Southeast Asia’s continued reliance on fossil fuel generation: Is carbon capture the solution?

For more on this topic, download the full report.

Carbon capture will be one of many solutions to reduce carbon emissions from fossil fuel generation

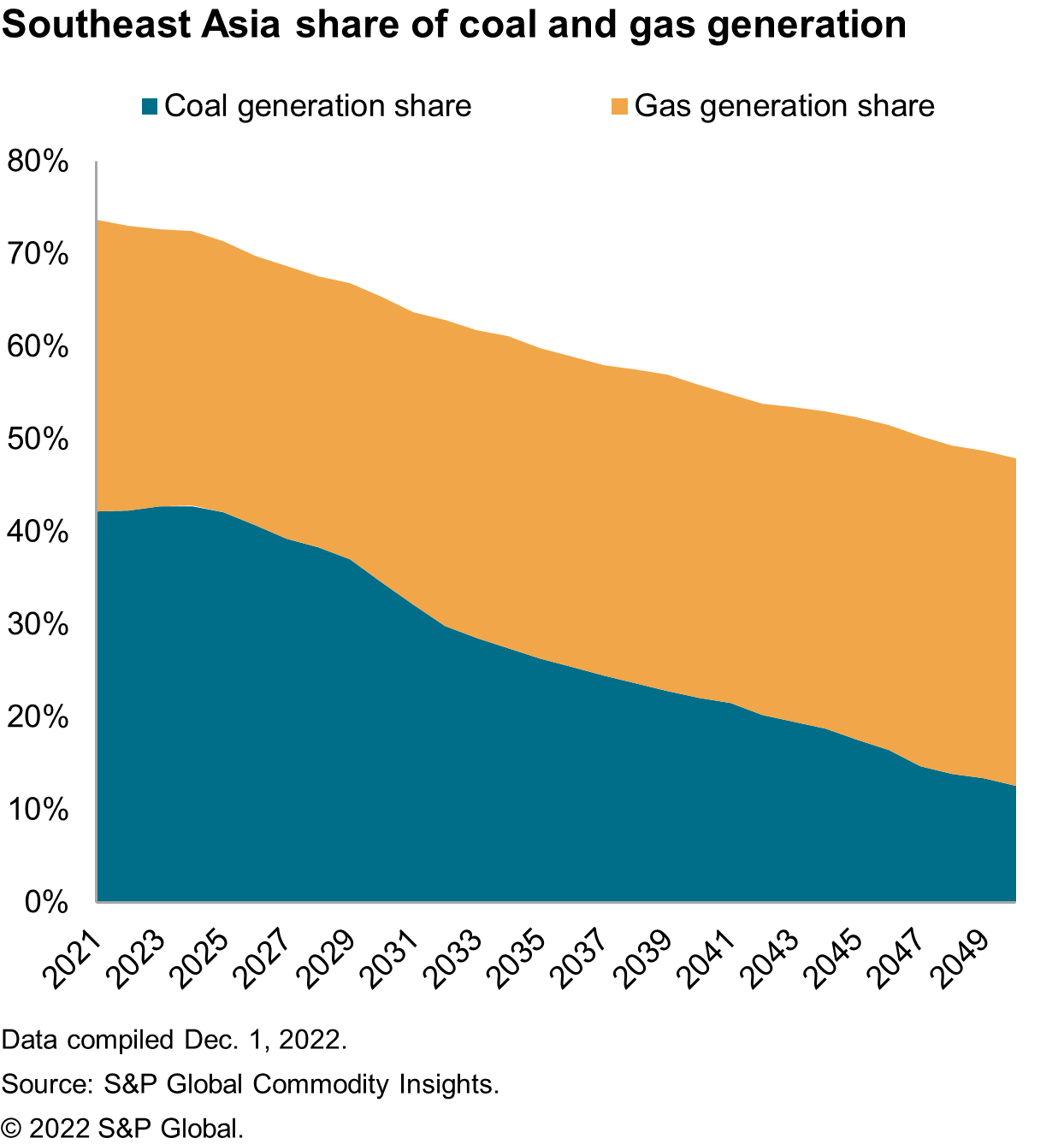

As fossil fuel generation continues to feature prominently in the generation mix over the next three decades, while the countries target to achieve net zero or carbon neutrality by 2050, there has been a slew of options being studied and piloted to decarbonize fossil fuel generation both in the region and globally.

