Indonesia’s "cap-and-trade-and-tax" carbon pricing scheme: only a light touch on the power market

In 2021, Indonesia announced its ambitious climate commitments to peak national greenhouse gas (GHG) emissions by 2030 and reach carbon-neutrality by 2060 in its Long-Term Strategy for Low Carbon and Climate Resilience (LTS-LCCR). In the same year of the announcement, Indonesia stepped up its efforts to establish a domestic carbon pricing framework as part of the key strategy for decarbonization and has already laid a comprehensive policy groundwork for the implementation of both a carbon tax and an emissions trading scheme.

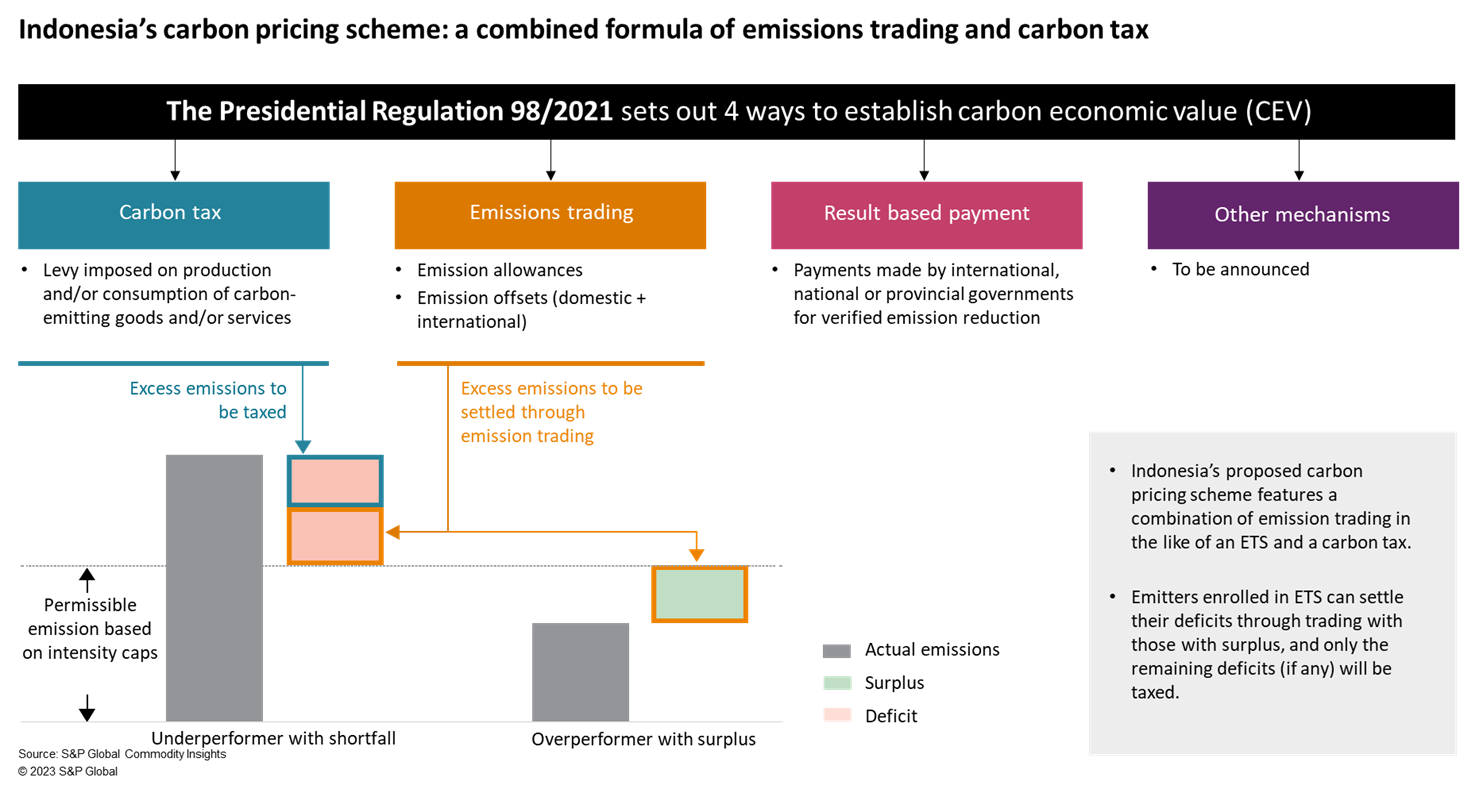

Coal has historically been, and will continue to be, Indonesia's dominant power generation source and the largest contributor to GHG emissions before 2040. Being the primary targets of carbon pricing regulations, Indonesia will charge CFPPs for their carbon emissions through a hybrid mechanism that the government terms "cap-and-trade-and-tax."

A total of 99 coal-fired units connected to the state grid with combined capacity of 32 GW are selected as the first batch of cap-and-trade participants, including both state-owned and independent power producers. These CFPPs are entitled to emit certain volume of emissions without incurring any charges based on the technical approval of emission ceilings (Persetujuan Teknis Batas Atas Emisi, or PTBAE) established by the Ministry of Energy and Mineral Resources, but need to either buy additional emissions allowances by trading with their outperforming peers or pay carbon taxes if their actual emissions exceed their respective ceilings.

While Indonesia's carbon pricing scheme is a highly commendable step forward in its journey to decarbonize, it will only leave a light touch on the power market. The emission intensity ceilings are set rather loose and differentiated across subgroups of CFPPs to match their typical performance, but this will shield a large share of their emissions from any carbon charges to begin with. Even for underperforming CFPPs that do end up paying for their excess emission, their maximum cost burden will be effectively capped at the carbon tax rate times the size of their excess emissions, which, according to S&P Global simulation, will be bound within $0.5/MWh in most circumstances. This level of added cost will be barely enough to incentivize emission reduction efforts from CFPPs nor will it materially shift the dispatch order to reduce inefficient coal generation, unless a significantly higher carbon tax is implemented. In addition, the vertically integrated nature of Indonesia's power market and the dominance of long-term power purchase agreement (PPA) will restrain the carbon cost passthrough and hamper its ability from unlocking wider structural changes in the power market.

On a positive note, a relatively loose carbon pricing environment will help Indonesia better balance growth and affordability concerns while testing out and improving its carbon pricing mechanism as it moves along the way of decarbonization.

Customers can read the full paper on S&P Connect.

Learn more about our global power and renewables research.

Xiaonan Feng, principal research analyst on the Gas, Power and Climate Solutions team, focuses on the power-carbon nexus, where she leads analysis into power sector emissions, carbon pricing schemes, CCS, and general carbon- and climate-related policies for Asia-Pacific countries.

31 October 2023

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.