Debt Statistics & Financial Ratio Data

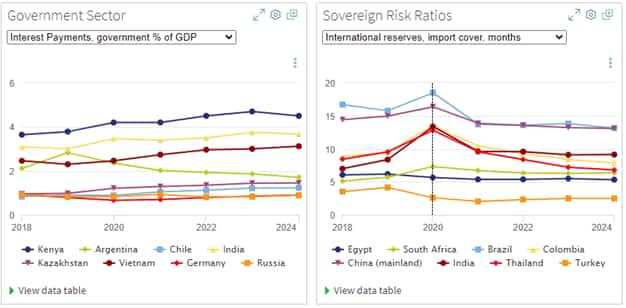

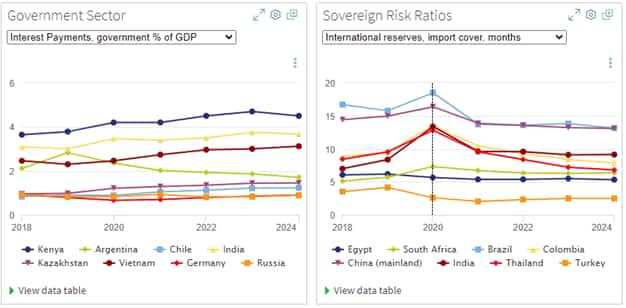

Based on the latest data releases and solid economic forecasts, our sovereign risk solution provides excel spreadsheets with detailed balance sheet and debt figures for 206 economies, including external liquidity and solvency ratios from 1999 to the present and a five-year forecast. Our financial risk metrics are derived from this detailed forecast of each economy's external finances, relevant domestic finances, and key macroeconomic growth indicators.

Sovereign Risk Table

Calculations of each economy's creditworthiness, based on financial, economic, and political attributes are numerical scores on a zero-to-100 scale corresponding to the probability of default. Our short-term (1 year) scores focus more on liquidity criteria, where the medium-term (5 year) scores also take into account solvency ratios as well as qualitative political, economic, and governance impacts.

Sovereign Risk Report

Detailed reports present all the key liquidity and solvency ratios for each of the 206 economies we score.

Sovereign Risk Scores

Short (1-year) - and medium-term (5-year) risk scores for each economy. These are updated on a quarterly basis using our latest economic forecast data, which makes it possible to capture emerging risks or positive inflection points on a timely basis.

Peer Group Rankings

Tool to rank economies by sovereign risk within specific peer groups

Comparative Scores Presentation

Our scores are presented vs. those of three major credit rating agencies, culminating in a "consensus score" for short- and medium-term horizons

Headline Analysis

Daily coverage of key financial risk events that impact an economy's sovereign debt situation (trade, debt data) is also provided, along with systematic coverage of the major credit rating agencies ratings changes with detailed comparison to our scores.

Connect: Maximize your subscription with Connect – our state-of-the-art business intelligence platform that gives you 24/7 access to your solutions

- Headline analysis articles covering all sovereign rating changes made by S&P Global and the three major ratings agencies, as well as major policy changes impacting creditworthiness on a daily basis

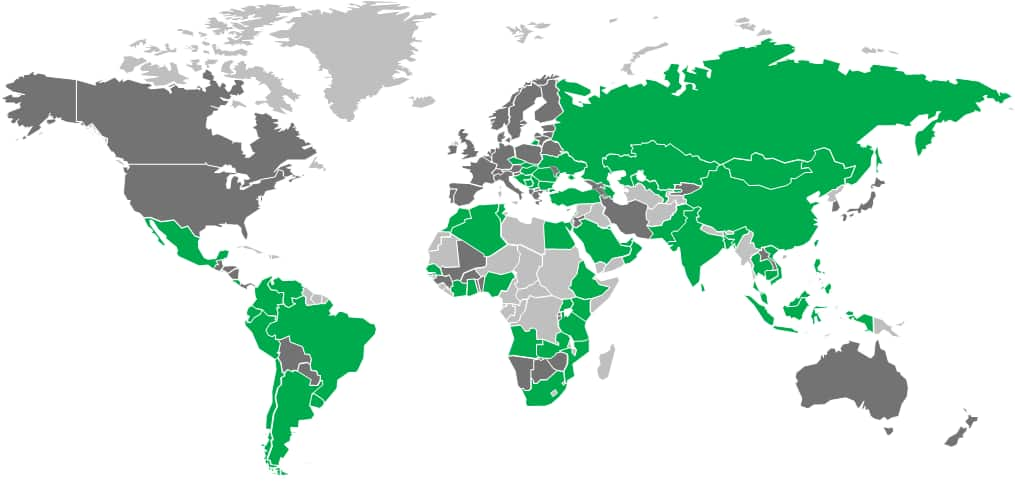

- Risk and ratings table and map for comparison of ratings over time and across all 206 economies

- Full and transparent access to detailed scoring allows for a deeper understanding of fundamentals impacting creditworthiness (debt load, interested payments)

- Detailed reports for all 206 economies describe fundamentals behind sovereign risk scores

- A unique, quarterly sovereign risk review that assesses trends and prospects covering all sovereign score upgrades and downgrades globally

- Download forecast and historical data behind the ratings and create customizable, refreshable spreadsheets with our Data Browser

REST API: Recieve data continuously and reliably directly into your workflow.

Representational State Transfer Application Programming (REST) API makes data available via URL addresses (or ‘endpoints’)

Provides a foundation on which to build databases, charts, websites, visualizations, and CSV files, plus facilities to query and look up specific data

- Offers the simplest approach to application integration:

- Access to the API is instantaneous

- Provides an interactive web environment for developers to explore API features and review technical documentation

- Developers can test the API calls interactively in a browser

- 24/7 monitoring and support is provided

- Scales horizontally for both datasets and clients, ensuring it can meet present and future demand

- Built for consistent speed, with carefully selected technologies to ensure the best possible performance

IDDS: Tailored data feeds featuring continuous updating and seamless delivery.

- Internet Data Delivery System (IDDS) delivers fixed data updates in CSV or XML format to the S&P Global web servers in real-time

- Metadata includes economic concept, geography, source, and frequency

- Updates pull in data changes only, optimizing load speed

- Data updates can be scheduled

Analyst Access

On-demand access to our team of sovereign risk experts

Country Risk Webcasts

Webcasts on key events and trends, with Q&A delivered by leading experts