Asia Pacific Regional Integrated Service Research Highlights: Q2 2023

In the second quarter of 2023, 14 new insight papers have been published in the S&P Global Commodity Insights Asia Pacific Integrated service, apart from the regular updated reports. This research highlight summarized the key impact papers and provided an overview the market signposts in Q2. A link to a select set of reports is provided below.

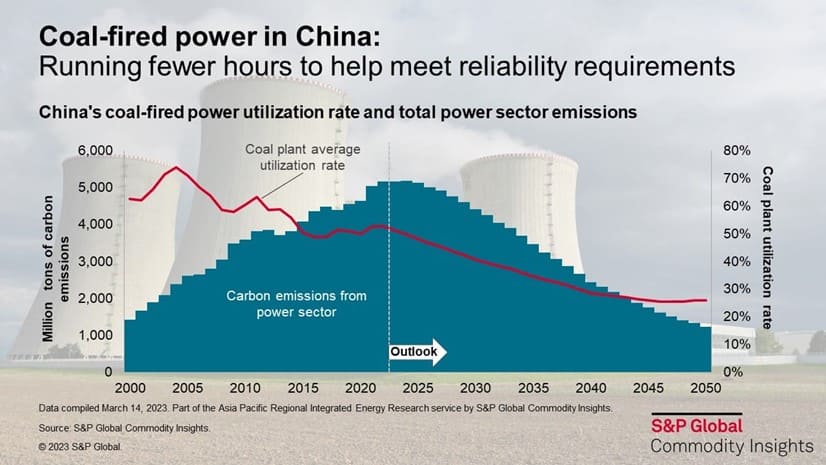

The graphic of the quarter is selected from "Despite record-breaking coal capacity approval in 2022, energy transition in mainland China remains on track", showing the utilization rate of coal-fired power generation and total power sector emissions in China.

Despite record-breaking coal capacity approval in 2022, energy transition in mainland China remains on track

An astonishing 86 GW of coal capacity was given approval in mainland China in 2022. The move raised critical questions such as whether mainland China has deviated from the energy transition pathway and when it will shift away from coal. The approved coal capacity in 2022 alone is 40% higher than the cumulative approved capacity during 2016-21. Nearly 90% of the newly approved capacity are located in developed provinces in the eastern, southern and central grids, which are typical demand centers with large peak-trough demand variations as well as a large share of power imports.

Despite the massive coal capacity approval, grid emissions will peak as early as 2024 and decline precipitously in the long term. This is mainly because majority of incremental power demand will be met by significant uptick in renewable generation.

Read more here: China's record coal capacity approvals in 2022: Will carbon targets still be met?

Buying the right renewable energy certificates in India

The Renewable Energy Certificates Regulations, 2022, came into effect in India on Dec. 6, 2022, and aim to restructure the renewable energy certificate (REC) mechanism. The new regulations introduce the concept of multipliers for different technologies based on their cost, increase the validity of RECs to perpetuity until sold and, most vitally, remove the floor and the ceiling price for REC trading.

The demand for green energy attributes is increasing with higher RPOs and voluntary sustainability targets. However, the local REC market remains constrained owing to high market and regulatory uncertainty with the new regulations not doing enough to address the demand-supply gap.

As the local REC market maneuvers the ebbs and tides of regulatory uncertainty, renewable generators are looking for alternate market-based mechanisms. The international renewable energy certificate (I-REC) enables corporations to purchase green attributes that are unique, trackable, reliable and cost competitive. However, I-REC prices are significantly lower than the local REC prices, which could deter renewable generators from registering with the international mechanism.

Moreover, local REC premiums need to adjust to market price signals. Solar photovoltaic (PV) and onshore wind generators will no longer require a premium to be commercially attractive or viable, as the levelized market capture price for these technologies will be higher than the cost. On the other hand, hydro, biomass and battery storage projects may extract a premium of $14-$40/MWh in 2023 and decline to $10-$20/MWh in 2030.

