Lebanon, What’s Next?

After three years since the last exploration well (Byblos 1) drilled by TotalEnergies SE in Block 4, Lebanon is hopeful that the country's second ever offshore exploration well will be a success. The expectations are even higher than in 2020 that the Qana 1 well delivers positive results, considering the Country's fragile economy and US$103.39 billion debt (World Economics).

The discovery of major offshore fields over the last 15 years in neighbouring countries such as Israel, Egypt and Cyprus has led to total discovered recoverable resources increasing to around 144 trillion cubic feet of gas (Tcf), with significant upside exploration potential remaining. Development of these resources has transformed Israel from a net fossil fuel importer, to being self-sufficient and an exporter of natural gas. Success at Qana 1 could pave the way for Lebanon to do the same, albeit if the substantial above ground challenges are resolved.

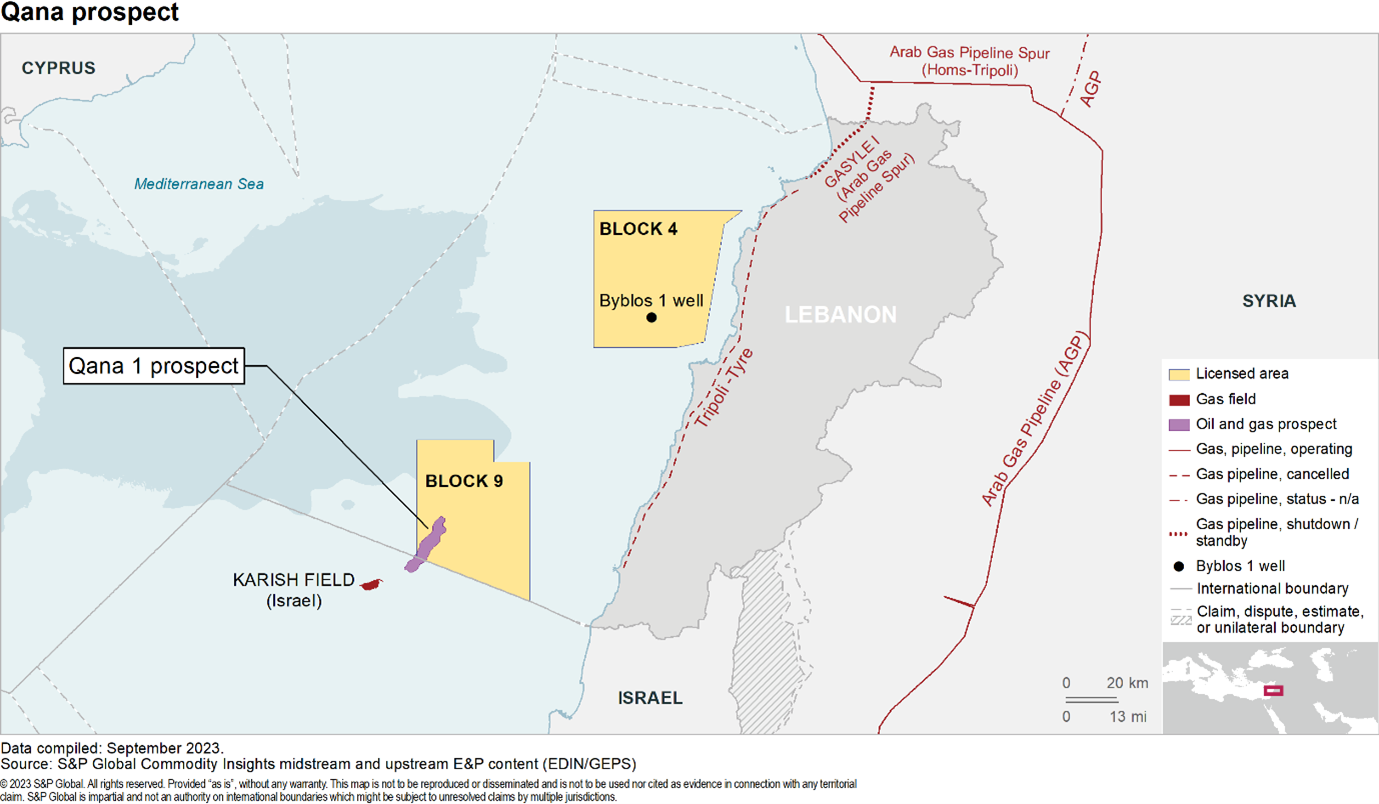

Qana 1 drilling activities started in early September 2023 with the well targeting biogenic gas. The prospect is located in the south of Lebanon, straddling the Israeli maritime border and is less than 10 km from the producing Karish field in Israel. Targeting the same play, the well is expecting to encounter the Tamar Sands reservoir, prolific in the nearby Israel fields, however, was absent in Lebanon's first offshore exploration well. The Byblos 1 well in Block 4, located 100 km to the north, penetrated the entire Oligo-Miocene section and encountered gas shows, however there were no indications that the Tamar Sandstone reservoir formation objective was present.

