Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 09, 2024

India's Special DSF Bid Round 2024: Prospects and Challenges for Mumbai Shallow Water Blocks

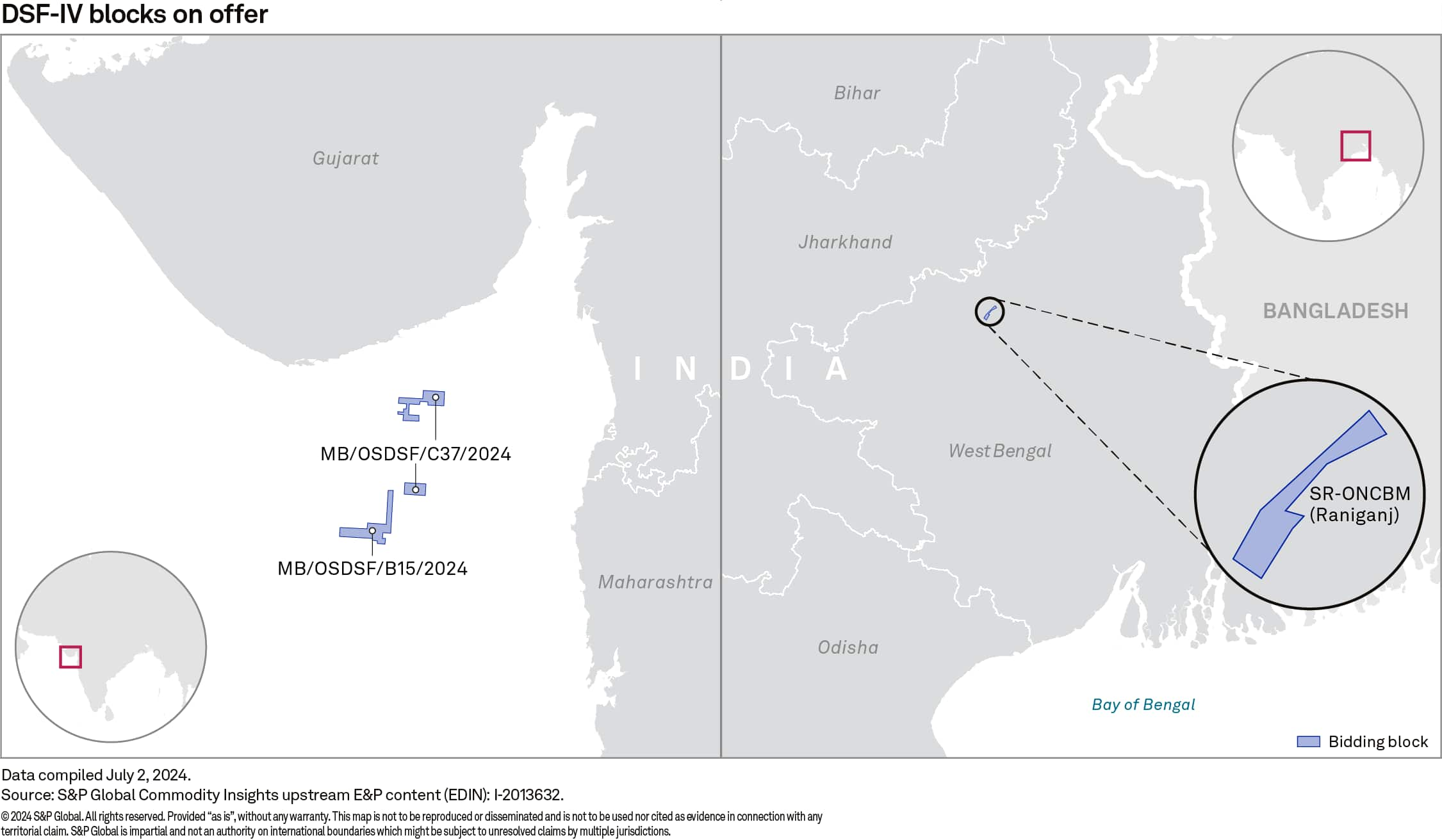

The Indian government has offered two conventional Blocks (C-37 and B-15) in Mumbai shallow water and one unconventional coalbed methane (CBM) block in the Raniganj coal field area, Damodar Graben, in West Bengal as part of a Special DSF Bid round 2024.

