Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 01, 2016

Week Ahead Economic Overview

Global PMI results for March are released during the week and will provide a complete picture of economic conditions during the first quarter as a whole. The US will also remain in focus, as factory orders and trade data are likely to add to the policy debate. The UK meanwhile sees the release of industrial production figures and retail sales data are out in the eurozone.

The release of PMI, factory orders and trade data will be closely monitored by monetary policy makers in Washington for signs that the US economy is ready for a further rate hike later in the year. Following a speech before the Economic Club of New York, Fed Chair Yellen stated that the bank would proceed "cautiously" with rate increases. Traders are now only placing a 40% likelihood of a rate rise in July, down from 51% before the speech.

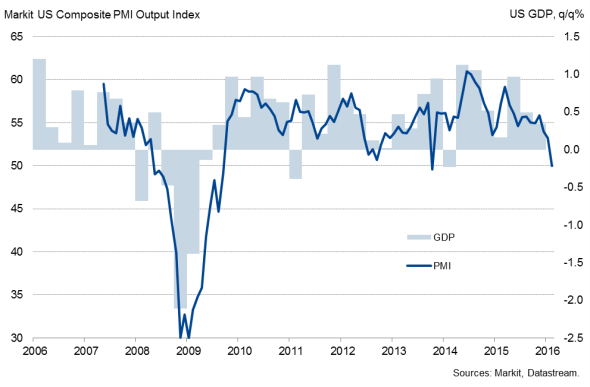

Markit's US PMI data have signalled a substantial slowing in the rate of economic growth at the start of the year, with the business survey data consistent with annualised first quarter GDP growth of just 0.7%. If confirmed by the final data, out on Tuesday, this would mean that the US is currently going through its worst growth spell for three-and-a-half years and would clearly be an argument to postpone any future rate hikes.

US GDP and the PMI

Business survey data suggest that new order growth at US manufacturers was worryingly weak at the beginning of the year and factory orders are expected by economists polled by Thomson Reuters to have declined 1.6% in February, thereby reversing an equally strong increase in January. Other notable releases in the US include trade and mortgage approval data.

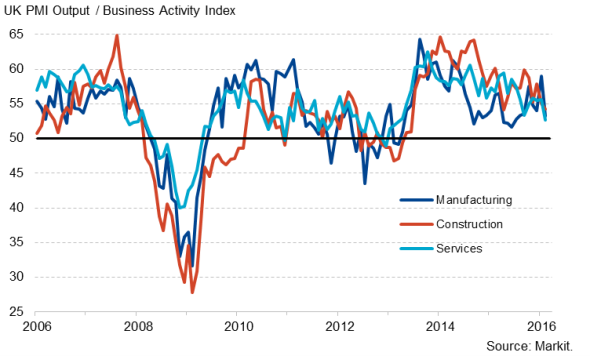

Over in the UK, the Bank of England seems a long way off raising interest rates amid worries that intensifying Brexit fears and slowing global economic growth will lead to weaker demand. The release of industrial production numbers and PMI results for the construction and service sectors will therefore provide the bank with valuable information on the health of the UK economy in the first quarter. With the PMI already in territory which has in the past seen the Bank of England inject stimulus into the economy, a further weakening of the survey data could increase the chances of policymakers having to resort to further non-standard measures to boost the economy.

UK PMI

The Office for National Statistics releases official UK industrial production data for February on Friday. January saw the first rise in three months (+0.3%), but with the manufacturing PMI falling to a 34-month low in February, it is unlikely that the data will show any meaningful growth of industrial output.

Final PMI results are also out in the eurozone and will include more national detail about its member states. The 'flash' estimate showed the region's economy picking up pace in March, although it was consistent with a meagre 0.3% expansion in GDP over the first quarter as a whole.

Official retail sales numbers and Markit's Retail PMI will meanwhile provide more information on household demand in the currency union. Eurostat reported a stronger-than-expected rise in retail sales in January, but both PMI data and consumer confidence numbers have been weak in recent months, so it remains to be seen whether the positive trend in retail sales has held up in February.

Eurozone consumer confidence

With recent business survey data signalling that global economic growth is slowing sharply, data watchers will be awaiting the release of the March JPMorgan Global PMI results. In February, the index fell to its lowest since October 2012, signalling only a 1% rise in global GDP in the first quarter. A specific focus will be on the emerging markets, as PMIs in Brazil, China and India all fell since January.

Monday 4 April

Building permits and retail sales numbers are released in Australia.

The latest Nikkei India Manufacturing PMI is published.

In the euro area, the Eurozone Sentix Index and producer price figures are issued.

ISTAT releases public deficit data for the fourth quarter in Italy.

The Markit/CIPS UK Construction PMI for March is released.

Employment trends and factory orders numbers are updated in the US.

Tuesday 5 April

Service sector and whole economy PMI results are published worldwide.

Australia sees the release of trade data.

The reserve banks of Australia and India announce their latest monetary policy decisions.

Eurostat publishes retail sales numbers for the currency bloc.

In Germany, Destatis issues latest factory orders figures.

UK house price information are released by Halifax.

Trade data are meanwhile published in Canada and the US.

Wednesday 6 April

Service sector PMI results are issued in China and India.

Japan's Cabinet Office publishes its latest Leading Indicator.

The latest Eurozone Retail PMI is released by Markit.

Industrial production numbers are meanwhile updated in Germany.

The US sees the release of mortgage application data.

Thursday 7 April

Global sector PMI results are issued by Nikkei and Markit.

Business confidence and manufacturing production figures are issued in South Africa.

Current account and trade data are out in France, while Spain sees the release of industrial output numbers.

Meanwhile, unemployment figures are updated in Greece.

In Canada, building permit numbers are issued.

Initial jobless claims data are out in the US.

Friday 8 April

In Japan, consumer confidence and current account data are updated.

Germany sees the release of latest trade numbers.

France updates its budget balance and also publishes industrial output figures.

Industrial production and inflation data are meanwhile out in Greece.

The Office for National Statistics issues industrial output and trade numbers in the UK.

Housing starts and employment data are released in Canada.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042016-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01042016-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}