coal demand, consequently softening coal imports in 2020. In 2021, IHS Markit expects coal demand to increase as economy recovers from the effects of lock-down and pandemic in 2020. However, the demand for imported coal may remain subdued due to various reasons. Growth in domestic supply capacity against weaker demand levels, regulatory changes that favor domestic coal, and high inventories mean that although the imports are expected to grow again in 2021, they will not return to 2019 levels until the late 2020s.

The Ministry of Coal (MoC) in November 2020 successfully conducted the first of its kind auction under India's newly introduced commercial coal mining. Out of the total 38 blocks that were finally approved for auctioning, 19 blocks were fruitfully auctioned. The success of the auction can be gauged from the fact that the winners committed to sharing on average 28% of the accrued revenue with the state governments, and even then, stand to earn handsome returns on their investments. However, the only factor that raises a question to this feat is the absence of any foreign companies in the auction process. Apart from the COVID-19 pandemic, various bureaucratic challenges, regulatory challenges, and approvals required to start a mining project remain key concerns for international investors. After evaluating the results of the first round, the central government has already initiated various changes to increase the project's attractiveness e.g. 'Single window clearance portal', 'Amendments to the mining act' etc. It is expected that the central government, in 2021, may come up with more reforms and policy measures to further entice private investors including foreign players to the commercial coal mining sector.

Will domestic gas production growth affect LNG import demand? What would be the impact on gas demand, of new reforms being proposed in gas sector?

The domestic gas production declined by 11% y/y in 2020 primarily due to maturing gas fields and falling output from the private sector entities. On the other hand, the natural gas demand of India remained resilient despite the COVID-19 pandemic, reaching pre-COVID-19 levels by the third quarter of 2020. Low LNG prices coupled with other factors resulted in strong LNG imports, which grew by 16% y/y to 26.8 MMt in 2020. However, in 2021, IHS Markit expects tepid growth for LNG in India as the domestic gas production rebounds (production increase and startup of various domestic fields expected) and higher spot LNG prices (as seen in some of the recent spot tender for month of February and March) forcing the end-consumers switch to alternative fuels.

To achieve target of 15% of natural gas in India's energy basket by 2030, the government plans to expand the gas transmission network, adding more CGDs and increasing the compressed natural gas (CNG) stations count. Further, there is a strong push for natural gas sector reforms. In 2020, the Petroleum and Natural Gas Regulatory Board (PNGRB) approved the country's first gas exchange—IGX, which supported the development of a competitive marketplace and brought transparency to the gas pricing mechanism. Other key reform measures include—unified gas tariff mechanism, and the unbundling of Gas Authority of India Limited (GAIL) into standalone gas marketing and transmission entities (also announced in Union Budget FY2022). Nevertheless, the implementation and commercial challenges remain, and the proposed measures are being continuously delayed. The uncertainty over these market reforms may continue in 2021 as well. Hence, IHS Markit does not expect any aggressive increase in demand from the reforms in 2021.

Will the focus on energy transition move from renewables to other technologies?

Unlike some of the countries (like US, mainland China, Japan, South Korea, UK, Sweden, Denmark), India has not committed to 'net-zero carbon emission plan' and is still working on a sustainable development agenda to address climate goals and deliver its commitment to energy access for all.

In 2015, India set an ambitious renewable target of 175 GW to be achieved by 2022. A year later, under the Paris agreement, India committed to voluntary targets of reducing the emission intensity of its GDP by 33-35% (vis-à-vis 2005 levels), achieving a 40% non-fossil fuel power mix by 2030, and creating an additional carbon sink of 2.5-3 billion tons of CO2 equivalent. Further, in the 2021 budgetary speech, the government of India announced budgetary support (a fund of $300 million) to various clean air programs across various cities and launch a "Hydrogen Energy Mission" in 2021 to generate hydrogen from green power sources.

These plans clearly state the government's intention to invest in actions that address environmental concerns by diversifying its overall approach to tackle the energy transition and meet its commitment to reducing emissions.

Learn more about our research and insight on the India energy market through our Asia Pacific Regional Integrated Service.

Abhishek Rakshit, principal research analyst on the Coal, Metals, and Mining team, leads the coverage of the coal markets of the South Asian countries at IHS Markit.

Ankita Chauhan is a senior renewable analyst on the Climate and Sustainability team at IHS Markit, covering research and analysis for Indian and South Asian markets.

Ashish Singla, associate director with the Climate and Sustainability team at IHS Markit, covering research and analysis on Power and Renewable for South Asian countries.

Rashika Gupta, Ph.D., is a director on the Climate and Sustainability team at IHS Markit, responsible for research and analysis for the India, Sri Lanka, Pakistan, and Bangladesh energy markets.

Vasu Goyal, senior gas analyst on the Climate and Sustainability team, is an expert on South Asian gas and LNG markets.

Posted 01 March 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.