Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 01, 2015

Oil & Gas credit stabilises; China contagion

Oil price stability has helped oil firms adapt, while another corporate default in China looms.

- Markit iBoxx USD Liquid High Yield Oil & Gas Index yielding lowest year to date, at 7.55%

- Cyprus signals end to crisis with return to bond markets, looks towards QE eligibility

- Chinese utility firm Sound Global sees its dollar bond plummet 17pts in two days

Oil stability

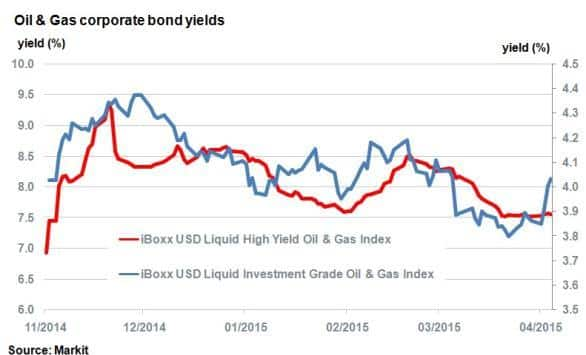

Since mid-March, crude oil prices (WTI) have gained $12 and are at the highest level since December last year. Prices look set to be range in the $40-60 range and the relative stability over the last three months has helped oil firms adapt to the new normal by cutting costs and consolidating businesses. This increased stability is reflected in bond yields, as evidenced in the Markit iBoxx USD Liquid High Yield Oil & Gas Index which is now yielding its lowest year to date. The current 7.55% yield is nearly 2% lower than at the height of the oil price downfall.

Major oil firms also reported earnings this week with both BP and Exxon Mobil beating albeit low expectations. Other oil majors Total and ConocoPhillips also fared better than expected. The Markit iBoxx USD Liquid Investment Grade Oil & Gas Index, which incorporates debt issued by major oil firms, recently saw its yields dip to 3.8%, on par with its one year average. On a spread to treasuries basis, levels continue to see an inverse relationship with the oil price.

Cyprus returns<</strong>

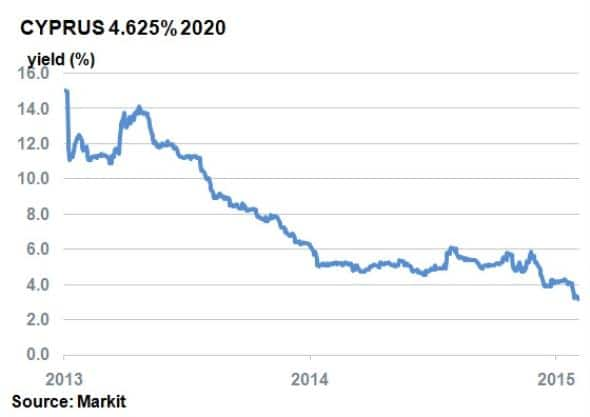

Just two years ago, Cyprus’s 4.625% 2020 bond was yielding 14%; it now yields just 3.18%. Bailed out by the IMF and the EU in 2013, the turnaround was complete when the Republic of Cyprus made a return to the debt capital markets this week with a €1bn seven year deal. The market response was positive, as was the timing, which came just as Cyprus passed a mortgage foreclosure law that would make it eligible for the ECB’s QE programme. Bonds rallied across the curve; the aforementioned 2020 bond tightened 13bps in one day.

While economic and structural progress has been made by Cyprus, fears of a Greek-like relapse cannot be ignored. Greece, which returned to capital markets last year, has seen its credit collapse as a new government came to power.

Not so sound

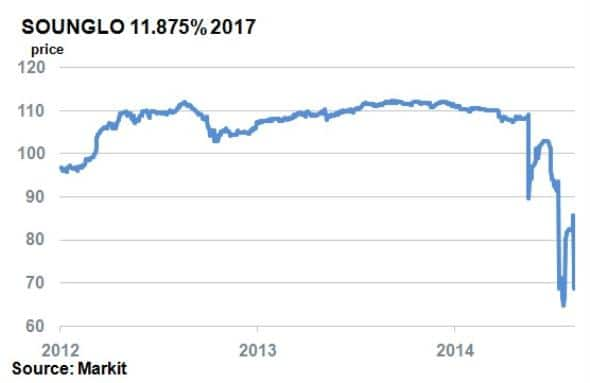

In Asia troubled Chinese water utility firm Sound Global saw its dollar denominated bond dive as further accounting irregularities surfaced. The $150m bond which matures in 2017 saw its price move from 85.75 to 68.75 in the last two days, according to Markit’s bond pricing data. The latest drop was due to auditors identifying a cash shortfall in already delayed 2014 filings. With shares having been already suspended since March, a technical default beckons.

The troubles come as concerns mount around China’s corporate debt market. Just last week, property developer Kaisa defaulted on its overseas debt, triggering fears of contagion into the broader market. Concurrently, China’s central bank injected cash into the financial system in hope of simulating stumbling growth.

Neil Mehta, Analyst, Fixed Income at Markit

Tel: +44 207 260 2298

neil.mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01052015-Credit-Oil-Gas-credit-stabilises-China-contagion.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01052015-Credit-Oil-Gas-credit-stabilises-China-contagion.html&text=Oil+%26+Gas+credit+stabilises%3b+China+contagion","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01052015-Credit-Oil-Gas-credit-stabilises-China-contagion.html","enabled":true},{"name":"email","url":"?subject=Oil & Gas credit stabilises; China contagion&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01052015-Credit-Oil-Gas-credit-stabilises-China-contagion.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Oil+%26+Gas+credit+stabilises%3b+China+contagion http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01052015-Credit-Oil-Gas-credit-stabilises-China-contagion.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}