A high electric mobility scenario for India leads to a relatively small increase in electricity demand relative to energy efficiency gains

The electric mobility transition is not only set to disrupt the automobile sector ecosystem, but also the ways in which electricity demand is managed. Already, EV sales have crossed 10 million units annually, with its penetration growing from less than 2% to more than 5.5% within one year. 2W and 3W sales contribute 95% of overall EV sales, but the sales of commercial electric four wheelers (4W) has been climbing. Over time, diversity of EV categories will play a major role in growth of EVs' electricity demand, as well as the charging cycles or demand patterns.

Based on historical trends and our assessment of the future EV technology, uptake and use, S&P Global has done a bottom-up estimation of electricity demand from electric mobility. A total of 69 vehicle classes in the government's Vahan dashboard are mapped to 10 distinct categories across passenger and freight segments. The results are useful for electricity supply planning at the grid level as well as for independent suppliers of renewable energy eyeing the charging business. The fuel efficiency of the EV switchover is estimated based on category-wise comparisons with prevalent ICE technologies. Below are the key takeaways from this research:

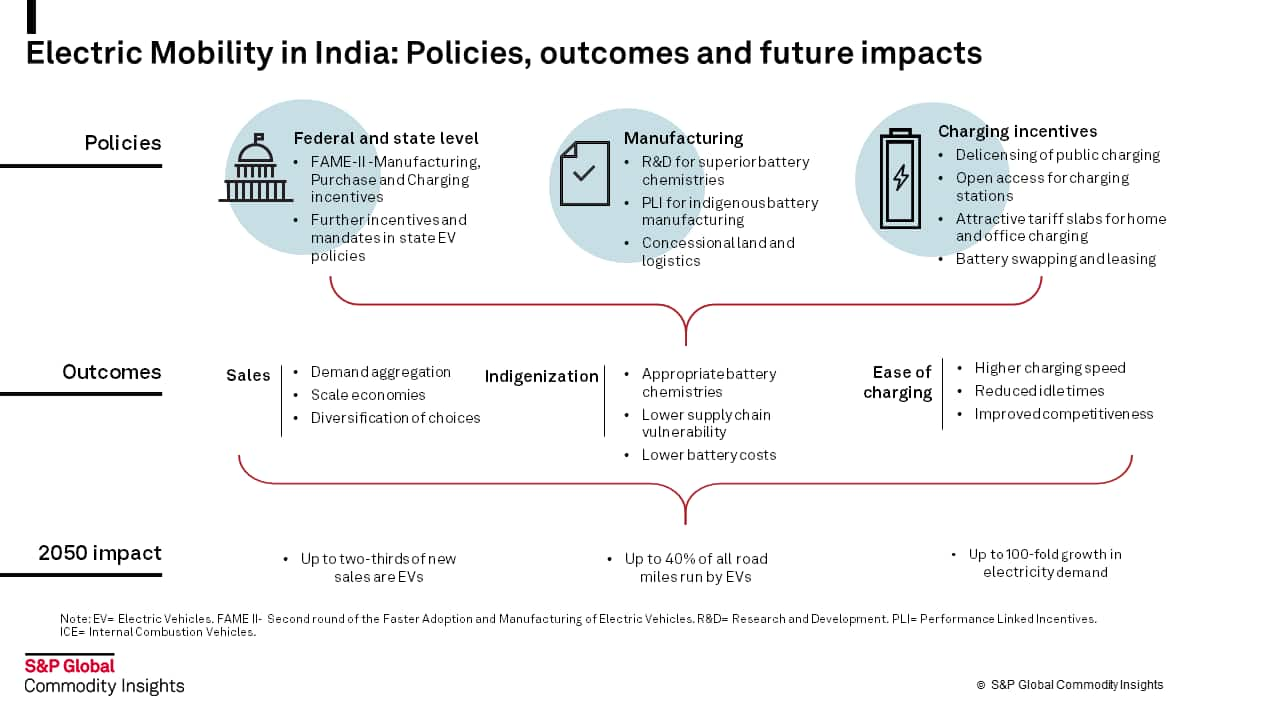

- Policy landscape is geared to address the key market

barriers including production, purchase and charging

incentives under Faster Adoption and Manufacturing of Electric

Vehicles -II (FAME II) scheme. FAME- II is supported by state EV

policies offering additional incentives[1]. The Central Electricity

Regulatory Commission (CERC) has done away with licensing

requirements for public charging business and notified open access

to enable easy procurement of clean electricity. Several states are

pricing electricity for home or office EV charging at attractive

tariffs slabs.

- Conducive policy environment for charging and

technological growth will drive EV penetration in India.

Growth in indigenous manufacturing, scale economies, innovative

business models, diversification of choices and ease of vehicular

charging will be the key drivers for EV ownership and use.

Resultingly, EVs could make 20-25% of new vehicular sales by 2030

and up to two-thirds by 2050. However, EVs may not be preferred

over conventional or even hydrogen vehicles for long distance,

especially freight travel, unless stable battery chemistries with

high energy densities are discovered. Accordingly, the share of

vehicle kilometers from EVs will grow from less than 2% at present

to 30-40% by 2050.

- Electricity consumption from EVs could grow by upto 100

times by 2050. By the end of 2022, India had excess of 10

million EVs but these contributed less than 1% of total end-use

electricity demand. By 2030, demand from EVs will grow at least

10-fold. A more aggressive scenario of EV adoption and use will

lead to 60% higher demand than the base (moderate) scenario by

2050. But even in the accelerated scenario, electricity demand from

EVs would represent less than a fifth of India's total end-use

electricity demand in 2022.

- EVs can reduce the energy demand from road transport by three-fold. Despite significant improvements in ICE's efficiency over time, EVs will consume three times less energy than they use when compared to their ICE counterparts by 2050. Therefore, electric mobility will be key to unlocking end-use efficiency in India's road transport.

Customers can read the full report here or log on to our Connect platform to view our full range of offerings on India's EV landscape.

Want more information about our offerings? Learn more about our Asia-Pacific energy research.

Mohd. Sahil Ali, a senior sustainability analyst with the Gas, Power, and Climate Solutions group at S&P Global Commodity Insights, covers cross-cutting issues in power and renewables for South Asian markets.

Posted 27 July 2023

[1]These policies have been analyzed and ranked in terms of attractiveness in the paper India's preparedness for large-scale electric vehicle adoption: Innovating away the roadblocks

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.