Indonesia is pursuing the option of cofiring of biomass together with coal. Indonesia's state utility company Perusahaan Listrik Negara (PLN) has been aggressively seeking biomass cofiring solutions. This was clearly articulated in the 2021 electricity supply business plan and has been tested since 2020 across 52 coal-fired power plants. Currently, PLN has tested cofiring in different types of coal boilers with different blending shares (2-5%) and biomass types, including rice husk, municipal solid waste, wood pellets, saw dust, and palm kernel shells. Currently, cofiring is done commercially at 15 plants, and the latest trial has demonstrated that up to 20% blending made no significant operational difference for a coal-fired power plant. Indonesia has yet to make cofiring with biomass mandatory, as there are still challenges in finalizing the details on timing and blending ratios, as the supply chain for biomass fuel will need to be established. Vietnam also mentioned blending biomass with coal in its August 2022 draft Power Development Plan; however, this is at an even earlier stage than where Indonesia is at currently.

Many countries across the region intend to tap on hydrogen as a fuel for power generation, with some even intending to produce it for domestic consumption and exports In Malaysia, Tenaga Nasional Berhad (TNB), together with IHI and PETRONAS, has also conducted cofiring of ammonia with coal successfully at its test rig facility. Vietnam in its November 2022 draft Power Development Plan 8 is targeting to fully switch from gas to hydrogen and coal to ammonia in the longer term. These have provided a strong basis for the planned developments in Southeast Asia.

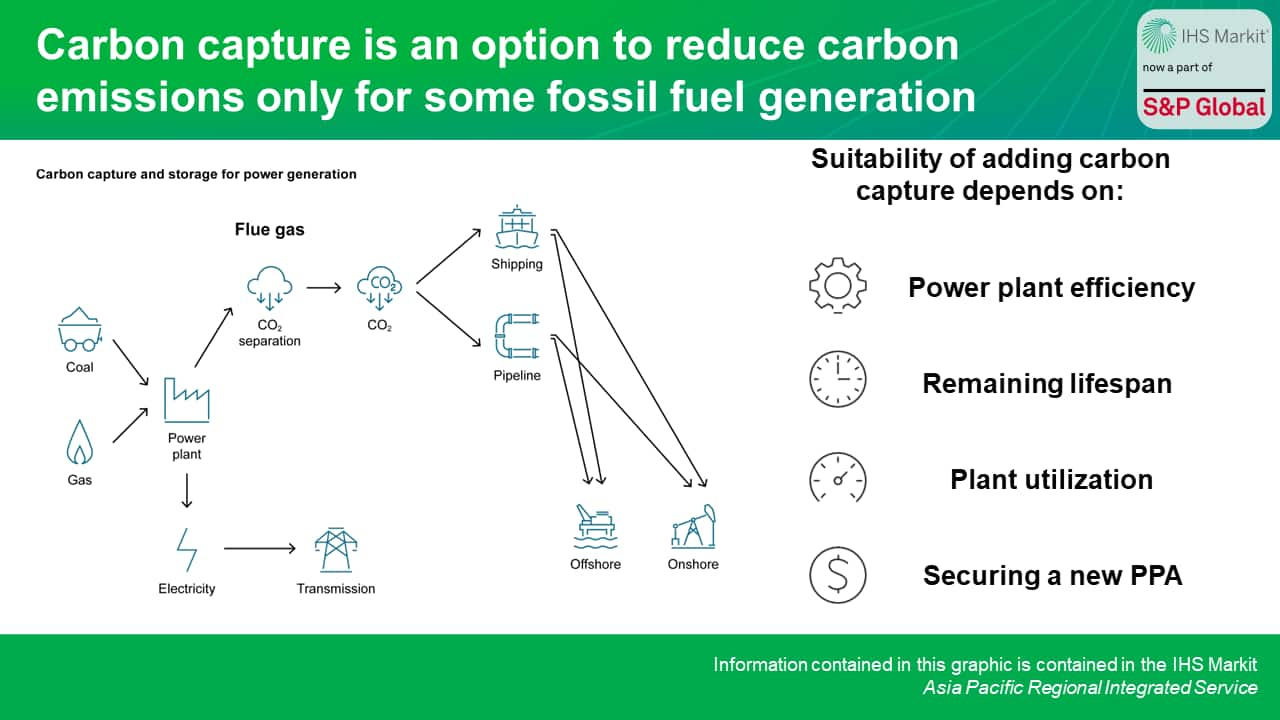

Carbon capture technology is the most mature of technology among the options above. Currently, there is around 50 million metric tons per annum (MMtpa) of carbon capture capacity in operation globally. However, the majority of carbon capture capacity is being utilized in the gas processing and oil and gas refining industry. The addition of carbon capture and storage (CCS) in the power sector is only included in Indonesia's electricity supply business plan and has been discussed in Singapore's 2050 energy scenarios.

