Offshore wind installation energizes epoxy resins demand

Global epoxy resin demand exceeded 3.1 million tons in 2020 and

is expected to grow 3.4% per year from 2021 through 2026.

The fastest-growing applications will be adhesives and composites. Adhesives are being used in greater quantity to bond dissimilar materials of construction that are increasingly used in the automotive and aviation industries. Composites, made by epoxy reinforcement of carbon and other fibers, are increasingly used for wind turbine blades, aircraft, pressure vessels, automotive, and other high-value goods.

Epoxy resins have been commercially important for about 80 years

due to their excellent resistance to corrosion and chemicals,

mechanical strength, dielectric properties, adhesion strength and

reasonable costs. Most applications are mature, however, tending to

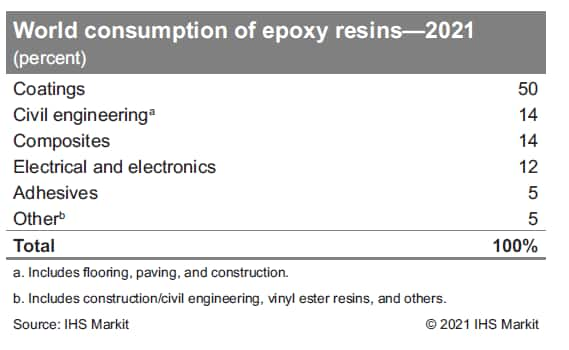

grow in step with GNP. Coatings account for around 50% of

consumption, followed by civil engineering (flooring, paving and

construction), composites, electrical/electronics, and adhesives.

A

Opportunities from offshore wind

One of the more dynamic markets for epoxy resins is the wind

turbine blade market, where epoxy is used as the binder for carbon

fiber reinforcement (CFR) in very large blades such as those used

in offshore applications.

Newer blades are 50 meters or longer to maximize efficiency. Epoxy/CFR blades are lightweight, very strong, and are specified for use by major manufacturers of large wind turbine blades. As the world strives to meet the goals of the 2016 Paris Agreement on climate change, annual global capacity additions of offshore wind turbines are expected to rise by 600% by 2035. This is expected to turbo charge epoxy resins demand from this sector.

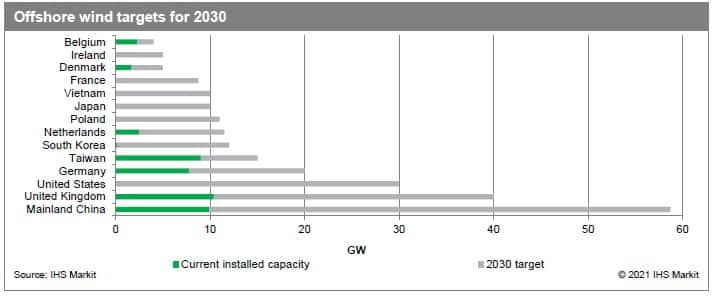

Offshore wind is expected to grow from 5.7 GW of installed global capacity in 2020 to 37 GW by 2035, about 15% of the total renewable energy mix. Offshore wind is an attractive source of renewable energy because it is more powerful and predictable, can be located closely to densely populated areas, is less of an eyesore, and has lower limits on blade sizes. In addition, technology is improving, and costs are falling. However, they are expensive to build and maintain, costing up to 50% more than onshore installations. Possible opposition from environment, tourist, maritime traffic and fishing industries could also hamper growth of offshore wind installations.

Currently, most offshore wind installations are in Europe and China.

The U.S. currently has little offshore wind capacity, with only a small (30 MW, 5 turbine) unit operating off the coast of Rhode Island. However, the Biden Administration, in support of the Paris Agreement, plans to accelerate development of renewable energy. The Biden Administration is anticipating annual capital investments in excess of $12 billion.

Other nations are also planning for major investments in offshore wind.

The industry is developing new technology to improve efficiencies

and increase potential. For example, the use of floating wind

turbine farms has been proposed for installation off the coast of

California. These factors should further boost installations and

demand for epoxy/CFR blades as well.

Meanwhile, advances are also being made in wind blade size. Larger sizes generate more power and reduce the number of units required to generate a given amount of power. For example, the $2.8-billion Vineyard Wind project, planned for installation off the coast of Massachusetts, originally planned to use as many as 108 turbines situated 24 kilometers off the coast of Martha's Vineyard to supply 800 megawatts of power. In December 2020, Vineyard Wind temporarily withdrew its application while it considered the use of General Electric, the most powerful on the market. With the use of General Electric's Haliade-X turbines technology, Vineyard Wind will now require only 62 turbines to produce the same amount of power.

The wind turbine industry also uses adhesives based on epoxy resins to make highly durable bonds. Some manufacturers supply highly specialized formulation for this application, which is quite demanding. As the blades grow in size, the stresses on the adhesives increase considerably.

Epoxy resin producer Olin has joined the CETEC (Circular Economy for Thermoset Epoxy Composites) coalition of industry and academic leaders to develop a new technology enabling circularity for thermoset epoxy composites, the material used to make wind turbine blades. The new technology delivers the final technological step on the journey towards a fully recyclable wind turbine value chain. Wind turbines are 85%-90% recyclable, with turbine blade material constituting the remaining percentage that cannot be recycled due to the nature of thermoset composites. CETEC is aiming to close this recycling gap and enable a significant step forward in the elimination of waste across the wind energy industry.

All in all, the winds of change will provide new growth prospects for epoxy resins.

The latest on epoxy resins are available on the update of the Chemical Economics Handbook (CEH)