Key Strategic Issues Impacting the Global Ethylene Markets

Introduction

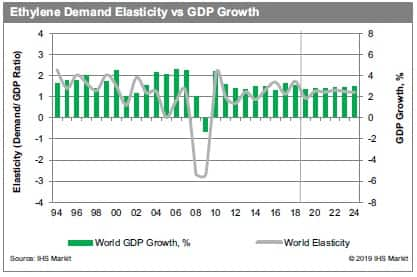

Historically, global demand for ethylene has grown at a multiple of

world GDP growth. However, the relationship between ethylene demand

growth and economic growth is becoming less straightforward. The

ethylene demand to GDP elasticity is being diluted by the

increasing influence of the technology and services sector on GDP

growth and the correspondingly lower impact of manufacturing. Also,

there has been a strong push toward sustainability and recycling,

so some ethylene demand has been replaced by recycled or natural

materials (paper, glass, etc.). This is resulting in lower

multiples to GDP growth, especially in developed countries. In

2019, ongoing trade tensions between the United States and China

have resulted in an overall slowdown in derivatives demand and a

shift in global trade flows. Prices of feedstocks were volatile in

2019 amid sanctions on Iranian crude oil, attacks on Saudi oil

production facilities, the upcoming 2020 implementation of a new

International Maritime Organization (IMO) fuel regulation, and

overall length in global LPG supply, all of which influence price

competitiveness and cracker feedslates. The 2019-2024 forecast

period projects ethylene demand growth at an average rate of 1.2

times GDP.

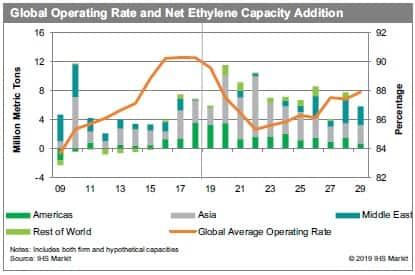

Global capacity addition has been uneven across global regions,

influenced by infrastructure and port facilities, feedstock

competitiveness, economic growth, and demand. Asia and the Middle

East have been leading new ethylene capacity addition in the past

decade, and Asia-particularly China-will continue to do so in the

next decade. The United States has also invested heavily in new

cracker projects in recent years due to an ethane feedstock

advantage with approximately 7 million metric tons (mt) of new

ethylene production facilities added in 2018-19. Capacity totaling

another 3.5 million mt is expected to come onstream in 2020.

Looking ahead, global capacity addition is expected to outpace

demand in the next few years. Consequently, IHS Markit forecasts

operating rates to drop in 2019-22; and recover from 2023

onward.

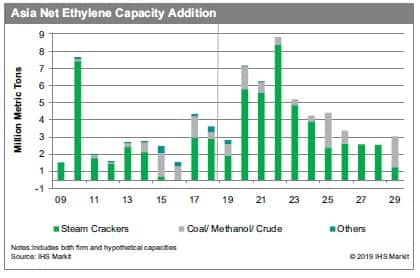

The emergence of lower-cost coal to olefins (CTO) and methanol to

olefins (MTO) technologies to produce light olefins starting from

around 2010 came at a time when crude oil and naphtha prices were

close to peak levels. As a result, in the years that followed, new

capacities in China were dominated by CTO and MTO, while interest

in traditional steam cracker projects was deferred due to weaker

project economics.

However, the tide is gradually shifting against MTO and CTO

technologies due to the current relatively low crude oil and

naphtha prices since the collapse at the end of 2014. The industry

also recognizes that both CTO and MTO technologies have their own

sets of challenges. CTO technologies are coming under increasing

scrutiny in China due to environmental reasons while MTO

technologies are uncompetitive due to high methanol feedstock

costs. As such, some new MTO and CTO projects were either delayed

or cancelled in China. Meanwhile, steam cracker projects are

regaining prominence due to both environmental and economic

advantages. In China and South Korea, most new cracker

expansions/investments allow for the use of both naphtha and LPG as

feedstocks. In China, there are also several gas crackers in

construction and planning phase amid competitive feedstock prices.

The economic advantage from cracking LPG compared with naphtha is

expected to last for the next few years as IHS Markit forecasts

that the length in the global LPG market will continue in next few

years whereas naphtha and gas oil supply is anticipated to tighten

due to implementation of the new IMO regulation. It is crucial for

Asian crackers to remain cost competitive, especially with capacity

growth outpacing demand, increased exports of competitive ethylene

and derivatives from integrated complexes in the United States, and

a slowdown in the global economy expected in the next few

years.

Trade

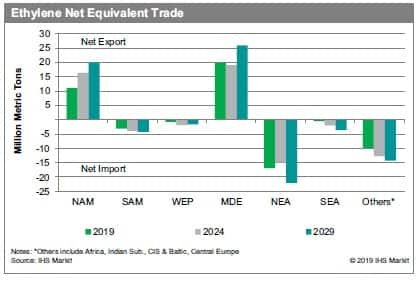

International trade of ethylene monomer will remain quite

limited overall compared with its derivatives owing to high freight

costs associated with transporting refrigerated liquids. However,

this is still necessary to maintain outlets for ethylene in regions

that have imbalances in production and consumption of ethylene, and

crackers operating at high rates due to high margins. In 2019, spot

cargoes from various origins-including the Middle East, Europe, and

Southeast Asia-have been shipped to Northeast Asia due to tight

supply in the region and workable pricing. Furthermore, sluggish

sales of key downstream polyethylene (PE) have resulted in several

integrated Asian producers offering spot ethylene monomer to

maintain high cracker operating rates. However, most of the

ethylene traded across international borders remains in the form of

derivative chemicals, including PE, ethylene glycol, styrene, and

vinyls (EDC) due to much lower transportation costs. IHS Markit

tracks the "net equivalent" trade volume globally, which is the

total amount of ethylene contained in the derivative trade. Shipped

as liquids or bulk solids, these ethylene derivatives are far less

expensive to transport than ethylene monomer.

Despite slower economic growth and aggressive investments in new

ethylene/derivative capacities, China will continue to dominate

ethylene derivative imports. Ethylene equivalent exports from the

Middle East have increased rapidly as new capacities allow Middle

Eastern producers to increase PE and ethylene glycol exports to

Asia, mainly targeting China, although shipments are also going to

other regions. Exports of ethylene derivatives from the United

States to global markets are expected to increase over the forecast

period as new steam cracker and derivative capacities are brought

online in the next few years, taking advantage of the low-cost

ethane feed available. Meanwhile, exports of ethylene derivatives

from other parts of Asia (Southeast Asia, Japan, and South Korea)

will be impacted as these regional exporters become less

competitive compared with producers in other regions with feedstock

cost advantages.

Strategic Issues

There are other key strategic issues that, in the opinion of IHS

Markit, will have a significant impact on global ethylene markets

over the next 10 years. These are discussed widely and in greater

depth in the

2020 World Analysis- Ethylene.

2020 World Analysis - Ethylene

IHS Markit is pleased to present the

2020 World Analysis- Ethylene. This annual service provides our

clients with comprehensive analysis of and insight into the global

markets for ethylene. In addition to the electronic versions of the

study (Tableau, PDF files, and searchable HTML files on IHS Markit

Connect), clients can access the online capacity database, which is

updated daily, and the online supply and demand database, which is

updated once during the 12-month service period. Access to IHS

Markit consultants worldwide is also included in the 12-month

service period.