The cost of carbon capture applied to the power sector is expected to decline more rapidly starting in the 2040s

Based on our global carbon capture project tracker, only 4% of the current projects are utilized in coal- and gas-fueled power generation plants, while close to 70% are utilized in gas processing and oil and gas refining. Carbon capture projects in natural gas processing facilities have been the main driver of growth over the past decade. This was necessary to remove CO2 from the produced gas to meet pipeline specifications, and there was also value from utilizing the CO2 for enhanced oil recovery (EOR). This was on top of the relatively lower cost of capture, owing to the high concentration stream of CO2, which reduces the energy requirement to separate CO2 from flue gas.

Over the coming decade, based on the projects currently being developed, there will be a sizable increase of carbon capture projects in the power generation sector, as compared with natural gas processing and oil and gas refining. Post-2030, CCS costs are forecast to decrease more rapidly, as the build-out increases. The S&P Global Commodity Insights Inflections scenario estimates five doublings of capture capacity between 2030 and 2050, presenting an opportunity for more sizable cost reductions through learning by doing and economies of scale, on top of the development of new capture technologies. The transportation and storage of CO2 could also experience a decline in cost, owing to the larger volumes of CO2 requiring transportation and storage, allowing scale.

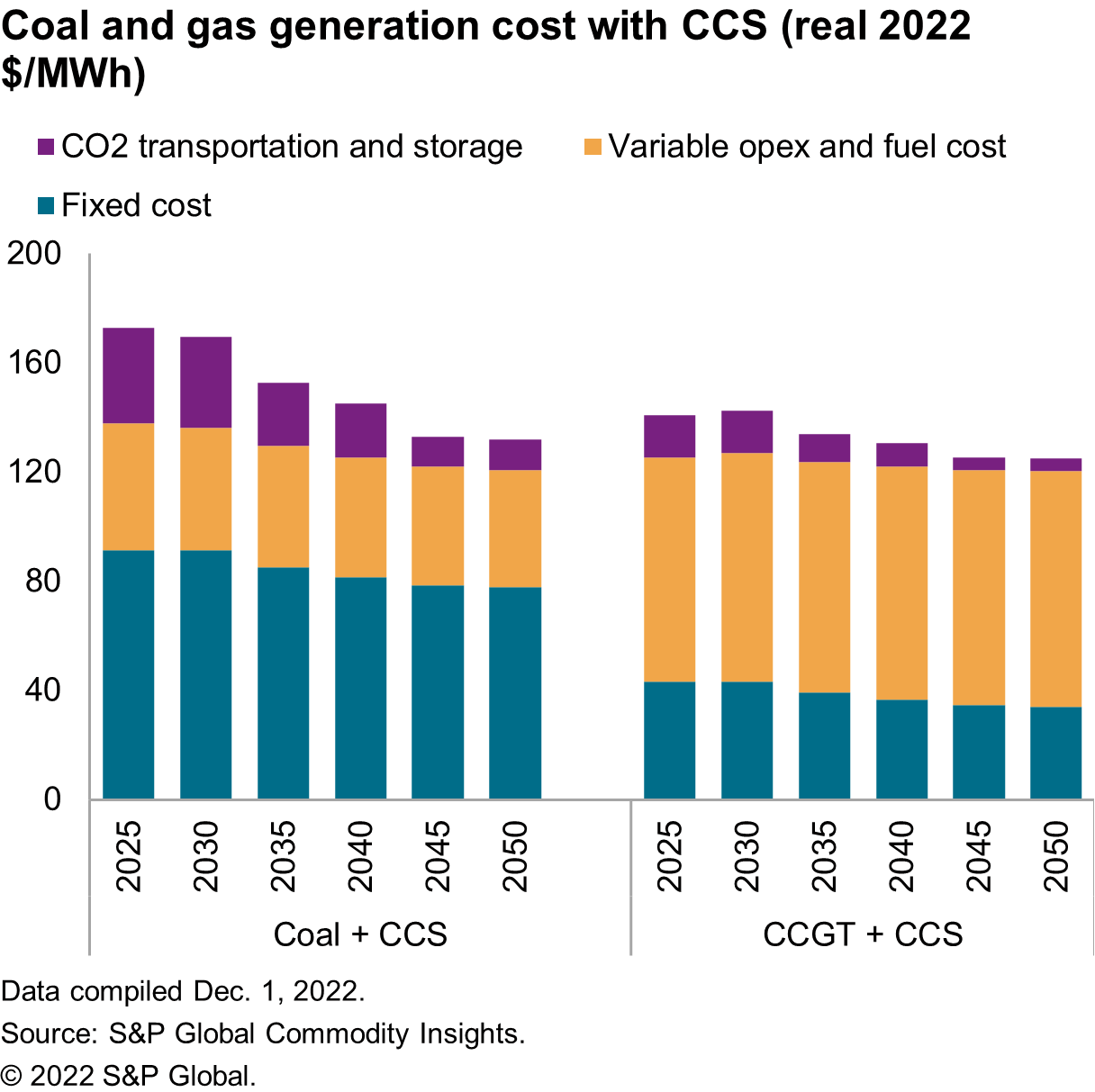

The cost of power generated from coal and gas power plants with the addition of CCS is expected to gradually decline over the coming decades. This is largely due to cost decline from the technology cost, through learning by doing and economies of scale, as the global build-out increases. On top of technology cost declines, the cost of transportation and storage of the captured CO2 is anticipated to fall, as projects are scaled up from demonstration scale to regional commercial hubs utilizing depleted oil and gas wells, which are available in the region. Based on those cost declines and incorporating our current fuel cost forecast, the levelized cost of electricity (LCOE) from gas generation, with the addition of CCS, will average around 10% lower than coal with the addition of CCS throughout the outlook horizon in Southeast Asia. The gap between the two will narrow to around 5% by 2050, as coal and gas generation LCOEs decline by 24% and 11%, respectively. This is despite a faster cost decline in CCS capex for gas-fired generators vis-à-vis coal, owing to the significantly smaller share of the LCOE from capex of around 24% versus 47%. In contrast, fuel cost contributes to nearly two-thirds of the LCOE for a gas generator, compared with a quarter for a coal generator, and this exacerbates the narrowing difference in LCOE, arising from rising gas prices versus the decrease in coal prices, although it will be partially mitigated by improvements in gas-fired power plant efficiency.

