Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Apr 01, 2016

Ireland goes long; SunEdison debt nearly worthless

In this week's credit wrap Ireland issues a 100-yr bond, Janet Yellen spurs on risk, and SunEdison's bonds converge to distressed levels.

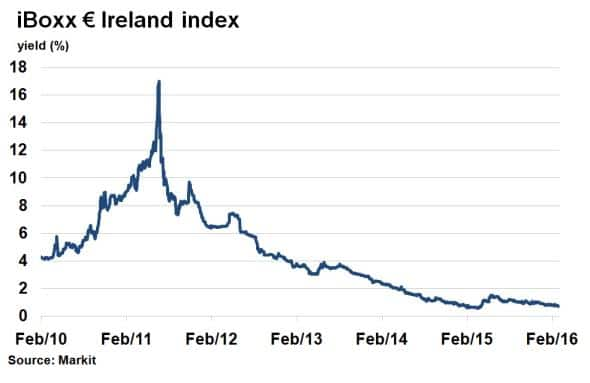

- Markit iBoxx " Ireland index yield is 0.68%, from 16% in 2011, as Ireland issues 100-yr bond

- Yellen's dovish speech has sent the Markit CDX.NA.IG index to last November's lows

- SunEdison's bonds have converged to similar distressed levels as the company faces bankruptcy

Go long

Ireland reiterated its economic recovery this week by issuing a 100-yr bond at a yield of 2.35%.

The country was bailed out by the ECB, IMF and EU Commission in 2010 in a "85bn rescue package, but has since seen sturdy growth and a successful return to capital markets.

Irish government bonds, as represented by the Markit iBoxx " Ireland index, saw yields fall considerably after the bailout. At one point in 2011 yield spiked above 16%, but by the time the bailout programme expired in December 2013, yields had fallen to 2.9%. The 100-yr bond's yield of 2.35% is equivalent to what the Markit iBoxx " Ireland index was yielding two years ago - its average maturity is just 6 years then. Its current yield is 0.68%.

The deal also displays the demand for meaningful yield in today's low interest rate environment. The ECB increased its QE programme and cut interest rates further earlier this month. This supressed short term bond yields in the euro region further, compelling investors to chase returns by delving into riskier or longer maturity assets.

Central banks subdue risk

Spurred on by Fed chair Janet Yellen's dovish rhetoric on Wednesday, credit risk among US investment grade companies has fallen to four month lows.

After the Bank of Japan's introduction of negative interest rates and the ECB's latest QE drive, it was the Fed's turn to reassure investors that central banks will remain accommodative towards risky assets in the near future.

US investment grades corporate credit, as represented by the Markit CDX.NA.IG index, has seen its 5-yr spread tighten to 79bps - the lowest level since last November. Since mid-February, spreads have fallen by 37% as central banks have, one after another, announced simulative monetary measures.

Distressed

Renewable energy giant SunEdison's troubles worsened this week as the company teeters on the edge of bankruptcy. Low energy prices have forced the firm to restructure parts of its business and it now faces a SEC investigation over accounting disclosures.

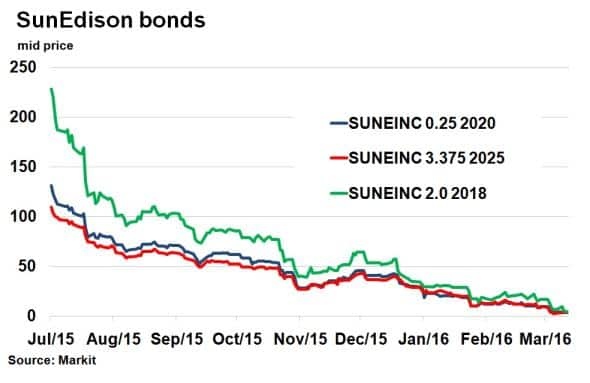

The company's creditors already face substantial losses judging by the bond market's reaction. According to Markit's bond pricing service, SunEdison's bonds are all trading at similar levels; typical of companies in distress. SunEdison's 0.25% 2020 bond and 3.375% coupon bond maturing in 2025 had been trading at over 100 (cash basis to par) in July last year, but are now priced at 3.625 and 3.5625 respectively, showcasing the fall from grace

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042016-Credit-Ireland-goes-long-SunEdison-debt-nearly-worthless.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042016-Credit-Ireland-goes-long-SunEdison-debt-nearly-worthless.html&text=Ireland+goes+long%3b+SunEdison+debt+nearly+worthless","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042016-Credit-Ireland-goes-long-SunEdison-debt-nearly-worthless.html","enabled":true},{"name":"email","url":"?subject=Ireland goes long; SunEdison debt nearly worthless&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042016-Credit-Ireland-goes-long-SunEdison-debt-nearly-worthless.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Ireland+goes+long%3b+SunEdison+debt+nearly+worthless http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042016-Credit-Ireland-goes-long-SunEdison-debt-nearly-worthless.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}