Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 01, 2015

Japan's rally sees investors add to exposure

With the economy gathering pace and the Nikkei 225 trading at its highest level in over 15 years, investors have been eagerly adding to their Japanese exposure.

- Japan's Manufacturing PMI readings indicated stronger growth in May

- Japan exposed ETFs have continued to see inflows, led by domestic Japan funds

- Electronics firm Sharp has missed the rally and seen short sellers circle

Japan's stimulus fuelled economic growth spurred back to life in the first quarter of the year at an above expectation 2.4% annualised growth rate. This growth looks to have carried over into the current quarter as Markit's May release of the Japan Manufacturing PMI indicated that output growth returned to the rate seen in the opening months of the year, after stalling in April.

The bullish economic mood has also been reflected in equity values, with the Nikkei 225 advancing by over 5% in the last week; taking its year to date advance to 17.8%. This recent strong performance has taken Japan's most recognised equity index past the 20,000 mark for the first time in nearly 15 years.

ETF exposure

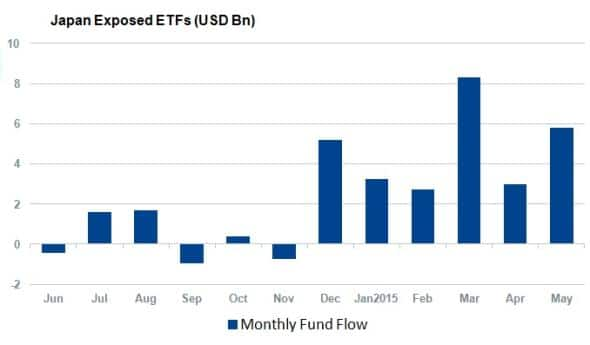

Japanese exposed ETFs have seen large inflows over the last few weeks. May saw ETF investors add $5.8bn into Japan exposed ETFs; the second largest inflow tally of the last 12 months. This strong appetite for Japanese exposure demonstrates that most investors aren't yet concerned about the recent equity increases.

Domestic Japanese listed products have made up 70% of the last month's inflows. Two TOPIX benchmarked funds have led the recent inflows, with the MAXIS TOPIX ETF and Nomura TOPIX Exchange Traded Fund each seeing over $800m of inflows.

But the rally has seen overseas investors lose some of their appetite, as Japan exposed funds listed outside of Japan registered the lowest inflow tally in three months with a total of $1.7bn.

Currency hedged funds have continued to be the favoured instruments for overseas investors looking to gain Japanese exposure, with four currency hedged ETFs among the top five overseas listed funds seeing the largest inflows. This desire to hedge against yen was well timed, as the Japanese currency is now trading at 12 year lows against the dollar.

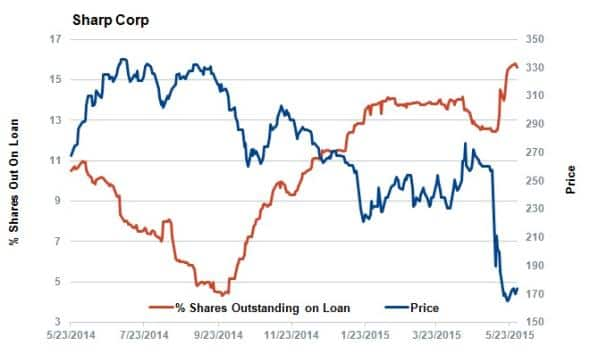

Betting against Sharp

Not all news out of Japan has been bullish however as electronic company Sharp's recently announced capital restructuring sent its shares down sharply. Sharp's shares are now trading a third lower than one month ago, which has encouraged short sellers to add to their positions with over 15% of Sharp shares now out on loan.

While Sharp's recent struggles could be interpreted as a weakness in Japan's ability to compete in the international market, the bearish sentiment hasn't spread to its recently floated rival Japan Display. Japan Display's stock has managed to rise over the last month, taking its year to date performance past the 40% mark.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062015-Equities-Japan-s-rally-sees-investors-add-to-exposure.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062015-Equities-Japan-s-rally-sees-investors-add-to-exposure.html&text=Japan%27s+rally+sees+investors+add+to+exposure","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062015-Equities-Japan-s-rally-sees-investors-add-to-exposure.html","enabled":true},{"name":"email","url":"?subject=Japan's rally sees investors add to exposure&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062015-Equities-Japan-s-rally-sees-investors-add-to-exposure.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan%27s+rally+sees+investors+add+to+exposure http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062015-Equities-Japan-s-rally-sees-investors-add-to-exposure.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}