Shipping market outlook—Container vs dry bulk: Second quarter 2023 update

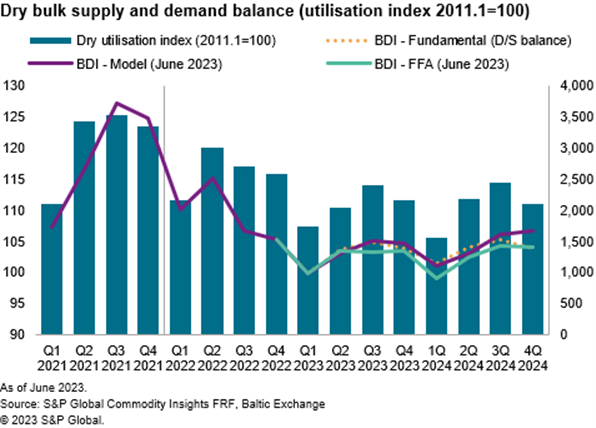

In the last three months (March-May 2023), Capesize market performed in line with the S&P Global Freight Rate Forecast (FRF) model's expectation, but Sub-Panamax markets underachieved their potential mainly owing to reduced grain shipments and slower-than-expected recovery of demand from mainland China. Indeed, in the last edition (first quarter 2023), we noted our cautious view on near-term outlook, mostly for second-quarter 2023 expectation, mainly owing to negative profitability and low margin in commodity markets as well as the lack of confidence in private sectors. While writing our second-quarter 2023 update, we found key drivers would still be in line with the assumption and continue to support our cautiously positive view for the third quarter 2023, compared with bearish market consensus.

- Although mainland China's service sector and industrial production will recover earlier than market consensus, business and consumer confidence is likely to recover gradually. We expect mainland China's demand to grow steadily from 2023 onward. Therefore, Capesize is expected to return to the highest-earning segment in 2023 with recovery in demand from mainland China and normalizing minor bulk and backhaul demand for smaller segments.

- The conflict in Ukraine will continue without major escalation in the foreseeable future, and economic sanctions and voluntary embargoes will remain.

- Finally, bills of lading data has indicated that container spillover impact in geared bulk and general cargo market or reversed decontainerization trend has almost finished with a significant drop in container freight rates. We do not expect additional containerization on traditional dry bulk cargo, although the risk remains if box freight rates decrease more than expected with another round of war on market share, which happened in 2015-16.

Outlook

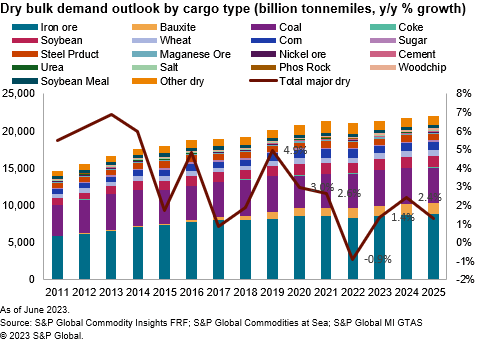

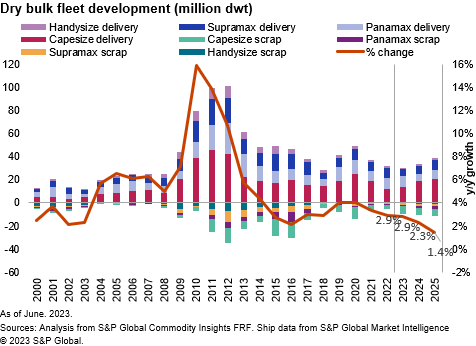

In our key supply and demand assumption, we believe dry bulk demand is expected to increase by 1.4% in 2023 with recovery in iron ore and coal shipments, settling at 2.5% in 2024, while fleet growth in 2023 will remain stable with steady new deliveries and slow scrap activities with unfavourable age profile, but overall fleet growth will be limited in 2023-25 to about 1%-2% with reduced orderbook that will support long-term profitability of freight market.

