Low hydraulic fracturing demand in the first half of 2019 to keep utilization rates in the low 60% range

IHS Markit expects continued, low hydraulic fracturing demand through the first half of the year, although a gradual ramp up is likely to occur by the end of 2019, with the overall average hydraulic horsepower demand for 2019 expected to be lower than for 2018. The low demand and ample supply should keep utilization rates in the low 60% range in the near future.

The first half of 2019 will continue to be a transition period for pumping suppliers as overall hydraulic fracturing demand increases during the second half of the year, with pipeline capacity opening and drilled but uncompleted wells being converted. Compared with 2018, 2019 overall demand is expected to decrease by around 7%. However, by the end of 2020, hydraulic fracturing demand could potentially reach levels like those seen in the first half of 2018, driven mostly by the Permian.

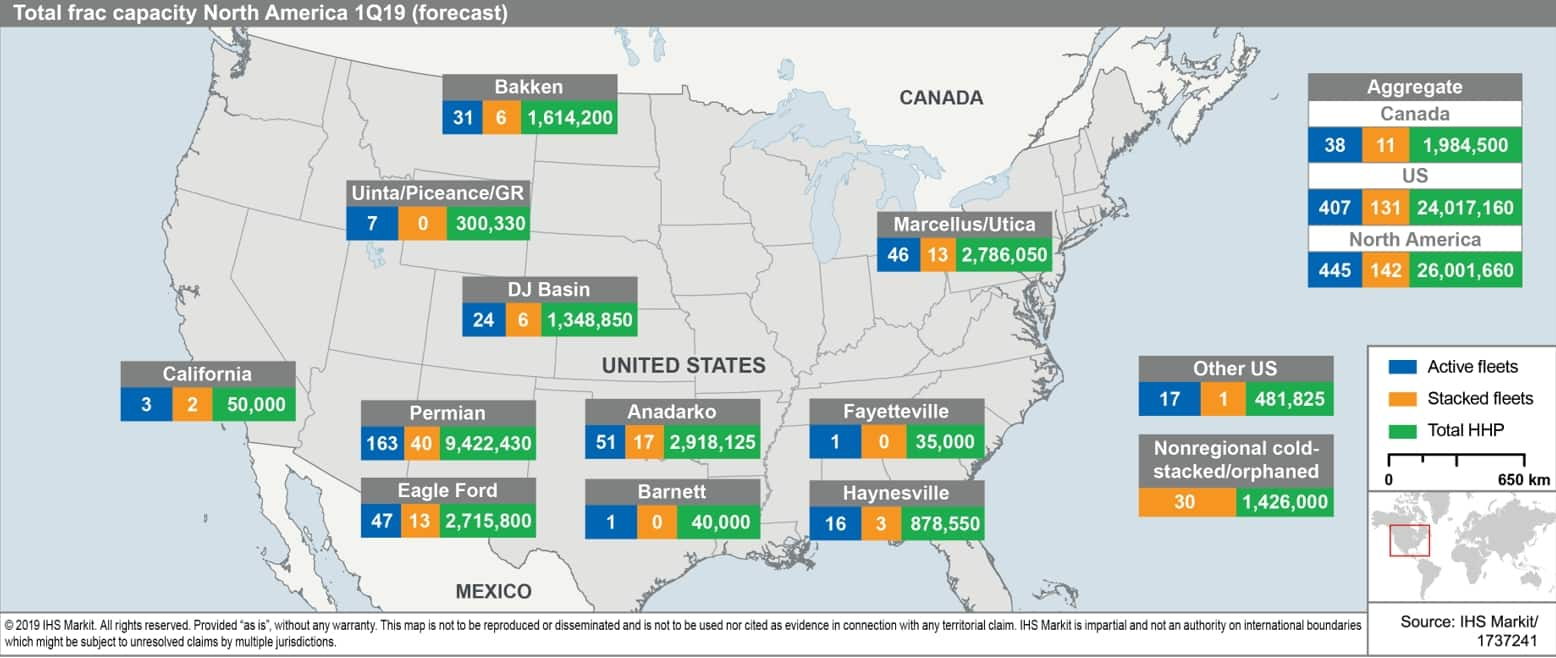

Compared with the previous quarter, Anadarko and the Haynesville are expected to be the biggest drivers of downward fracturing demand, while the Permian and Marcellus are the only plays expected to have marginal demand growth when compared with the previous quarter. The change could be a result of focus slowly shifting back to the Permian from other oil plays and the Marcellus returning as the focus for gas plays (as compared with the Haynesville).

Figure 1: Total frac capacity in North AmericaFirst Quarter 2019(forecast)

The downward pricing experienced in late 2018 will likely stabilize as an oversupplied market with flat demand continues the trends started in fourth quarter 2018; weak pricing has led to approximately 20-25% of all capacity to be warm- or cold-stacked for the quarter. Financially, as emphasized in this report's quarterly highlight, most pumping suppliers had a weak fourth quarter, with share prices for some suppliers plunging in the fourth quarter 2018 anywhere from 25% to 60% as compared with the third quarter.

Capacity additions will be minimal in 2019, with supply expected to remain stable at around 24 million HHP for the United States. Many fleets brought on in 2019 are likely to be replacement fleets or those already scheduled for construction prior to the start of the year. In Canada, owing to a difficult mix of government regulation and low pricing, the region faced a challenging fourth quarter that is likely to continue into 2019, leading to extremely low demand rates.

Learn more about our coverage of onshore materials, including proppant and water.

IHS Markit's Onshore Services & Materials team's recent PumpingIQ report for the first quarter of 2019 tracks the market size and horsepower supply for hydraulic fracturing operations in North America. The report is available in its entirety on Connect™ for Onshore Services & Materials clients.

Emanuel Ozuna Vargas is a Principal Research Analyst, Senior Associate at IHS Markit.

Posted 1 April 2019

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.