Latin American E&Ps: Evaluating low-carbon strategies

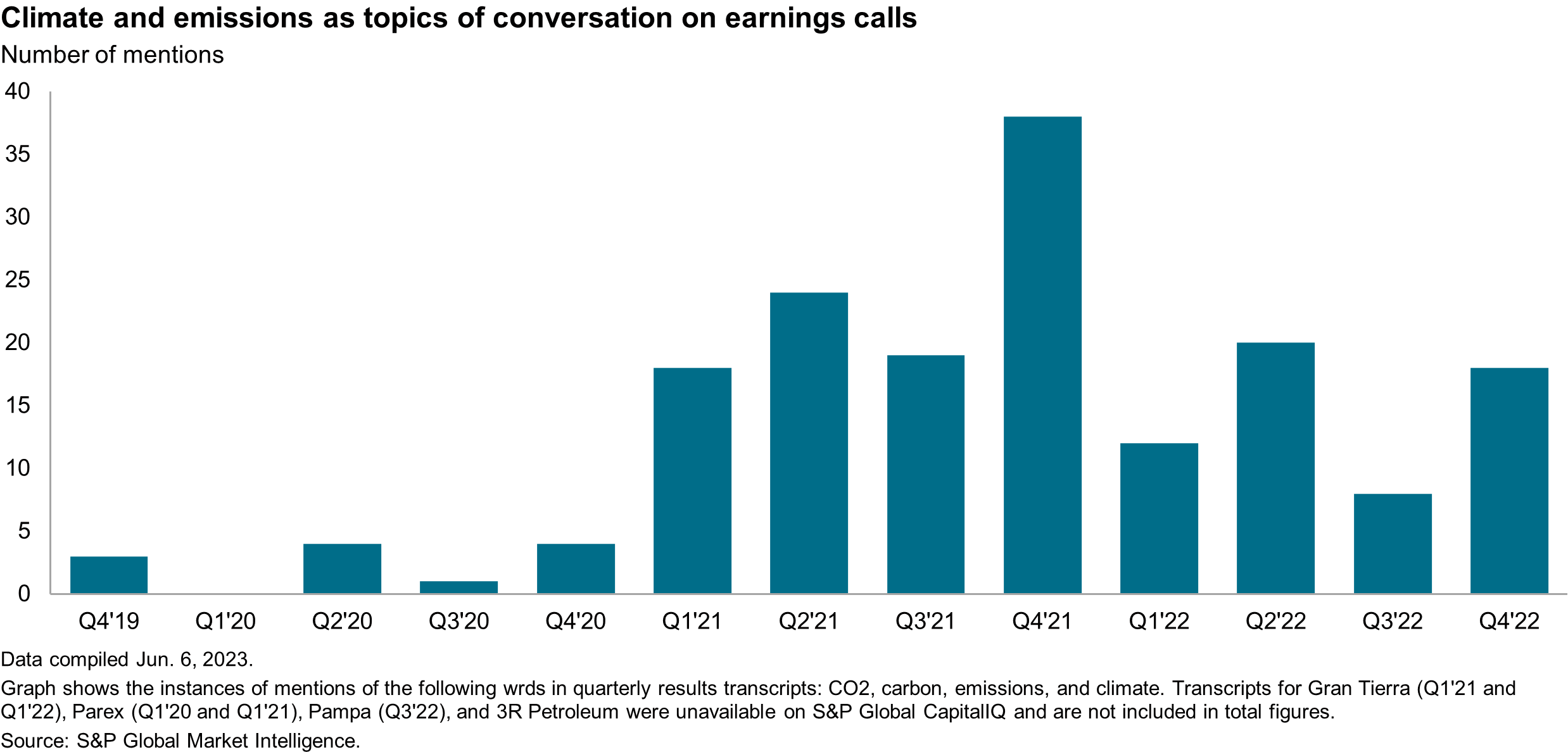

Government regulations and rising shareholder pressure are compelling oil and gas companies to address their impact on climate change. Within the sector, global integrated oil companies have taken the lead on this issue; however, reducing greenhouse gas emissions has also become a growing topic of conversation within the boardrooms of smaller regional companies, including those in Latin America.

For large and small companies, oil and gas production will remain central to their corporate strategies since these resources are responsible for generating most — if not all — of their revenues and shareholder returns. On the other hand, differences exist in terms of the scale of efforts that these companies are undertaking to slash emissions. For regional producers, actions on the low-carbon front will be limited relative to their larger counterparts. According to the International Energy Agency, oil and gas operations account for 15% of energy-related greenhouse gas emissions. This means that limited initiatives — such as reducing methane leakage, eliminating routine flaring, and powering upstream operations with renewables — would serve a significant role in reducing emissions from operations. While smaller producers are in the fledgling stages of their upstream transformation, cutting emissions has become a notable element within most corporate strategies.

