Solar and wind leading the clean energy investments and partnerships in 2023

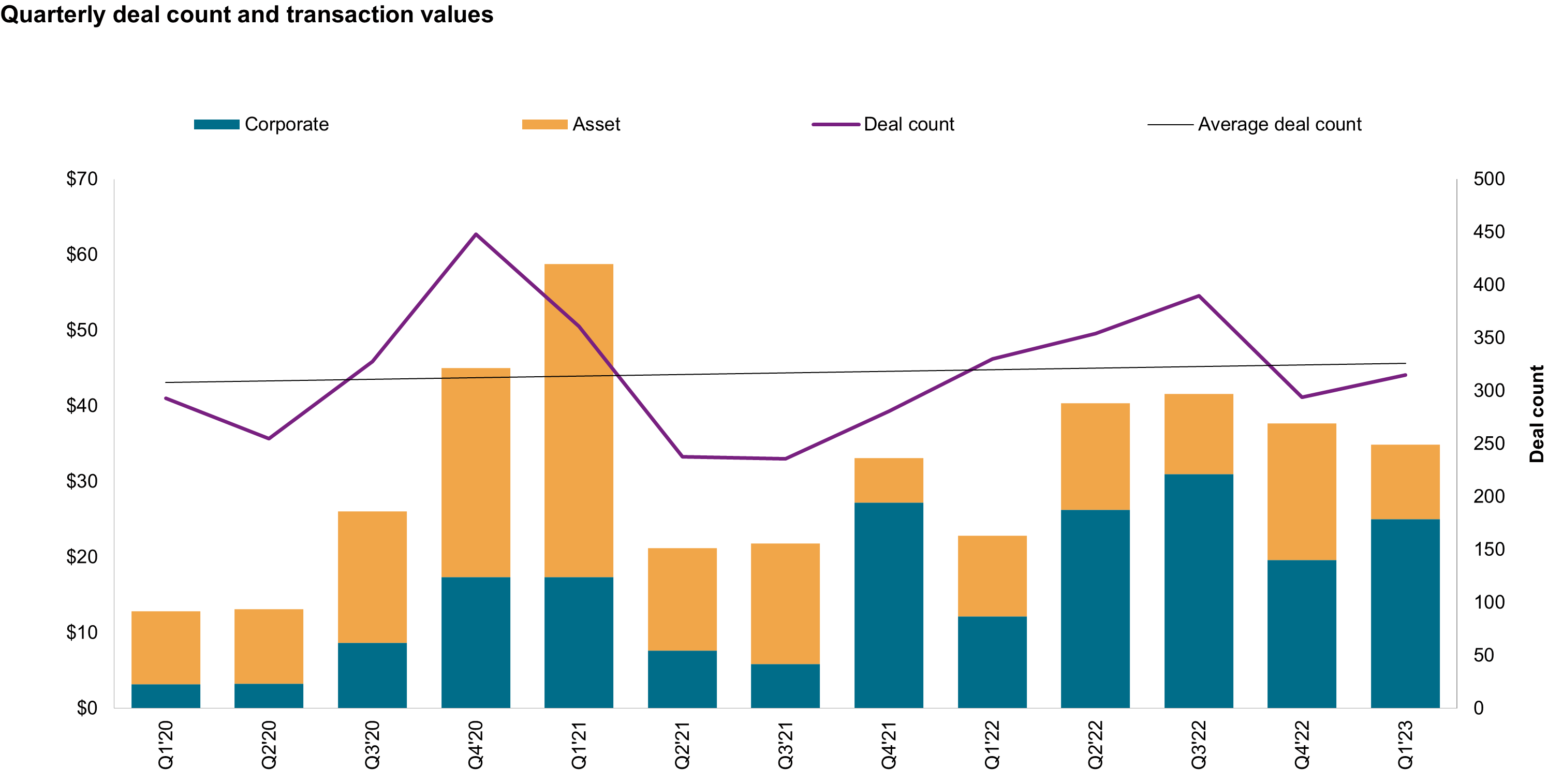

Low-carbon deal activity gained momentum marginally in the first three months of 2023 following its astonishing growth in 2022 as the countries aiming to achieve their net-zero targets in today's volatile fossil fuel prices environment and geopolitical uncertainties.