Since bulk freight rates have also declined along with box rates, we believe further containerization from bulk cargo will be limited; however, downside risks remain with large-scale new containership delivery in coming years. Therefore, demand factors and new seasonal patterns will be major drivers for the freight market in the near term, which indicates that freight rates will peak in the third quarter.

Congestion has already returned to pre-pandemic levels with lower import demand and the easing of supply chain issue and we do not assume immediate impact by regulations in speed, since most sailing speed has already slowed down with lower freight and higher bunker prices. In the long term, we expect supply normalization with 1%-2% fleet growth annually in the next few years with stricter regulations will help the market to remain stable.

Regulation-related additional costs with increasing over-age capacity may boost scrap activities, specifically after 2025. However, it is unlikely to see major impact in speed and demolition in the near term with lack of scrap candidates, transitional phase of the regulations. However, in the medium term, with lack of investment in alternative fuel, regulation-related additional costs (CII, EU ETS, etc) with increasing over-age capacity may boost scrap activities and reduce sailing speed to meet the requirements of regulations or save the fuel cost, specifically after 2025.

Although methanol (green) started to gain attention recently, mostly from the container sector, gas has been the preferred choice for alternative fuel, while conventional LSFO-HSFO with scrubbers are still the dominant type for dry bulkers.

In this context, S&P Global freight rate forecast (FRF) models predict the Baltic Dry Index to rebound from an average of 1,100 points in the first half of 2023 to average about 1,300-1,500 points in the second half of 2023 and settle at an average of about 1,400 points in 2024-26.

Demand

After declining by 0.9% in 2022, dry bulk demand is expected to increase by 1.4% in 2023 with recovery in iron ore and coal shipments, settling at 2.5% in 2024.

Supply

With limited orderbook, annual dry bulk fleet growth will slow to 2.9% in 2023 and 2.3% in 2024, compared with 2.9% in 2022 and 3.4% in 2021. Container fleet continues to grow at about 6%-7% in the next two years.

Regulation will limit maximum speed, however, immediate impact will be limited as fleet speed has already slowed down with lower freight rates and higher bunker fuel prices. Regulation-related additional costs with increasing over-age capacity may boost scrap activities, specifically after 2025. However, with $500-$600/ldt scrap prices and positive earning expectations, there will be limited demolition activities in the next two years.

Regulations and energy transition impact

Shipbuilding - regulations and fuel transition: Environment regulation, including carbon intensity indicator (CII), and energy efficiency existing ship index (EEXI) will boost scrap activities and reduce speed in the coming years, which will lead to supply normalization with about 2% fleet growth annually in the medium term.

With EEXI — design requirement for existing ships — many vessels go for engine power limitation (EPL); maximum and operating speed are expected to be reduced, however, immediate impact will be limited as fleet speed has already slowed down with lower freight rates and higher bunker fuel prices.

CII rating is calculated as CO2 emitted per cargo-carrying capacity and nautical mile; this may increase ballasting voyage and reduce cargo intake. CII regulation will start to reduce sailing speed from 2024 and the impact may become significant in scrap activities from 2025 onward with favorable age profile. However, this also incentivizes higher demurrage to reduce idling time and congestion in the coming years.

Theoretically, EU ETS may cost shipping companies an additional €100-300 per 1 VLSFO tonne based on an estimated CO2 price of € 60-100/tonne CO2, which could be passed on to customers through higher freight rates. The ETS will apply to 100% of emissions on voyages between European ports and 50% of emissions on inbound and outbound voyages. Shipping companies that do not comply with the ETS will be fined €100 for each EUA as penalties.

Although methanol (green) started to gain attention recently, mostly from container sector, gas has been the preferred choice for alternative fuel including dry bulk sector, while conventional LSFO-HSFO with scrubbers are still the dominant type for dry bulkers.

In summary, it is unlikely to see major impact in speed and demolition in the near term with lack of scrap candidates and transitional phase of the regulations. However, in the medium term, with lack of investment in alternative fuel, regulation-related additional costs (CII, EU ETS, etc) with increasing over-age capacity may boost scrap activities and reduce sailing speed to meet the requirements of regulations or save the fuel cost, specifically after 2025.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.