Europe will struggle to reach its solar PV manufacturing target without subsidies

Recent announcements including additional funding from the EIB and the use of State aid aim to accelerate manufacturing investment decisions in the region

China has dominated the module supply chain for the last 15 years.This status quo is shifting as multiple emerging factors pose a threat to mainland China's dominant position in the solar supply chain, including increasing scrutiny of solar supply chain sustainability and traceability, along with a growing global subsidy race, with the United States, India, and European Union announcing plans to provide funding support to domestic manufacturers. A suite of policy levers has been recently used by global markets to directly or indirectly support growth of domestic PV manufacturing such as the IRA in the US or the BCD and the PLI scheme in India.

At the policy level, Europe is still lagging. REpowerEU sets ambitious targets for renewables by 2030 but does not say much about supporting local manufacturing. The recent New Zero Industry Act proposal aims to spur local manufacturing and, although the NZIA is a step ahead, it could take up to two years before the European Commission approves it. In other words, the European Union has set very ambitious targets for renewable installations in Europe until 2030 but high renewable targets will not automatically increase demand for products manufactured locally.

To provide some context, the EU is targeting a minimum of 45% self-sufficiency across all manufacturing nodes when there is currently no ingot or wafer capacity to process polysilicon in Europe. It would require the building of more than 40 GW of ingot, wafer and cell and capacity and another 30 GW of module capacity to reach these targets. To have any chance to get anywhere near this ambitious target, the European Union would need to set a combination of high manufacturing incentives, barriers of entry to lower-cost imports (e.g. CBAM, carbon footprint), as well as potentially set quotas for local content product in public tenders.