Corporate acquisitions regained dominance among investors including financial, oil and gas (O&G), and renewable companies.

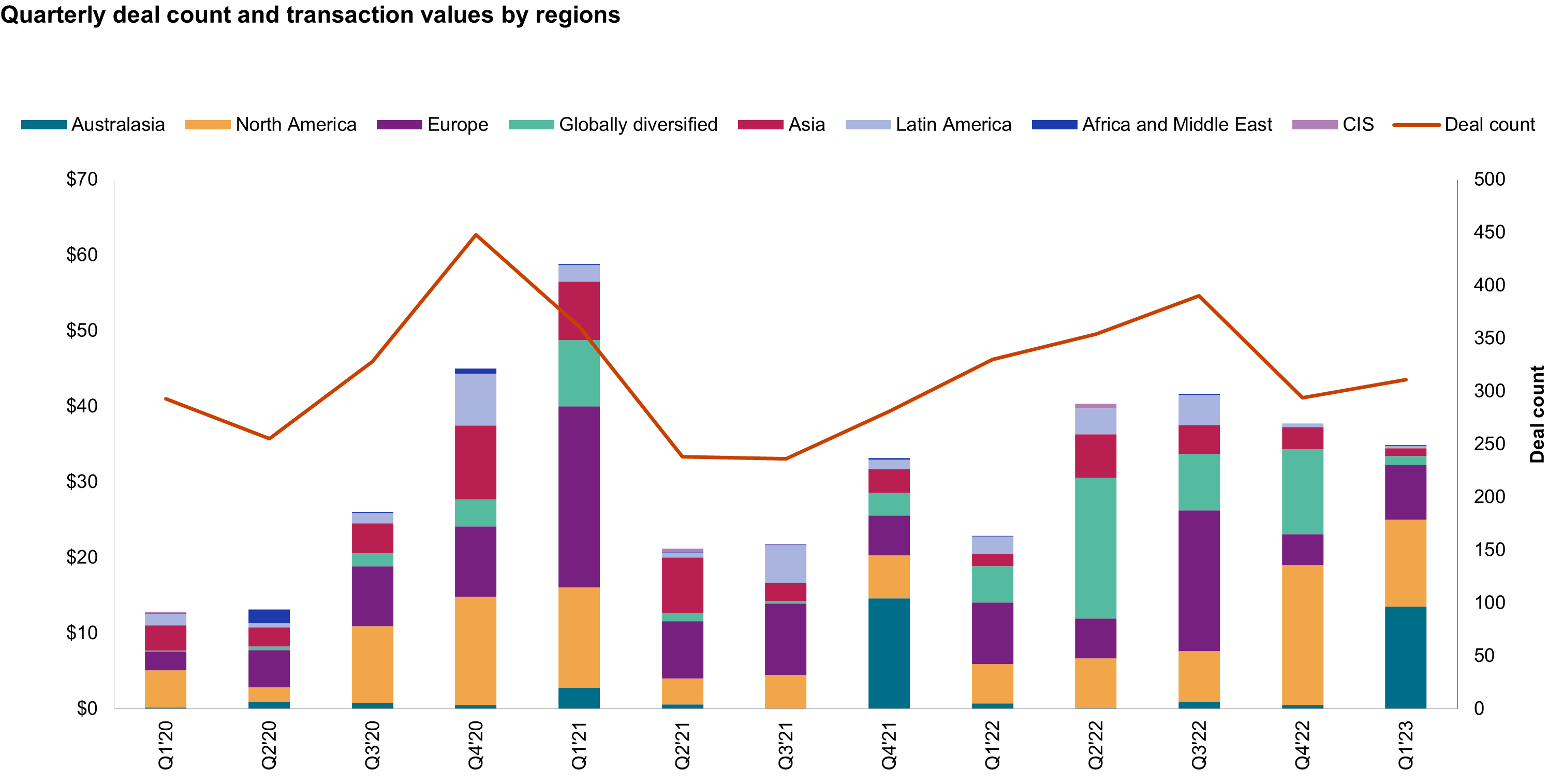

Energy security concerns have prompted countries to increase their renewable energy capacity and reduce dependency on fossil fuels. The increase in clean energy investments is heavily concentrated in a handful of regions. Australia topped the list by announcing a $13 billion takeover of Origin Energy, followed by Europe and North America, which contributed 30% and 20% of the total transaction value respectively.

