The European offshore vessels market is facing a make-or-break time due to rising demand until 2030

Several European countries have increased their offshore wind targets, surging from 31 GW today to about 125 GW by 2030. Denmark, France, Germany, Netherlands, Norway, and the United Kingdom hold 80% of these targets.

At present, over half of the operating capacity comes from the United Kingdom. According to Petrodata by S&P Global Commodity Insights, 61 GW of capacity is expected to be realized if they can reach final investment decision (FID) in the next five years. The United Kingdom is taking the lead, accounting for 37% of these new projects.

If these ambitious targets can be met, we could reasonably foresee significant growth prospects for the offshore vessel market in Europe. However, the achievability of these targets may be under pressure due to an already constrained supply chain, combined with some poor economics facing the industry.

The race for the supply chain begins

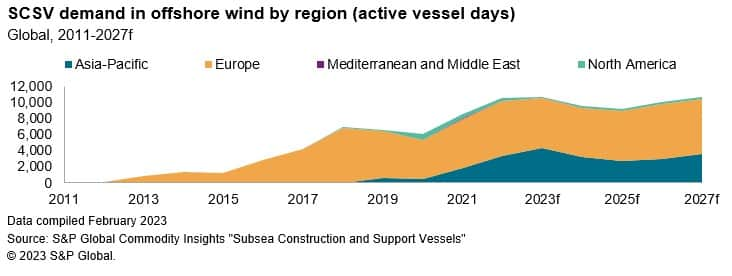

For many coastal countries in Europe offshore wind is the preferred renewable option for 2030 targets. Since 2021, operations from the offshore wind market have become one of the main sources of demand for offshore heavy lift (OHL) fleets and subsea construction and support vessels (SCSV).

Consequently, oil and gas clients will face continued competition from offshore wind clients to secure services and vessels. In parallel, and although not at the same rapid rate, demand from oil and gas sector is on the rise.

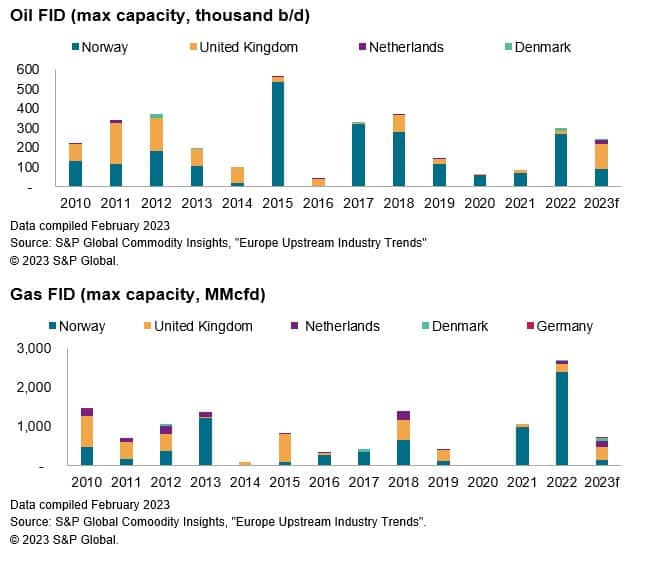

In terms of oil capacity, FIDs in 2022 have rebounded to 2017/18 levels. Sanctioned gas projects have increased by more than six-fold in 2022 since 2019. The increased level of projects in the North Sea will generate higher activity for suppliers over the coming years.

Offshore IMR (Inspection, Maintenance, Repair) activity is also thriving. Operators are still working systematically to reduce the maintenance hours backlog that has built up from previous years' supply chain disruption and the COVID-19 pandemic.

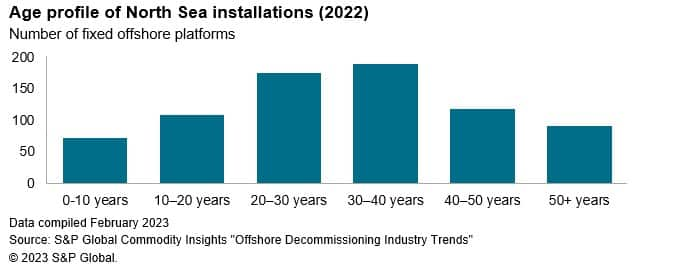

Additionally, offshore oil and gas decommissioning is set to rise, with more than 200 aging installations in the North Sea toward 2030. In the UK, the authority has approved 64 oil and gas decommissioning programs between 2020 and 2022.

The removal of topsides and subsea infrastructures that are planned to be executed between 2023 and 2030, will increase the seasonal demand for OHL and SCSV in the region.

Ambitious goals are pulling SCSVs and OHL vessels into offshore wind market.

The absence of a purpose-built fleet to service the offshore wind market has contributed to rapid growth in demand for SCSV since the early 2010s. Turning into 2022, Europe became its leading offshore market, followed by Asia-Pacific at 32% of regional share and North American market at 1%.