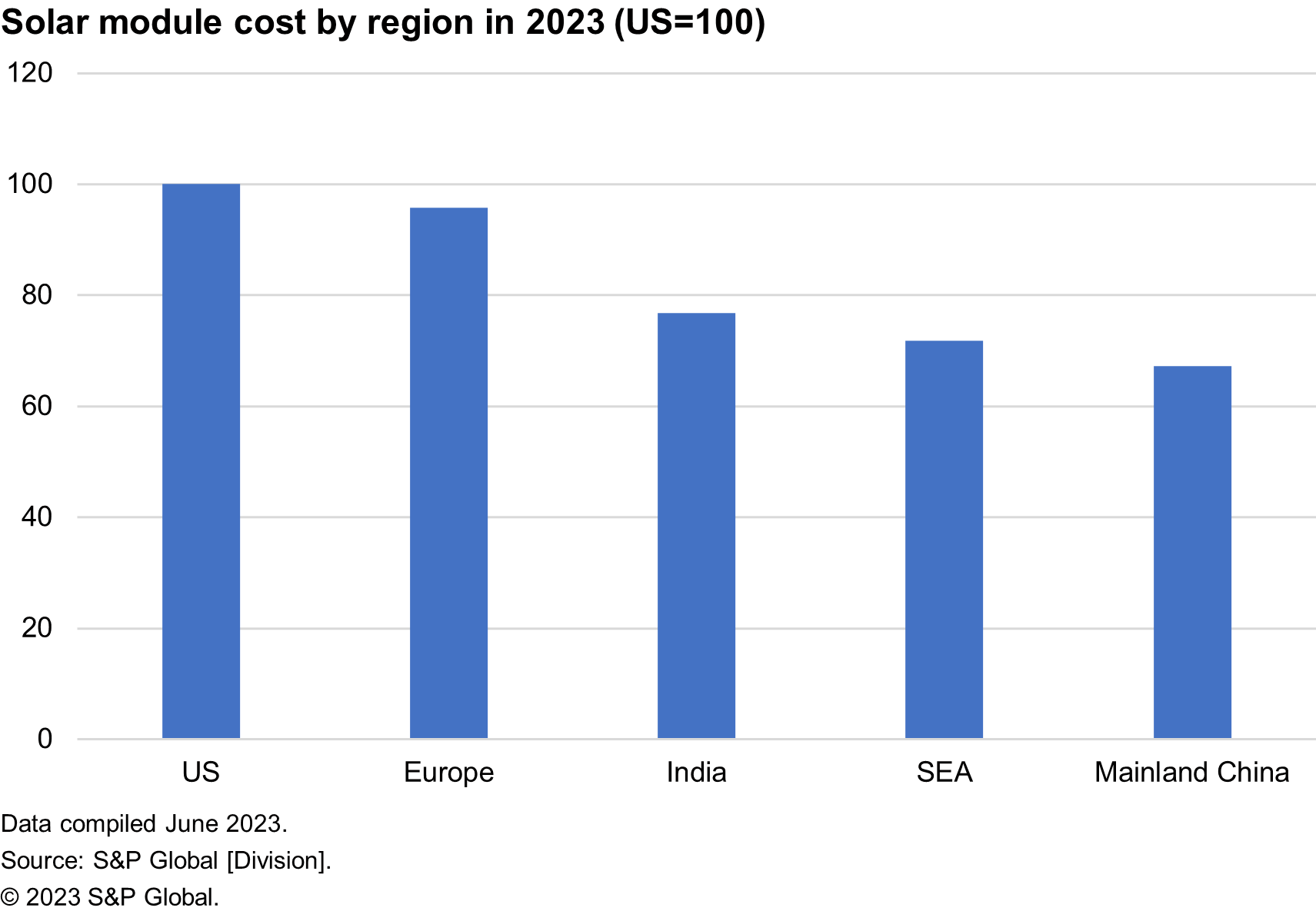

The large production cost gap between regions is the biggest challenge to overcome to spur local module supply chain manufacturing. On our recent S&P Global Commodity Insights report, we found that productions costs in Europe could be 33-50% higher than in mainland China mostly driven by higher power prices and labor costs. The recent low-price module environment might become another unexpected hurdle to reshore the module supply chain to Europe. High polysilicon prices have maintained module costs artificially elevated in the last two years closing the gap between best-cost manufacturing locations in mainland China, Southeast Asia and other regions (i.e., Europe, US). Forecast low module prices will make bringing onshore module supply chain manufacturing increasingly challenging without definite manufacturing subsidies.

Yet, local manufacturers couldbe competitive in other dimensions. European module production costs are higher compared with other regions but may hold advantages due to reduce carbon intensity. This sustainability dimension will be particularly relevant given the trend to tax imports of materials and components with higher carbon footprints, which will increasingly favor production of low-carbon components within the EU. European Governments could also set quotas for local content and low-carbon products in public tenders — the current NZIA proposal includes a clause for carbon footprint and equipment origin for public tenders and a 15-20% sustainability and resilience weight scoring system proposed.

Another dimension where EU manufacturers can be competitive is technology. There are opportunities for EU manufacturers to lead in the development of new technologies such as Perovskites, advanced back contact technologies, or direct wafer technology with lower cost production methods and higher efficiencies. Partnerships have emerged in several European markets aiming to commercialize next generation cells and modules based on Si- Perovskite tandem technology. These ongoing research partnerships could promote European technological leadership across emerging cell and wafer technologies, enabling lower LCOEs and reduced supply-chain risks.