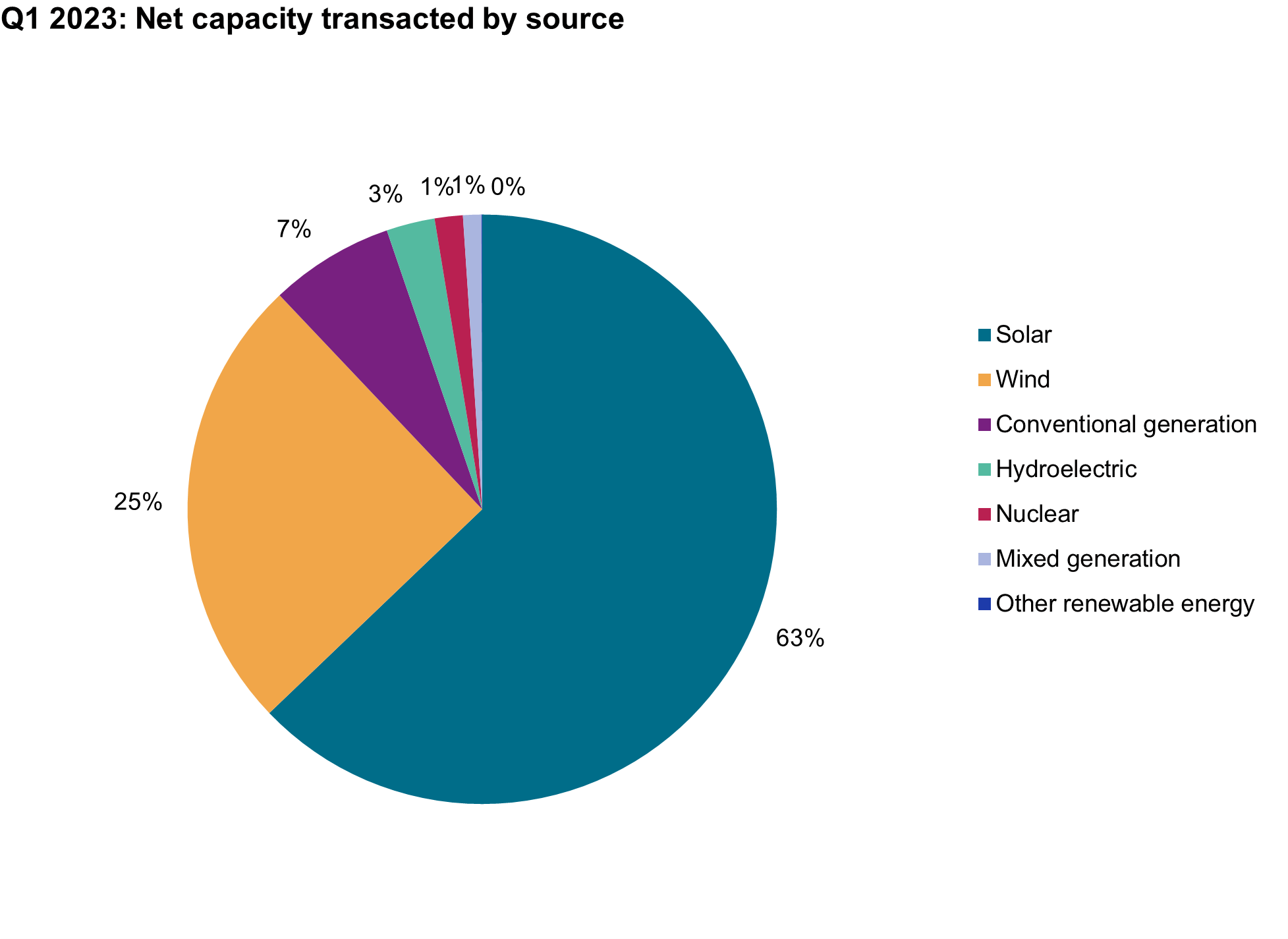

Solar PV and onshore wind are the low-cost options for renewable electricity generation and triggered a spike in under-development solar and wind investments in the first quarter of 2023. In addition, other active low-carbon segments in North America and Europe included waste to energy, and support products/services such as supply chain, manufacturing, and technology.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.