M&A Perspectives — Upstream: May 2023: Key trends and insights from the current global upstream M&A market

Are you looking for analysis on key upstream oil and gas transactions and regional trends & insights on recent global upstream M&A activity? Check out the latest May edition of our Upstream M&A Perspectives for key takeaways related to monthly upstream deal flow and deal value, key corporate and asset acquisitions, buyer and seller strategies and deal pricing.

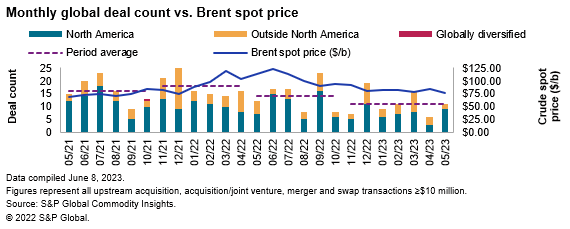

- Global upstream M&A activity rebounded strongly from the 2023 year-to-date lowest monthly deal count in April, nearly doubling in May on higher US activity.

- North America dominated deal count and value while international activity remained sluggish for the second consecutive month.

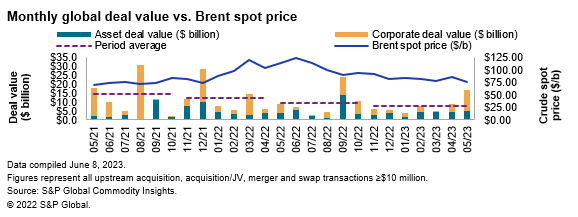

- Total transaction value in May rose for the second consecutive month and nearly doubled month over month boosted by high-value corporate takeovers.

- Corporate deal value climbed to $12 billion in May, the highest monthly total for corporate acquisitions since December 2021.

- Contingent payments continue to be a critical component in buyers and sellers bridging the gap on asset valuations and facilitating transaction agreements.

- Private and private equity-backed players continue to be active in the US unconventional space as both buyers and sellers.

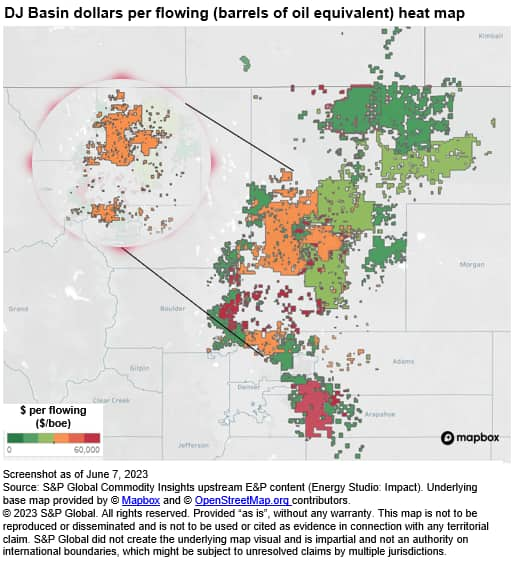

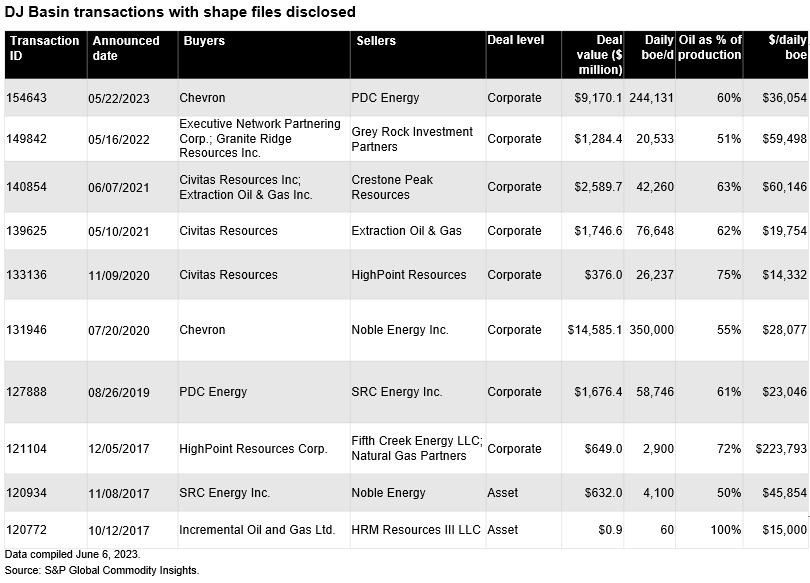

- While global international oil companies (GIOCs) focus on returning capital to shareholders amid a cash flow boom, select majors are seeking sizeable upstream acquisitions using stock. In the largest upstream acquisition to date in 2023, Chevron Corp. agreed to acquire US Rocky Mountains DJ Basin exploration and production company PDC Energy Inc. in a $9.2 billion stock transaction, including debt, as corporate consolidation is accelerating in the Rockies.

- The largest asset-level acquisition in May was in the Canadian oil sands. ConocoPhillips announced plans to exercise its preemption right to purchase the remaining 50% interest in the Alberta oil sands Surmont development from TotalEnergies SE for $3.0 billion plus contingent payments, partially preempting Suncor Energy Inc.'s April 2023 $4.05 billion agreement to acquire TotalEnergies' Canadian operations that included stakes in both the Surmont and Fort Hills projects.

- International deal activity was divided among two countries — the UK and Mexico. In the largest international deal, Grupo Carso SAB de CV agreed to acquire an 8.68% stake from Talos Energy Inc. in the shallow-water Zama development offshore Mexico for an up-front $74.85 million plus contingent payments.

- Warren Buffett continued to invest in the oil and gas sector, increasing his stake in Occidental Petroleum to nearly 25%.

In addition to significant acquisitions and divestitures over $10 million, every month we also highlight other significant transaction market developments, including unsolicited bids, joint partnerships, private-equity investments and significant transactions without disclosed financial terms. Every month we also highlight significant bankruptcies, and restructurings.

To see the full May Perspectives report and other M&A-related scheduled updates and insight reports, please go to the S&P Global Commodity Insights Companies and Transactions page on our Connect platform.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.