Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 17, 2023

China Wholesale Power Price Outlook

Following the power market reform during the past decade, China's wholesale power price system is currently under dual-track operation. Market-based prices in the wholesale power market cover over 60% of total generation today. Regulated feed-in tariffs (FITs) are still applied for guaranteed offtake of renewables generation and prioritized generation from conventional power.

The most recent acceleration of power market reform in China has brought wholesale and retail tariff liberalization to the forefront since 2021 by bringing all coal-fired power generators and commercial and industrial power users to the market. The dual-track mechanism is expected to remain in place from now through 2030, albeit with an increasing share of market-based power transactions.

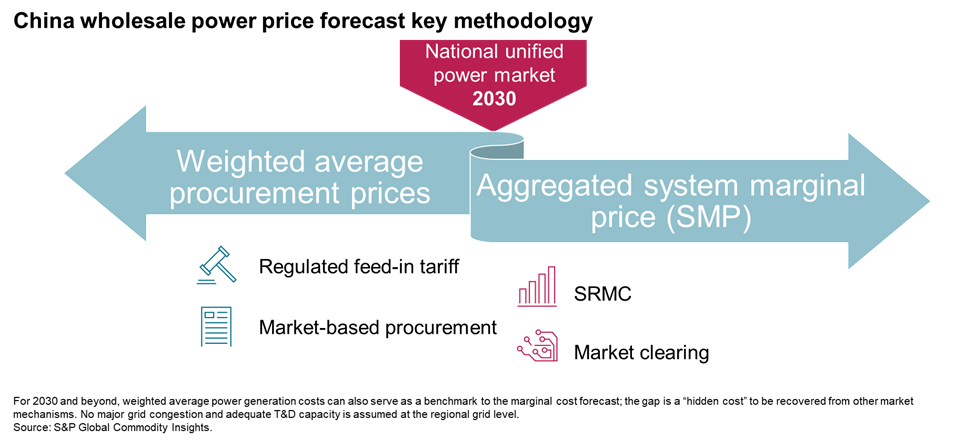

By 2030, a unified national power market is targeted to be established at a basic level. With that, the mid-to long-term (M2LT), spot and ancillary services markets are expected to operate as a whole, both regionally and nationwide. As for the wholesale power price outlook, methodologies adopted to forecast prices before and after 2030 are differentiated to better reflect the anticipated transition of the market mechanism from a dual-track mechanism to a unified market-based mechanism.

Before 2030, the weighted average method is adopted for procurement prices of market-based power generation and the regulated Feed-in Tariff (FIT) for a grid's guaranteed offtake. Beyond 2030, the short-run marginal cost (SRMC)-based market clearing price will be the main reference for energy prices, while wholesale power prices also include other costs retrievals such as ancillary services and capacity remuneration.

Systemwide levelized cost of electricity is expected to decline by 1% year on year toward 2050 owing to the aggressive addition of cheaper zero-carbon sources in the generation mix. However, wholesale power prices will follow a more volatile trajectory and vary significantly across seven grid operating regions, influenced by pricing mechanism switch, fuel prices, carbon policies and supply-demand balance at a more granular level.

The bumps in wholesale power price trajectories around 2030 are mostly attributed to the expected price mechanism switch hence forecast methodologies. The transition can be managed in a smoother manner via evolving market design from now toward 2030. Long term, wholesale power prices are forecast to trend downward on annual basis while energy supply gets cleaner, despite enhanced volatility with power users paying for the energy on a more granular timescale. Heightened uncertainty regarding power asset investment retrieval is also expected in the absence of a prudently crafted remuneration mechanism, for both conventional power and renewables developers.

Other assumptions applied in our wholesale power price outlook such as fuel price, carbon price, capacity and generation mix, load profile, generation costs are aligned with S&P Global Commodity Insights research and analysis.

For more information on this research and the service it comes from, please visit the Asia Pacific Regional Integrated Service page.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchina-wholesale-power-price-outlook.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchina-wholesale-power-price-outlook.html&text=China+Wholesale+Power+Price+Outlook+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchina-wholesale-power-price-outlook.html","enabled":true},{"name":"email","url":"?subject=China Wholesale Power Price Outlook | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchina-wholesale-power-price-outlook.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+Wholesale+Power+Price+Outlook+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchina-wholesale-power-price-outlook.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}