Thermal Revival: The Global Quest for Dispatchable Long-duration Power Sources

As renewable energy investments accelerate worldwide, many large power markets find themselves forced to build thermal power plants to fulfill the reliability requirements of the grid. Generation resources that grid operators can call on anytime ("dispatchable") and can provide energy for days, weeks, and even months ("long-duration") are becoming scarcer amidst more extreme weather, high electricity demand growth, and the retirement of firm generation resources like coal-fired power plants.

This has brought renewed attention to conventional thermal plants as a source of reliability - alongside carbon-free technologies - as system planners seek a diverse set of resources to meet unpredictable grid conditions.

Carbon-free resources that have dispatchable and long-duration attributes aren't scaling up fast enough

The world retired roughly 187 GW of coal plants and 39 GW of nuclear plants during 2017-22 alone with more aggressive retirements under way. While battery storage has helped with reliability in places where investment has increased, the duration of batteries today is generally limited to 4 hours and can't meet multi-day or seasonal fluctuations in demand or particular supply sources.

Carbon-free technologies that are dispatchable and long duration - serving days, weeks and even months - are not expected to be commercialized at the necessary scale that matches the needs during the next 5-10 years.

From green hydrogen and carbon capture to geothermal and multi-day battery storage, the current pipeline of projects fall far short of the grid requirements. For example, there is only 0.5 GW of green hydrogen and 10 GW of carbon capture projects in operation globally. The need for replacement DLD resources at commercial scale is more urgent than ever.

Enter new thermal plants

Facing these rising challenges, major power systems seem to have quietly agreed to a common approach to fulfill DLD requirements: building more thermal units that only operate occasionally.

- The most public push for this came from China in 2022, when the government approved 86 GW of new coal plants. In approving these, the government specified that they must be highly flexible units with some of the world's most demanding ramp rates that can meet reliability requirements - almost functioning like gas plants (because China lacks natural gas resources). This was after the hydro shortage in 2022 led to power rationing even during a year of very low demand due to Covid lockdowns.

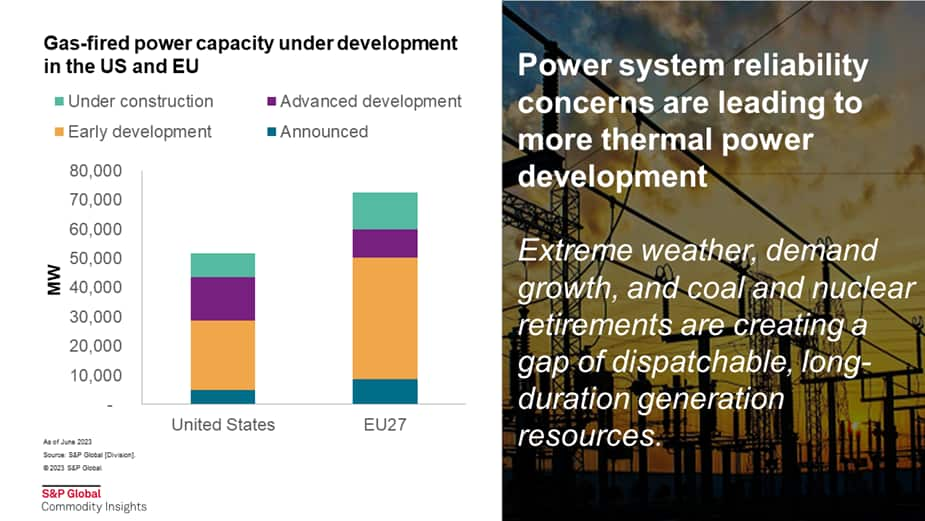

- In the United States, debates around capacity mechanisms are intensifying after events such as California wildfire-related power disruptions and the Texas freeze in 2022. Despite the major push for renewables under the Inflation Reduction Act, 8.2 GW of gas plants are under construction in the US as of June 2023, with almost 30 GW more in the pipeline in various stages of development. The governor of California - one of the most pro-renewable states in the country - went as far as creating a "strategic reliability reserve", effectively an out-of-market fleet of backup dispatchable capacity that many expect to be made up of old gas plants and new highly flexible gas-fired aeroderivative turbines.

- In Europe, after much back and forth, natural gas made it into the Commission's Green Taxonomy - albeit with strict conditions. Despite the Russian-Ukraine war, gas-fired power generation actually increased during the past year. There is currently 13 GW of gas-fired power plants under construction in the EU, with 60 GW more in various phases of development.

