Offshore Supply Vessels fleet ages worldwide

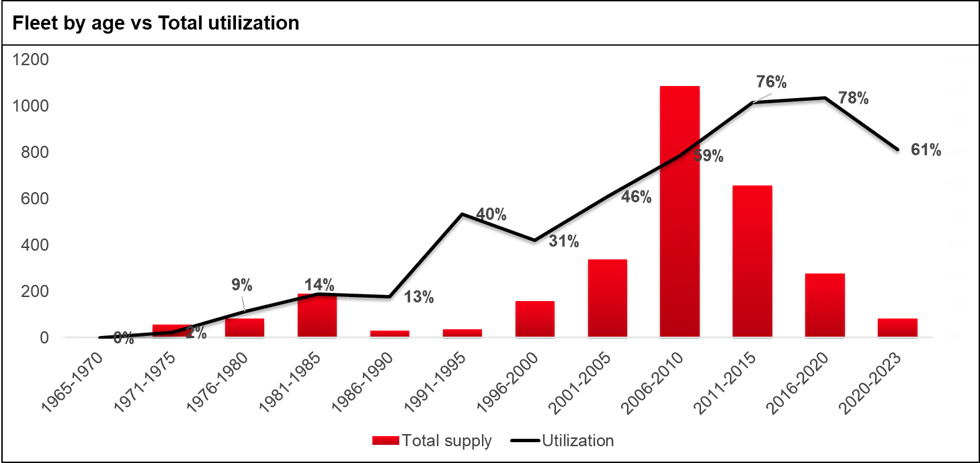

Since mid-2021, the offshore supply vessel (OSV) industry has reported record utilization levels which have continued over the last months. However, it's not just the improving demand responsible for the higher utilization observed in the last months, but the reduction in the overall tonnage. From August 2016, when the number of vessels serving the energy sector peaked to June 2023, OSV tonnage was reduced by 330 units. This decline of OSVs serving the energy sector is the consequence of two main drivers, the first is the increasing number of vessels that have withdrawn from the industry following the decline in demand experienced from 2014 to 2021. Most of these vessels started to work for non-energy sectors, since 2020 around 85 vessels have been converted out of the market. The second driver is the increasing number of vessels that have been scrapped, over 160 since 2021. The price earned for scrapped vessels has risen, which has attracted OSV owners to sell old units that have been cold-stacked for years and that are very difficult and expensive to reactivate. By the end of April 2023, the average build year of the total OSV fleet stands at 2006 while the median and mode is 2009. Vessels that were built between 2007 and 2014 represent the largest group covering 54% of the total tonnage. On average around 240 units joined the market annually between these years, however this peaked to 290 vessels between 2009-2010. Since 2015 new-build deliveries have sharply declined, over the last five years merely 177 units in total have been built and delivered. Currently, vessels that are older than 20 years absorb 25% of the total tonnage, but for the following three years it is forecast that this will jump up to 31%. In terms of utilization, as expected the younger the vessel the higher the utilization.

Graph 1: Total fleet by age vs Total utilization.

Source: S&P Global Commodity Insights upstream E&P content (Petrodata MarineBase)