Read more here: Buying the right renewable energy certificates in India

Singapore unlocks large-scale renewable import potential from Indonesia

On March 16, 2023, Indonesia signed a memorandum of understanding (MOU) with Singapore on renewable energy cooperation — a landmark announcement that aligns with Singapore's aim to import up to 4 GW of low-carbon electricity by 2035. Within the context of Singapore's Energy Market Authority (EMA) granting its first conditional approval to an import project on the same day, this sends a clear signal toward increased cross-border renewables trade and collaboration in future, representing a step forward in Singapore's low-carbon import plans.

The MOU between Indonesia and Singapore provides policy clarity regarding renewable exports from Indonesia, clearing the previous roadblock from the mid-2022 announcement that Indonesia would not be exporting renewable energy. The MOU signals progress especially for prospective importers with plans to develop projects in Indonesia.

Consumers seeking renewable electricity will benefit from the increased renewables supply to Singapore from its neighbors. Singapore's geographical limitations constrain domestic renewable generation; given the rising domestic demand for clean electricity, imports will provide a critical source of low-carbon electricity for consumers, depending on the route-to-market options utilized by suppliers.

Philippines' 11.6-GW GEA-2 renewables tender must balance ambition with strategic development

The Philippines will hold its 11.6-GW Green Energy Auction 2 (GEA-2) for renewables in June 2023, following the success of the 2.0-GW GEA-1 held in June 2022. The GEA-2 places larger focus on wind capacity, has higher Green Energy Auction Reserve (GEAR) ceiling prices for solar capacity and is an opportunity for international investors to participate in the growing Philippines market.

The country must balance its ambitious targets with strategic planning to avoid the potential pitfalls of sudden renewables expansion, as experienced in other markets like Vietnam, and support the development of its renewable potential.

GEA-2 winning bids are expected to be higher than in the GEA-1, owing to higher base costs and ceiling prices. The new preliminary GEAR price of 4.24 Philippine pesos/kWh (7.78 US cents) is 15.3% higher than the previous GEAR price for solar — however, previous winning bids under the GEA-1 fell below ceiling prices.

Increased renewables generation could reduce retail tariffs, owing to lower generation cost. The ceiling GEAR prices in GEA-2 remain below Meralco's generation cost, which reached 7.12 Philippine pesos/kWh in first quarter 2023 (13.1 US cents). Average retail tariffs in the Philippines have been rising and reached 9.52 Philippine pesos/kWh (17.5 US cents), owing to increasing fuel prices and generation costs.

In the time of net-zero: China's evolving role in carbon offset markets

Heightened global commitments toward net-zero has attracted tremendous interests to carbon offsets as a key tool to lower net emissions. Built upon the fundamental idea that one metric ton of carbon emissions reduction should have the same climate benefits no matter where it is produced, carbon offset markets are created to facilitate the exchange of mitigation benefits to further mitigation efforts, mobilize investments and lower abatement costs globally.

China has been a major supplier of carbon offset credits, initially through the Clean Development Mechanism (CDM) in the early 2010s and later through its domestic Chinese Certified Emission Reduction (CCER) program, as well as various other independent voluntary carbon market (VCM) standards. However, China's way of participating in the carbon offset markets will change in many profound ways, as both market rules as well as the role of China itself continue to undergo rapid changes.

Additional Insights and Strategic Reports published in second quarter 2023

- How will India's electric mobility transition impact electricity demand and fuel efficiency?

- Governments offer sweeping policies to accelerate clean energy development

- Chinese gas-fired power plants with record-low utilization rates for January/February

- How can India improve on its draft carbon market framework to build stakeholder confidence? Read more here.

- Shandong's negative prices: Lack of flexibility to tackle "duck curve" Read more here.

- Asia Pacific renewable corporate power purchase agreement — Q1 2023

- China's floating offshore wind market overview

- Australia Hydrogen Market Tracker

Ankita Chauhan is an associate director at S&P Global Commodity Insights, focuses on renewable energy research for South Asian markets.

Logan Reese is an associate director on the Asia Pacific Regionally Integrated team at S&P Global Commodity Insights, focusing on Australia power and gas markets.

Learn more about our Asia-Pacific energy research.

Posted 21 July 2023

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.