The conventional Blocks C-37 and B-15 were previously offered in DSF round I & III. Block C-37 received no bids in either round, but Block B-15 was awarded to Bharat Petro Resources Limited (BPRL) and Ganges Geo Resources in the DSF rounds I and III, respectively. Both companies did not progress. In the latest round, both blocks are on offer again. The deadline to submit bids is August 16, 2024.

While the government introduced no major changes in the recent revenue-sharing contract, a provision of constant revenue sharing is now included to incentivize early commercial production during the development period.

The conventional Block C-37 is divided into two parts. The south bid area consists of B-12C 2 gas discovery. Discovered in 2016 by Oil and Natural Gas Corporation Limited (ONGC), in the Upper Oligocene Daman Sandstone Formation, the field is in proximity to the under-development Adani Welspun (AWEL) A-1 gas field and the ONGC C-Series gas discoveries.

The C-37 north bid area is surrounded by multiple gas discoveries — Tapti mid and south in the northeast, MB-OSN-2004/1 2 in the north, and C-43 1 and C-37 1 in the south, close to the bid block boundary. Most of the surrounding discoveries are in the Lower Oligocene Mahuva Formation. The exploration targets within the C-37 Block area could be exploring Oligocene Mahuva and Daman formations.

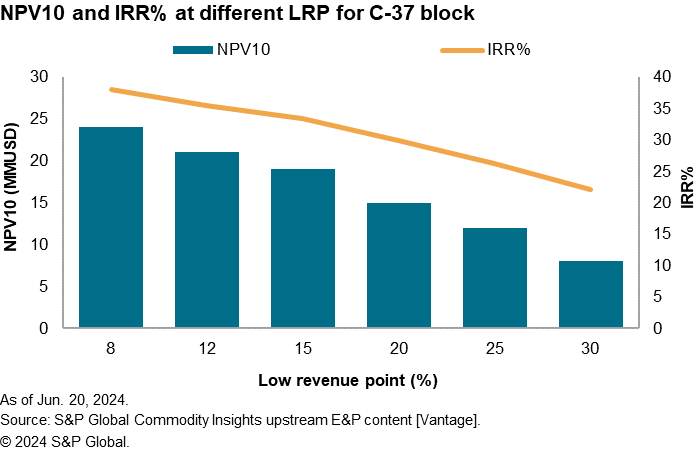

The Block bidding parameter has 50% weightage to the biddable share of revenue to the government which is the average Net Present Value share offered to the government based on designated LRP and HRP rate (Low and High Revenue point), at a discount rate of 10% per annum.

We have modelled the tie-back-based development concept of B-12C-2 existing gas discovery in the south bid area of the C-37 block and estimated a relation between lower revenue point (LRP %) and Net Present Value at a discount rate of 10% per annum (NPV10). Below is a chart showing the effect on NPV10 and Internal rate of return (IRR%) at multiple LRPs. For this analysis, we have kept the HRP fixed at 50% as we do not project the field to achieve a high revenue point under current circumstances. The project has low NPV10 but good IRR% across different LRPs.