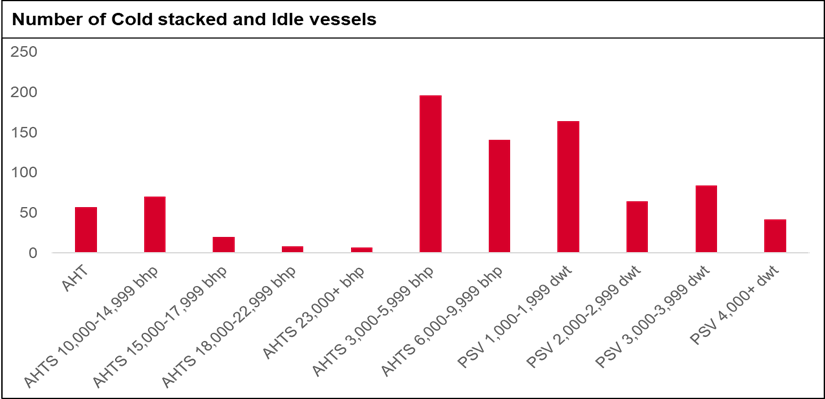

The utilization rate for OSVs younger than 10 years reaches 75%, but for older units this stands at 48%. This trend is due to the preference of oil and gas companies for newer units. The segment covering platform supply vessels (PSVs) of over 4,000 dwt is foreseen to experience tight availability for the coming years, currently it reports utilization of 78%. The average build year of this segment is 2012, and the mode is 2014. Most of these vessel were delivered between 2008 and 2017, covering around 74% of the total segment. In the last five years only 62 PSVs of over 4,000 dwt were launched, and it is anticipated that just 16 newbuilds will be in service by the end of 2023. A very important metric that helps to analyze how much the fleet could shrink is the number of vessels that are subject to be reactivated. In other words, how many can be reactivated because their features can fit the current demand of the market, and their reactivation could be financially viable. OSVs that had been cold stacked for less than five years, that are younger than 20 years and have DP systems are more likely to be reactivated. It is important to highlight that according to industry sources as well as the public comments made by the largest OSV owners, reactivating would be the first option before thinking of building new vessels. Currently, there are approximately 850 OSVs either cold stacked or idle, but as mentioned not all of them can be reactivated. As expected, +4,000 dwt PSVs and +15,000 bhp anchor handling tug supply (AHTS) vessels will be among the most in-demand tonnage in the short and mid-term, therefore it's estimated that these segments will see most of the reactivations. By mid July, the marketed utilization of large PSVs approached 90% and it was reported that 32 units could be reactivated. Regarding +15,000 AHTS vessels, currently there are just 18 units that would fit those parameters.

Graph 2: Number of Cold stacked and idle vessels

Source: S&P Global Commodity Insights upstream E&P content (Petrodata MarineBase)

The current order book shows just 89 vessels are due to be delivered before the end of 2024. A moderate number compared to what the market may require to meet the requirements for the coming years. As mentioned, the large PSV segment is showing tight availability. For the mid-term it is anticipated that the industry may face a severe shortage worldwide. It is important to mention that around 60% of the vessels that are under construction or are expected to be delivered were ordered in 2014 and 2015, resulting in an eight to nine years lead time for delivery. This situation was due to OSV companies postponing and even in some cases cancelling their expansion plans due to the adverse market and financial conditions. In some instances, as the money ran out, ownership of hulls and vessels reverted back to the build yards, which are now seeking new buyers for the units.

Currently the main trend in the industry is strong sales and purchase activity, besides the reactivation of vessels. Some OSVs owners have leveraged the current market conditions to sell some units, to either improve their financial situation, or just to follow another business strategy. For some OSV companies that want and have the possibility to enhance their fleet, purchasing vessels already in service is the first option before thinking of building new ones. The reason is quite simple, the price of a new-build PSV is skyrocketing. However, the list of vessels that are for sale has been shrinking, which could pressure the price of used vessels. Due to the possibility of a shortage of high-specification vessels and the aging of the current fleet, it's likely that we will see an increased interest in new builds. Nonetheless, most of the OSV companies have been very reluctant to start constructing new OSVs. Trade sources have said that for OSV companies to commence building new vessels, it would be necessary to have the collaboration of both IOCs and NOCs by ensuring long term contracts.

Therefore, the more the delay in constructing new vessels, the older the fleet gets. This situation is bringing about changes in client's requirements, which have been forced to become more flexible when it comes of the age of the vessels. Moreover, the day rates of newer vessels have increased compared to those with more years in service. As a result, clients are being more flexible in accepting older OSVs as it helps to fit their budgets. However, this situation might not be sustainable in the coming years as the units will experience the normal deterioration. In terms of carbon reduction, the aging of the fleet is also generating a delay in this area as usually older vessels are less fuel efficient and generate more carbon than those that are newer. This runs against the carbon reduction objectives set by many charterers within the oil and gas industry. Moreover, for the next three years, we will see more pressure not only from the increasing activity in oil and gas but also from offshore wind. Therefore, at some point, it would be necessary to renovate part of the fleet and thus we might see possibly build some new vessels in the mid-term.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.