Texas electric regulators turn to a novel solution to solve the state’s long-term resource adequacy issue

The Public Utility Commission of Texas (PUCT) is finalizing an ambitious plan to reform one of the largest wholesale electricity markets in the nation. The historic market redesign intends to strengthen the long-term reliability of the Electric Reliability Council of Texas (ERCOT) grid using a novel solution called the Performance Credit Mechanism (PCM).

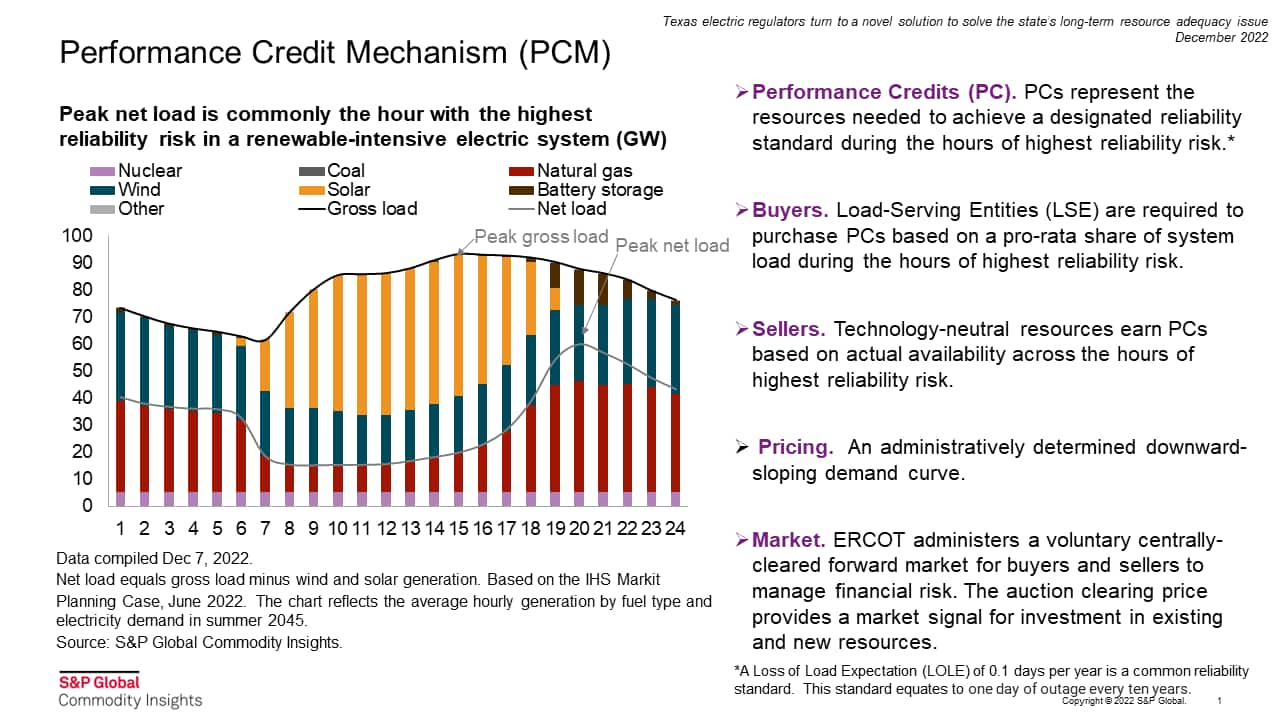

PCM uses performance credits (PC) to achieve a designated reliability standard during the hours with the highest risk of involuntary load curtailment. Traditionally, the hour with the highest electricity demand (gross peak load) had the most reliability risk—however, the risk shifts to the peak net load hour in a system that relies heavily on renewables to meet its energy needs. After the PCM is fully operational, load-serving entities will be required to purchase PCs based on a pro-rata share of the system load during the hours with the highest reliability risk. Electric resources can earn PCs based on actual availability across the same hours. Notably, the price of the credits will be determined using an administratively determined downward-sloping demand curve, and ERCOT will administer a voluntary forward market for buyers and sellers to manage financial risk.

The proposed market reform would fundamentally alter the current energy-only market structure in the region. Today, periodic scarcity pricing drives investment decisions and, in turn, determines the level of reliability in the region. Under the PCM model, predictable performance credits will inform investment opportunities, and electric regulators will set the reliability standard. It remains to be seen if the state legislature will overrule the commissioner's plan during the upcoming session. A bipartisan group of influential lawmakers recently expressed concern over implementing such a complex and potentially expensive market design. S&P Global Commodity Insights expects a final decision by mid-2023, and if approved, it will likely take an additional two to four years to be fully operational.

Learn more about our North American power research.

Michael Pickens, Director at S&P Global Commodity Insights, is a specialist in North American power market fundamentals.

Posted on 9 December 2022

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.