Specialty Chemicals forecast to grow 5% in 2021, 3.5% CAGR to 2026, after a 2.5% COVID-19 induced decline in 2020

Specialty chemicals are produced by a complex, interlinked industry. In the strictest sense, specialty chemicals are products sold on the basis of their performance or function rather than their composition. They can be single-chemical entities or formulations whose composition sharply influences the performance and processing of the customer's product. This report covers 28 specialty chemical segments that are categorized either as market-oriented products (used by a specific industry or market, such as electronic chemicals or oil field chemicals) or functional products (groups of products that serve the same function, such as adhesives, antioxidants, or biocides). There is considerable overlap in this method of characterization. Market-oriented groups often include numerous functional chemicals used by the same market, while functional chemicals typically are used by several different markets. This distinction is made for convenience in discussing strategic aspects of the business segments rather than because of a real difference in the products.

In 2020, the market value of the 28 specialty chemicals segments covered in this report totaled $602 billion. Because of the overlapping nature of the individual specialty chemical segments, the total market size is on average 8-10% lower than the sum of all the individual markets. In 2020, the degree of double-counting was 9%, or approximately $56 billion in terms of market value. Therefore, the adjusted global market value for specialty chemicals in 2020 was closer to $546 billion.

Mainland China was the largest consumer of specialty chemicals, accounting for 26% of the 2020 global market at $156 billion. North America (the United States, Canada, and Mexico) was second (22% of global sales), followed by Other Asia outside Japan and mainland China (16%), Western Europe (15%), and Japan (7%). The remainder was sales in Central and South America, Central and Eastern Europe, the Middle East, and Africa.

The largest specialty chemical segments in 2020 were specialty polymers, electronic chemicals, industrial and institutional cleaners, surfactants, and flavors and fragrances. These accounted for 37% of the industry's global sales. An estimated 65% of world consumption of specialty chemicals went into five end-use industries—soap, cleaning, and cosmetics; food and beverages; electrical and electronics; construction; and motor vehicles. Other important end-use industries for specialty chemicals include paper and pulp, plastic products, oil and gas mining, and printing and publishing.

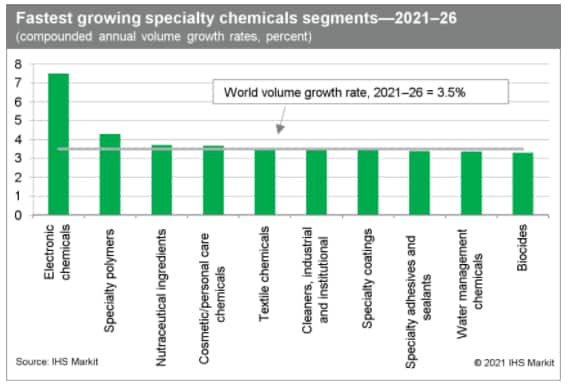

The COVID-19 pandemic led to a 2.5% decline in the global market value of the industry from 2019 to 2020. For this study, growth is projected to return in 2021, with market value increasing 5% from the 2020 level. During the 2021-26 period, the industry is projected to grow at a compounded annual rate of 3.5%, reaching almost $750 billion by 2026. Mainland China will continue to be the largest consuming area for specialty chemicals throughout the forecast period, where consumption is expected to grow at 5.8% per year.