From ad-hoc support in 2011, offshore wind is now driving a rapid growth for these vessels which accounted for 44% of workload in 2022.

Considering SCSV's, it is the heavier class assets, HCSVs, which are particularly well suited to meet the current technical demands with crane lifting capacity above 150 metric tons. While light construction support vessels (LCSVs) have a more limited construction service offering with less than 150 metric tons lifting capacity.

In addition to SCSV's supporting subsea lifting requirements in the offshore wind industry, they have also delivered accommodation support, installation, trenching, cable lay, IMR, survey, pipelay and removal for the industry.

Utilization of SCSV fleets is now hovering around 57% with prospects of 70% for HCSVs in the near term in the North Sea, suggesting higher demand amidst net-zero growth in supply.

By comparison, OHLs offer improved economies of scale. Newbuilds with delivery scheduled between 2023-2027 are mostly destined for the offshore wind market. Their designs represent greater lift capacity (1,600-3500 metric tons) with boom lengths and free deck spaces to handle the next-generation turbines and foundations.

The turbulent journey of the SCSV market

One of the primary challenges facing the SCSV sector was the significant increase of vessel supply in the early 2010s as suppliers committed to significant newbuild programs.

The supply and demand gap in Europe peaked in 2017/18, with attempts at rebalancing resulting in an active supply drop by 15% between 2018 and 2022.

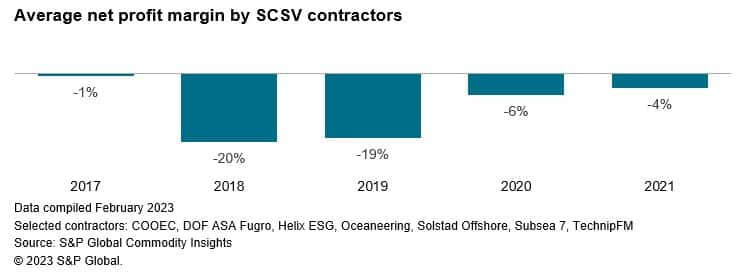

Despite demand growth, the last few years have not been without a continued degree of financial restructuring and poor financial growth for vessel contractors.

Leading contractor DOF ASA entered bankruptcy proceedings in 2023, after falling to secure a restructuring deal with existing shareholders to service debt. Boa Offshore AS left the SCSV market in 2022.

While the restructuring of Bourbon Maritime resulted in selling off assets, it no longer competes in the HCSV segment as well as losing ground in the Middle East for its LCSV segment.

Vessel contractors face ongoing commercial challenges in offshore wind

According to industry body International Marine Contractors Association (IMCA), most contracts are highly modified versions of a FIDIC (Fédération Internationale <span/>Des Ingénieurs Conseils) template, designed for onshore civil engineering contracts and do not consider the unpredictable nature of offshore contracting.

Coupled with contracts on fixed price terms, weather risks, seafloor survey risks and liquidated damages for delay in operations are some elements that are out of contractors' control.

Even contractors that are exposed on project risks, would not allow themselves with unlimited downsides as demand grows from this market.

To make sufficient returns and minimize project exposures, we expect to see more joint ventures (JVs) between competing contractors, like Seaway 7 and Saipem, who early this year established an offshore wind partnership to provide joint bids for contracts.

Offshore renewable targets are at risk if contractors continue with loss-making contracts

In 2022, Subsea 7 recognized impairments after a contract loss provision of US$30 million against the Hollandse Kust Zuid (HKZ) offshore wind project and an unstated loss associated with the Formosa 2 offshore wind project. Saipem faced similar losses the same year, attributed publicly to operational and commercial issues associated with its contract at the EDF-owned Neart na Gaoithe (NNG) site offshore in the UK.

The loss-making contracts from the offshore wind sector could further discourage participation of an already mature oil and gas supply chain to service this fast-growing market.

- With internal costs rising as a result from global inflation post pandemic, contractors will continue to find their margins squeezed.

- With vessel rates ascending, offshore wind projects will face fierce competition from the oil and gas sector.

- Many SCSVs may return to the traditional oil and gas markets as day rates are higher than in offshore wind.

Consequently, this may put offshore wind FIDs and ambition goals at risk if other types of vessels cannot provide the same duties or a suitable contracting model is not established.

The industry needs to act now to keep up with Europe's ambitions.

- Utilization of SCSVs is projected to rise in the near term.

- There will be resources constraints, so capacity needs to be built up.

- But for this to happen, the economic incentives and suitable contracting models need to be in place.

- If not, it will be difficult to meet Europe's offshore wind target by 2030.

***

This topic has been published by S&P Global Commodity Insights, Costs and Supply Chain group — "Europe Upstream Industry Trends" report.

Detailed offshore vessels market analysis covering "Subsea Construction and Support Vessels" and "Offshore heavy lift." are available to Oilfield Equipment and Services subscribers on our Connect platform.

For more information on Oilfield Equipment and Services can be found on the Costs and Supply Chain capability pages on the S&P Global website. For more information contact James Blanchard.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.