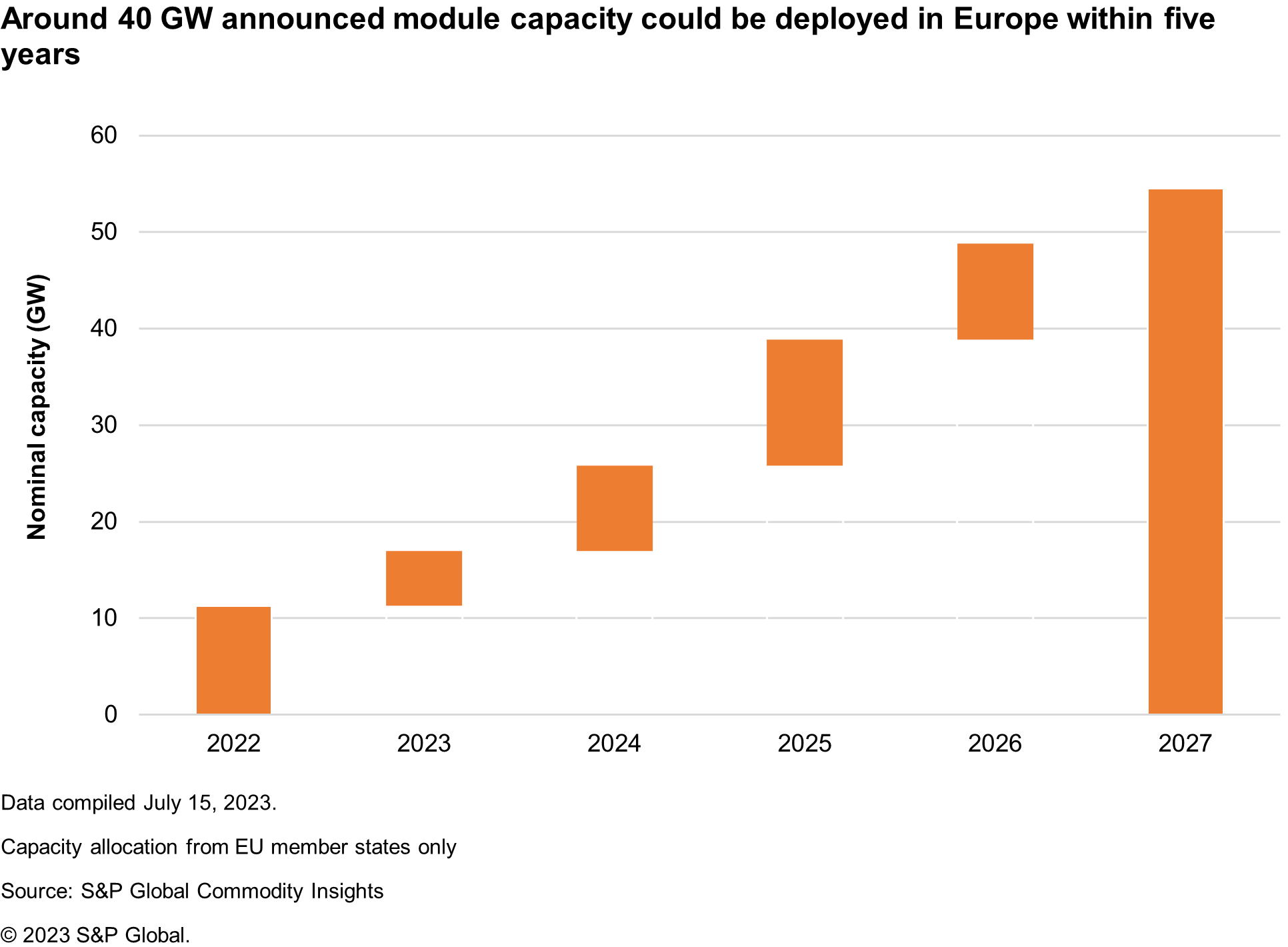

Remarkably, despite all the policy uncertainty,there have been 40 GW of module capacity announcements in Europe in the first semester of 2023, including a surge of new announcements in the last few weeks. These figures show evidence of new manufacturing activity in markets like, Germany, France, Spain and Italy, as well as in eastern Europe such as Romania and Poland. However, even if all these announcements would come on line, Europe would still be highly dependent on imported cells from mainland China or South East Asian countries.

Latest developments to support local manufacturing in Europe

Recent developments including additional funding from the EIB and the use of State aid to support manufacturing investments could trigger more announcements or contribute to the realization of the new manufacturing capacity announced. To close the financing gap with other regions, the EIB's Board of Directors approved early July to support the Green Deal Industrial Plan with €45 billion, which represents 50% of additional funding for solar, wind, storage and other clean energy technology projects and manufacturing. The EIB board expects that this additional funding will mobilize over €150 billion investment (€45 billion from the EIB and €115 billion from state members) for the targeted sectors until 2027.

In this vein, Germany has also recently announced the use of State aid to support manufacturing capex investments up to 10 GW along the value chain that fulfill high technological and sustainable standards - a minimum annual production capacity of 2 GW, module efficiency over 24%, and annual degradation below 0.2%. Other countries have followed with similar announcements like Norway, Sweden, Spain, and Netherlands.

Still to be seen if all these recent announcements will materialize and constitute a major reshoring of module supply chain capacity in Europe in the next few years or if, beyond some flagship manufacturing projects, the European Union still will prioritize the achievement of renewable targets to 2030 over reshoring manufacturing ambitions that would make the energy transition more expensive.

Learn more about our Global Clean Energy Technology research.

Would you like a demo of our service? Contact us.

Edurne Zoco, executive director within the Clean Energy Technology group at S&P Global Commodity Insights, leads the team's research activities across solar photovoltaic (PV), supply chain, and carbon sequestration.

Posted 20 July 2023

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.