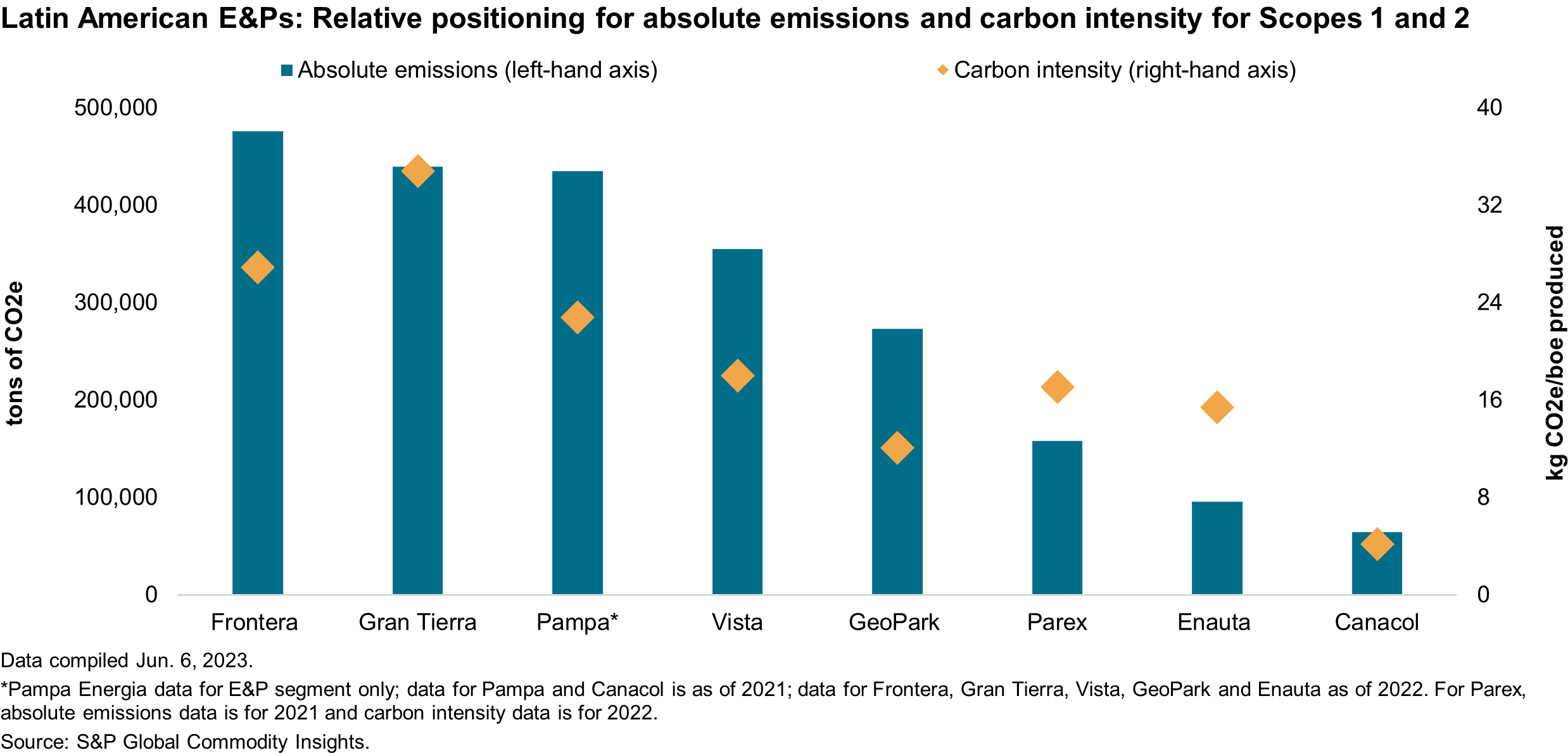

For Latin American E&Ps, initial efforts to reduce their carbon footprint have focused on operational efficiencies, improved technologies, and nature-based solutions. These measures address the so-called low-hanging fruit of emissions reduction, which can indeed have an impact. Some of these companies are going a step further and are investing in renewables to power their operations.

In a recently published report, S&P Global Commodity Insights evaluated in detail how nine of Latin America's largest independent producers compare in terms of their current emissions and what these companies are doing to reduce their emissions.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.