The exploration plan for Block 9 started back in 2017 but different concerns affected the speed of the project. The consortium composed of TotalEnergies, Eni and Novatek had to postpone drilling several times. Firstly, due to the Covid-19 pandemic, followed by the explosion in Beirut Port, the departure of Novatek and finally a dispute over the maritime border with Israel.

Optimism ramped up in October 2022 after a US-brokered deal solved the border dispute after nearly two years of negotiations, followed by Qatar Energy acquiring 30% share in Blocks 4 and 9, and the Consortium awarded the drilling contract to TransOcean. In August 2023, the awaited TransOcean Barents Vessel arrived in Lebanon.

The Lebanon authorities are optimistic that the well, which is expected to take 67 days to drill, encounters gas to kickstart further exploration in the area. The Second Offshore Licensing Round was re-launched in November 2021, with the deadline delayed to October 2023, by which time early indications from Qana 1 may be known. Eight blocks are on offer, covering the remaining offshore acreage in Lebanon. Likewise, the TransOcean drilling rig is contracted for an optional three more wells, which would likely be an appraisal well (if successful), and two other prospects in Block 9.

Although Qana 1 has a low geological risk profile, the economic and political problems of Lebanon will still exist if a discovery is made. Lebanon's politics remain highly fractious, with the ability of fragile coalitions to reach necessary compromises being fundamental to any future government's capacity to implement and sustain policies. Likewise, the World Bank called Lebanon's economic crisis one of the world's worst in 150 years. Success at Qana 1 would take several years before any economic benefits materialise, particularly given the lack of energy infrastructure in Lebanon. Nearby Cyprus exemplified this after their major Aphrodite discovery in 2011. After much optimism of a quick development and significant export revenue, the field is yet to be developed despite a stable economy and great willingness from the government.

Development options

If Qana 1 is a success, then supplying the domestic market will be the obvious development strategy. A priority for Lebanon is to replace expensive and inefficient fuel oil for gas in domestic power plants. However, currently only the Deir Ammar power plant, located in the far north of the country, is capable of being operated with natural gas. The southern power plants of Zahrani, Tyr and Baalbek can operate on gas, but would require some modifications first. A discovery would benefit from being only 70 km from the coast and could be developed as a subsea tie back to onshore facilities, or more likely as an FPSO development like the nearby Karish field in Israel. However, a major problem is the lack of gas pipelines in Lebanon, with only the Lebanese Gas Pipeline (GASYLE) in the north connecting the Deir Ammar power plant to the Arab Gas Pipeline (AGP) in Syria. The long planned and delayed Coastal Gas Pipeline (CGP), which would run from Deir Ammar to Tyr for a length of 175 km, would be essential in connecting a southern gas discovery to the domestic market in the north. The CGP, estimated at US$435 million, would be the backbone for the distribution of natural gas along the Lebanese coastline since it can connect to all domestic power plants as well as the AGP pipeline for future export.

Other export options would require a significant gas discovery and will prove difficult to develop. The easiest option would be to take advantage of Israeli infrastructure, with the Karish FPSO being only 10 km away. But while the two countries came to an agreement over the border dispute, it is highly unlikely that Lebanon gas will ever flow through Israeli pipelines. Utilising LNG facilities in Egypt would require a very long and expensive pipeline that avoided Israeli waters. Nearby Cyprus has no export facilities and is in its own predicament with monetising its gas discoveries. A tie-back to Turkey would need to cross Syria and/or Cyprus waters (with which Turkey has no diplomatic relations) and navigate difficult subsea terrain. Lastly, FLNG could be an option, but based on undeveloped discoveries in the region, would require around 4-5 Tcf to justify a standalone development.

***

Want to access more upstream content? Visit S&P EDIN & Vantage.

Posted 5 October 2023

by Chad Barnes: Sr Team Lead, Technical Research (Middle East)

and Zonia Palacios: Sr Specialist, Technical Research (Middle East)

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.