Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 01, 2015

Securities lending oversupply

The debate at Markit's 15th securities lending forum centred around excess supply in the face of muted demand. However, revenues from specials alongside the demand for collateral highlighted the essential role this market has in the provision of financing to aid liquidity.

- Securities lending supply exceeds demand by seven times, a trend that looks set to continue

- GC has failed to live up to expectations and regulatory rules reinforce this trend

- Opportunities lie in non-conventional financing trades, but lenders need to adapt

The recurring theme at the recent Markit Securities Finance forum was whether or not the industry continues to suffer from oversupply. A cursory look at the aggregate lendable and on loan figures tracked by our database would point to this being the case given the fact that inventories have swelled to over $15 trillion in recent years while loan balances have failed to breach the $2 trillion mark.

Panellists largely agreed that the growing disconnect between aggregate supply and demand were indicative of oversupply. However, there was an acknowledgement that little can be done given that securities lending is often bundled into larger custody contracts which makes it hard to turn down new supply.

This glut of supply has a dilutive effect on revenues if expressed as a proportion of lendable balances and one panellist thought the industry should instead focus on returns achieved on loan balances to benchmark performance.

Supply still useful

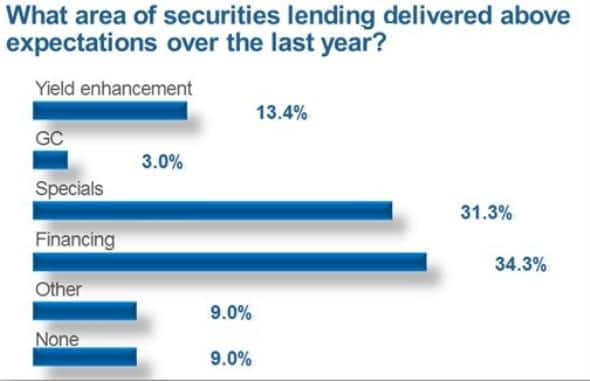

However, flat loan balances hide shifts in the demand mix. Specials were singled out as one of the industry bright spots during 2014 and their unpredictability means that some of the new supply finds its way into the hands of borrowers.

From the perspective of beneficial owners, securities lending has the potential to be a valuable revenue stream, especially as many funds hold a beta plus mandate where a few basis points can make a large difference to relative performance. While revenues from securities lending are useful, it remains low down the list of priorities for fund managers who ultimately look for the activity to be operationally pain free. Demands from borrowers to embrace changes in lending mandates have been viewed as too problematic or potentially damaging to the risk reward threshold.

GC a dying breed

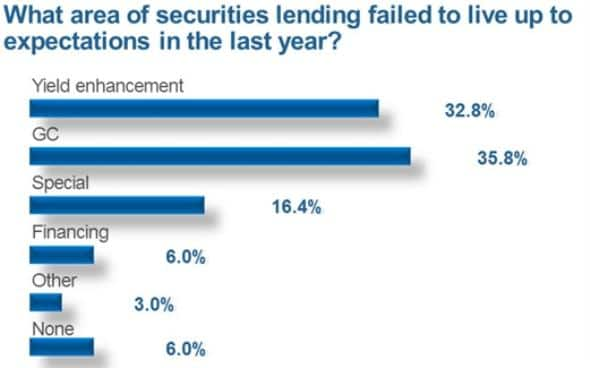

While demand for specials surprised last year, loan balances for general collateral (GC) stocks failed to live up to expectations.

The panels heard that CG balances have been increasingly covered by internalised flows within brokers. Over 40% of audience members thought that the practice covered more than a fifth of the aggregate securities lending demand. Panellists added that regulation was driving this trend as banks seek to cut third party exposure.

Financing opportunities

A third of the audience highlighted that financing trades, which include collateral transformation, performed better than expected last year.

The panellists largely agreed, with the caveat that not all beneficial owners were positioned to benefit from this trend with UCITS funds in particular singled out for their lack of flexibility to term out loans. Those that do not adapt are likely to see their assets clog up the dwindling GC trade.

The beneficial owners best poised to capture value from the increased appetite for financing are those prepared to lend out their assets on long dated term loans and those willing to show flexibility in terms of the collateral they receive against these loans.

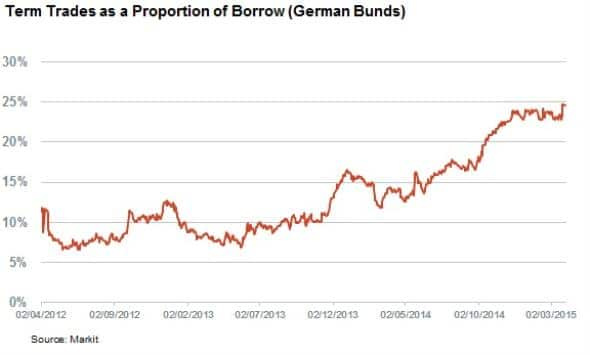

This was seen last year in the Bund market which saw the value of term trades double in to account for a quarter of the aggregate borrow.

Conclusion

Despite excess supply eroding, the securities financing industry remains relevant due to its ability to match the specific assets of those who want to lend into the hands of borrowers.

Collateral has evolved into a new kind of liquidity. Securities financing participants who take a pragmatic view on the collateral they receive and term stand to benefit the most from the regulatory driven demand for high quality collateral. The forum heard that lenders who do not adapt face seeing their assets chase dwindling returns from GC flows and unpredictable specials revenue.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042015-equities-securities-lending-oversupply.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042015-equities-securities-lending-oversupply.html&text=Securities+lending+oversupply","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042015-equities-securities-lending-oversupply.html","enabled":true},{"name":"email","url":"?subject=Securities lending oversupply&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042015-equities-securities-lending-oversupply.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Securities+lending+oversupply http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042015-equities-securities-lending-oversupply.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}