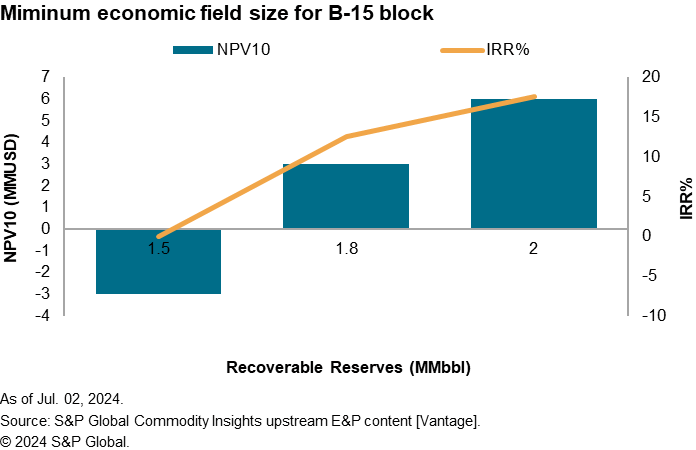

The B-15 block consists of B-15A 1 and B-15 2 oil discoveries with marginal volumes. The B-15 discoveries are approximately 10 km northwest of Mumbai High Field and were made in the Eocene Panna Formation, the clastic sandstone reservoir similar to one of the reservoirs in the nearby Mumbai High Field. The B-15 cluster is a subeconomic project under our base case modelling scenario as the volumes are marginal. Under these assumptions, the NPV10 remains negative, even in a hypothetical scenario where the operator retains 100% of the revenue. Therefore, further exploration is required to discover new resources and to make the development economically viable. Exploration strategy may include looking for any play extension of Mumbai High Miocene - Oligocene Carbonates into the B-15 area along with further exploring the discovered Panna Formation and finding new pools. These could be developed under the cluster-based field development plan/strategy.

Under our modelling scenarios, Block B-15's NPV is positive in a tie-back-based development concept for a minimum recoverable resource size between 1.5 and 1.8 million barrels (MMbbl). The scenarios are modelled at 8% LRP and 50% HRP.

Under the current scenario, Block B-15 is sub-economic while Block C-37 has low NPV10 but promising IRR%. Also, the development of both blocks is contingent on receiving approvals to tie-in to nearby existing infrastructure. Further exploration is likely necessary to improve the economic outlook; any addition of new plays or pools could potentially be monetized through a cluster-based development scheme to improve the project economics.

The DSF Policy, introduced in 2015, was aimed to bring marginal fields, unmonetized discoveries, and relinquished discoveries into production on a priority basis. Under the DSF policy, 83 blocks have been awarded until DSF III rounds, but only five blocks have been put into production so far. Policy reforms are required to expedite the development process for these blocks. It remains to be seen whether these two conventional blocks will be successfully awarded the third time.

The valuations are in Real USD, with a 10% discount rate, and are provided as of 1 January 2024. We have assumed gas price equal to the India's domestic gas price as notified by the Petroleum Planning and Analysis Cell (PPAC), with no floor price or ceiling inflated by 2% yearly. The forward-looking price is kept constant in real terms.

Learn more about S&P Global CommodityInsights,Vantage,EDIN,Upstream Intelligence

Parag Goyal is Senior Research Analyst at S&P Global Commodity Insights, covering Middle East and Indian Sub Continent upstream markets and focused on market intelligence, opportunity screenings, supply outlook and commercial analysis.

Rahul Dev Chauhan is the principal research analyst for the Indian Sub Continent Energy-Upstream Intelligence team and is the lead for the Upstream Research in India.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2findias-special-dsf-bid-round-2024-prospects-and-challenges-for.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2findias-special-dsf-bid-round-2024-prospects-and-challenges-for.html&text=India%27s+Special+DSF+Bid+Round+2024%3a+Prospects+and+Challenges+for+Mumbai+Shallow+Water+Blocks+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2findias-special-dsf-bid-round-2024-prospects-and-challenges-for.html","enabled":true},{"name":"email","url":"?subject=India's Special DSF Bid Round 2024: Prospects and Challenges for Mumbai Shallow Water Blocks | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2findias-special-dsf-bid-round-2024-prospects-and-challenges-for.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=India%27s+Special+DSF+Bid+Round+2024%3a+Prospects+and+Challenges+for+Mumbai+Shallow+Water+Blocks+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2findias-special-dsf-bid-round-2024-prospects-and-challenges-for.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}