BLOG

Jul 26, 2023

North American upstream spending projected to continue rising, even as inflation cools

Key insights

We are now almost on the downhill run toward 2024, yet many of the narratives playing out in the world and the upstream industry are still carryovers from 2022, with some key nuances.

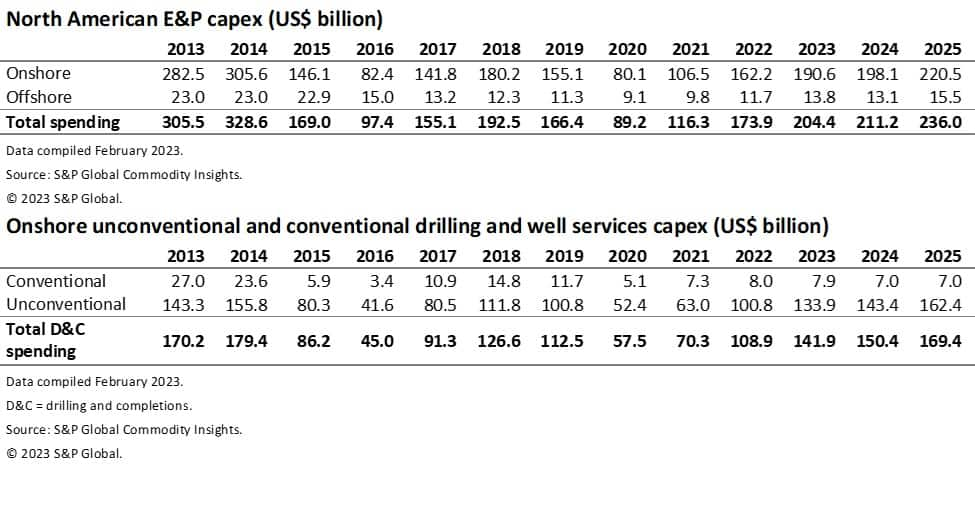

- S&P Global Commodity Insights projects that onshore

drilling and well services capital expenditure, as well as total

North American E&P capex, will increase steadily through 2027.

Total spending will always be some combination of activity and

costs, and while costs have been the predominantly driving factor

over the last few years, it is thought that their impact will

moderate somewhat in the medium term as material costs are

projected to decrease and operators continue to push to do more

with less.

- Inflation will continue to be an issue in 2023, although signs

do point to cooling of consumer prices, with a return to something

nearer the accepted 2% baseline starting late 2024. For upstream

operators specifically, the timeline is similar, although prices

are expected to continue upward at an annualized pace in the double

digits for at least the next 18 months.

- With this in mind, operators' strategies for maximizing

free-cash flow will continue to be put to the test, especially at a

moment when Commodity Insights has an oil outlook in the mid-$80/b

range through 2024, down from triple-digit levels in 2022. Gas

prices have also fallen notably, and operators in the Haynesville

and Appalachia regions are well into making operational decisions

to account for this new price environment.

- Although the US midterm elections are firmly in the rearview mirror, recent events surrounding debt ceiling negotiations remind us that politics are a constant point of uncertainty for the upstream industry. Even though Democrats were expected to take a turn from the previous administration's pro-industry stance, West Virginia Senator Joe Manchin championed — and received — approval for the Mountain Valley Pipeline, which would allow gas to flow out of West Virginia to other US markets.

For more information on this report, please contact James Blanchard (james.blanchard@ihsmarkit.com) or visit S&P Global Commodity Insights' Upstream Costs & Expenditures page for full details on our research offerings.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnorth-american-upstream-spending-projected-to-continue-rising.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnorth-american-upstream-spending-projected-to-continue-rising.html&text=North+American+upstream+spending+projected+to+continue+rising%2c+even+as+inflation+cools+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnorth-american-upstream-spending-projected-to-continue-rising.html","enabled":true},{"name":"email","url":"?subject=North American upstream spending projected to continue rising, even as inflation cools | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnorth-american-upstream-spending-projected-to-continue-rising.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=North+American+upstream+spending+projected+to+continue+rising%2c+even+as+inflation+cools+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnorth-american-upstream-spending-projected-to-continue-rising.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}