Despite the revived interest in more thermal capacity, in all three regions above, however, the scale of the thermal new build pales in contrast to renewables additions. Through 2035, we expect wind, solar, battery storage and other carbon-free technologies to account for 88%, 90%, and 91% of gross additions in China, Europe, and the US, respectively. The share of renewables in power generation will therefore continue to rise but during extended periods of extreme weather or other supply events, the grid operators will likely need to call on the thermal plants to maintain reliability.

There is a major question how these rarely run thermal plants will be compensated financially and whether they could become stranded assets. In many parts of the US and Europe, capacity markets have been formed to provide annual payments to project owners. In China, capacity payments are already utilized for gas peakers and discussions are underway to create capacity markets for all technologies. Some regional governments have even proposed using public funds to keep thermal plants on standby. The policy debates around financial compensation for peaking units are far from settled.

Emissions implications: Thermal fleet utilization will continue to drop

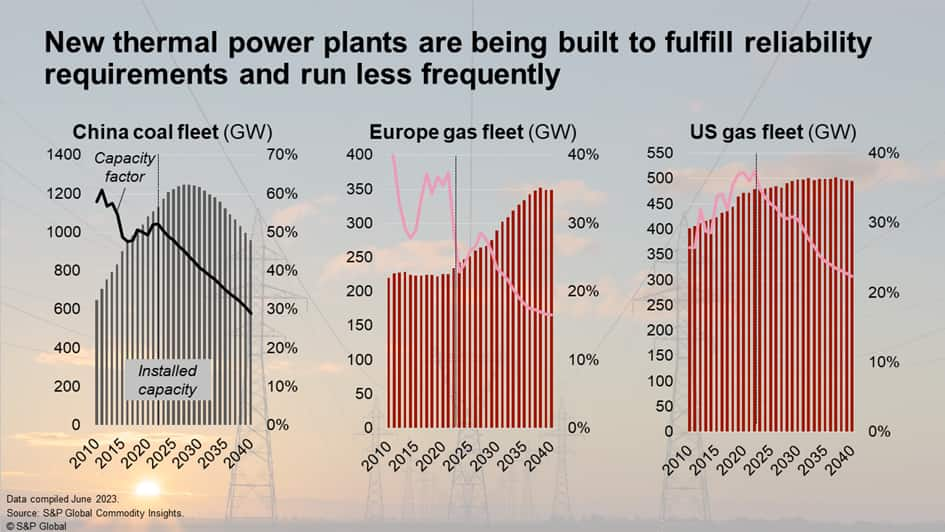

Given the main purpose of the new thermal plants - serving as a dispatchable, long-duration resource during extended periods of extreme conditions - the utilization hours of these coal and gas plants will decline over time as renewables and battery storage grow.

- In China, the highly flexible coal fleet has already seen its average capacity factor decline from more than 70% in 2005 to around 50% today. We expect it to continue drop to 30% or lower by 2040. As a result, total power sector carbon emissions by 2040 will be 44% lower than today's level in China.

- In the US, average gas plant capacity factor has gone from average 40% a decade ago to around 30% today. We expect it to be less than 20% by 2040. US power sector emissions by 2040 will be 63% below today's level.

- In Europe, gas plant capacity factors have been hovering around 30-35%, a number that is expected to drop to 20% by 2040, at which point Europe's power sector emissions will be 61% lower than today's level.

This means that even though more thermal units are added in these regions with aggressive renewables additions, the actual generation volume - and thus carbon emissions from the power sector - will continue to decrease.

As the world's power system moves towards net zero, meeting reliability requirements along the way means that all power generation resources will likely play a role - with policy preference afforded to carbon-free technologies. Renewables, battery storage, hydro, nuclear, hydrogen, and yes, conventional thermal plants will likely continue to complement each other as new technologies mature and scale up. In the meantime, a sizable thermal fleet that exists increasingly to be available and "on standby" is likely here to stay for years to come.

Learn more about our global power and renewables research.

Xizhou Zhou is a vice president S&P Global Commodity Insights and leads the company's power and renewables practice globally. Mr. Zhou has expertise in power and renewable market fundamentals analysis and forecasting, power market design and policy analysis, renewable energy business models, and company strategies, among other areas.

Posted 18 July 2023

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.