The addition of CCS is not suitable for all coal and gas capacity taking into consideration the impact on cost

This will be dependent on remaining plant life, technology type, and utilization level, meaning that at best, just under 70% of the fossil fuel generation emissions can be captured.

A sizable part of the cost of adding CCS is the capex on the equipment, which impacts coal-fired power plants more than gas-fired power plants. As a result, a longer economic life is necessary to depreciate the cost over, so as not to impact the LCOE as much. Therefore, it makes more economic sense to either add CCS to a new-build fossil fuel plant or retrofit CCS equipment onto a relatively young plant. In addition to the age consideration, more efficient generation technology will be preferred, as adding CCS will impact the plant efficiency.

The addition of carbon capture equipment onto a fossil fuel generation plant also impacts the plant's operating capability and efficiency. This is due to the power required for the carbon capture equipment and the increase in the minimum load that the plant needs to operate at, thus limiting the type of roles that generators with carbon capture equipment can play.

Financing and/or pricing mechanisms need to be implemented to facilitate CCS deployment

In a region where a majority of countries do not have any carbon tax implemented, it remains challenging for low-carbon generation technologies to be adopted for fossil fuel power plants to compete against the business-as-usual option, even as their cost gradually declines. Taking into consideration the sensitivity analysis in the section above, a carbon tax of between $100 and $200 per metric ton of CO2 is necessary to put the addition of CCS on a level footing with the stand-alone coal- or gas-fired generation.

In 2021, the Asian Development Bank (ADB) announced the Energy Transition Mechanism (ETM), which is a transformative, blended-finance approach that has the objective to retire existing coal-fired power plants on an accelerated schedule and to replace them with generating capacity using cleaner sources. However, there will still be a sizable fossil fuel generation fleet, as the region still needs a large amount of dependable power capacity. Therefore, allowing and supporting new PPAs to provide revenue certainty, which commensurate the increased cost from adding CCS, will make the additional investment to retrofit an existing power plant with CCS an attractive one.

This post is an abstract of a featured topic from the S&P Global Commodity Insights series on energy transition in Southeast Asia, where we deep dive into various aspects of the region's power sector energy transition.

For more on this topic, download the full report.

Joo Yeow Lee, an associate director with the Gas, Power, and Climate Solutions team at S&P Global Commodity Insights, covers the power and renewable markets in Southeast Asia.

Posted on 12 December 2022

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.