South Africa at a crossroads: Options for the future power mix

The year 2018 proved to be a difficult year for South Africa's power sector, with the state-owned utility, Eskom, facing steep increases in debt and a dip in its credit rating. Simultaneously, consumers faced blackouts and scheduled load shedding, as coal supply and power plant utilization rates were strained. This situation prompted discussions of reform, as well as the future supply mix.

The recent draft to South Africa's Integrated Resource Plan (IRP) outlines a transition from coal and nuclear to gas and renewables. However, coal is a staple of the South African economy, complicating decisions to diversify. In identifying potential pathways, IHS Markit evaluated five key variables:

- Retirement schedule of existing power plants: The schedule at which Eskom retires its coal units is a source of uncertainty and will ultimately be dictated by the country's ability to meet demand requirements. It is reasonable to assume that some units may be refurbished to address future needs, including emission control. However, there is little justification for heavily investing in power plants halfway through their life and four of the nine six-unit plants, which, owing to scale are the most likely to be extended, are already more than 30 years old.

- Coal supply and investment constraints: Eskom is in the process of completing supercritical power plants Medupi and Kusile, planned to accommodate 4.8 GW of capacity each. However, given the significant cost overruns and delays faced during their implementation, the risks for financing future coal projects are significant. Furthermore, demand for low-calorific coal has increased while investment in mines has lagged. In most cases, mines are approaching the end of their reserve life, prompting the need to build new infrastructure. However, Eskom's financial situation will make it difficult to invest in mines with which it shares costs (cost-plus contracts).

- Clean energy and emission targets: The IRP continues to reflect the country's renewable energy targets, with current projections at 18 GW of additional utility-scale solar and wind capacity by 2030. Renewable deployment will be constrained by delays in transmission buildout, but supported by the recently passed Carbon Tax Bill and the country's IPP program. In addition to renewable targets, South Africa committed to reduce carbon, sulfur dioxide, nitrogen oxides, and particulate matter. To retrofit plants to meet current and potential future standards will not only be expensive but also reduce the coal fleet's already-diminishing availability factor.

- Natural gas availability: Prospects for increasing South Africa's gas use depend on the ability to secure access to greater supply. There are three potential sources of supply: indigenous gas, gas piped from East Africa, and LNG imports. Domestic production includes potential in long-time discovered offshore Ibhubesi gas field, a recent and significant gas and condensate discovery within the Southern Outeniqua Basin, and more uncertain but potentially large unconventional shale and coalbed methane resources in the Karoo Basin.

- Political and social pressures: Coal has a broad role in South Africa's economy, particularly in relation to exports, employment, and independence. To date, high-coal export sales have contributed to the country's foreign exchange earnings and account for almost 19% of mining royalties. The use of coal in the power sector has allowed the country to serve as a power exporter while maintaining energy independence. Moreover, though coal is contributing to a declining percentage of jobs, pressure from labor unions remains strong.

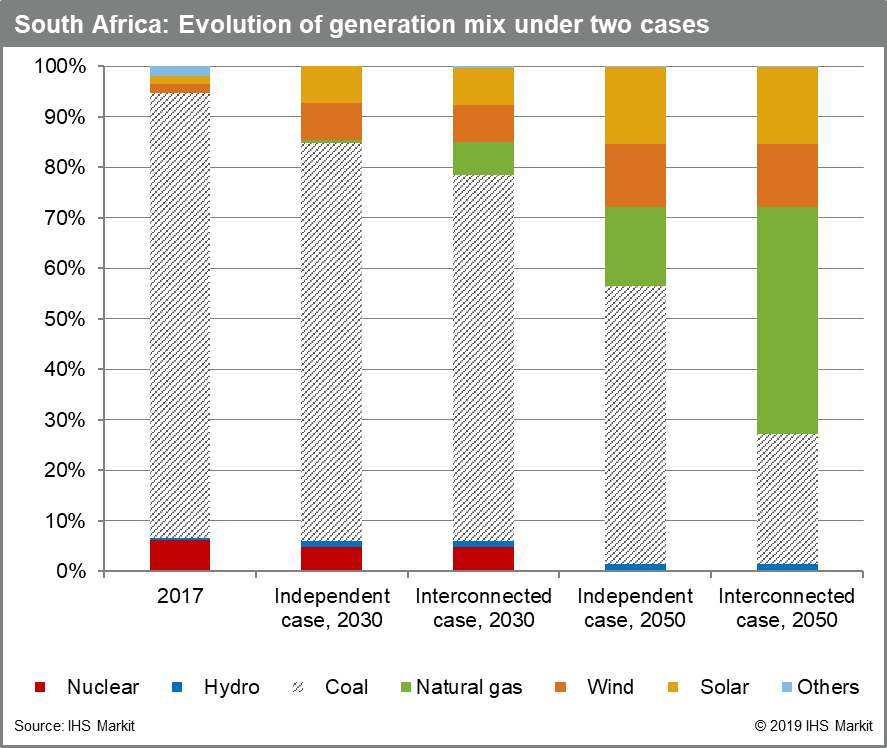

In evaluating South Africa's existing energy mix; technical, political, and social dynamics; and availability of generating resources, two power supply options to maintain the IHS Markit projected level of economic activity emerged:

- Independent case: Life of the coal fleet is extended and gas enters the picture incrementally. Investment in coal continues into the late 2030s, allowing the fuel to maintain its majority share of generation over the next 30 years. Resulting system generation costs sit below 5 cents per kWh in the long term, but the risk of older coal units failing and the opportunity cost of investing in capital-intensive plants—while other technology costs decline—must be considered.

- Interconnected case: Coal retires early and a swift and integrated shift to gas occurs. Natural gas generation is forecast to account for almost 45% of total generation by 2050, with costs ranging between 5.5 cents and 6 cents per kWh. Attaining fixed long-term contracts for gas supply is key to the success of this strategy.

Regardless of the determined supply trajectory, growing pains are expected. The rapidly changing dynamics around South Africa's power sector, renewable technology costs, coal supply, and gas markets will add a layer of complexity to achieving the IRP targets and will require an integrated and coordinated strategy.

Figure 1: South Africa: Evolution of generation mix under two cases

Learn more about our coverage of the global power market.

Anna Shpitsberg is a director within our global power and renewables group at IHS Markit.

Raul Timponi is an associate director within our global power markets group at IHS Markit.

Posted 3 April 2019

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.