Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 02, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in companies due to announce results in the upcoming week.

- Oil contagion seen as short sellers target rail related companies in US

- Greenbrier is the most shorted company

- Japanese retailers are most shorted in the Asia Pacific region

Short sellers have focused on North America and the Asia Pacific region as Europe displays low levels of shorting activity for companies reporting earnings in the first week of 2015.

North America

Railroads and more specifically rail related companies have come under increasing scrutiny recently as concerns mount that volumes of crude oil shipments in the US will fall drastically as continued low oil prices start to put high cost producers out of business.

The recent shale oil production boom, which led the oil price collapse, gave rise to rapid capacity expansion and utilisation of rail, to help deliver the output from the fracking expansion into new territories. Rail and related firms have performed admirably over the past 12 months however fortunes may have turned.

Oil's price has collapsed amid a glut in supply, which has caused companies to pull back on now unfeasible expansion plans. Short seller's interest in these stocks may indicate expectations of decreased volumes.

Companies that are exposed to rail volumes and offering related products and services have seen increased short interest and declining share prices, having posted a strong rally in the last year fuelled by US production of petroleum having hit 44 year highs.

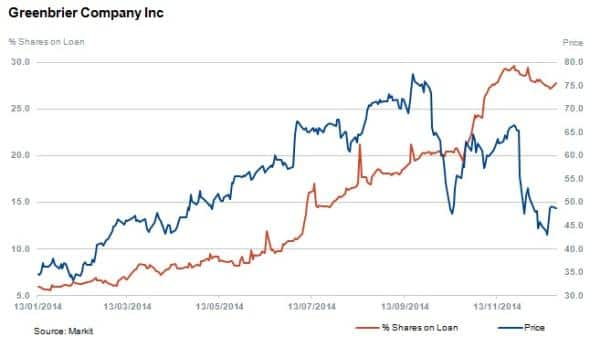

Greenbrier sees the greatest amount of short interest ahead of earnings in the first few weeks of January 2015. The company provides transportation equipment and services to the railroad sector including refurbishments, services and leasing.

Greenbrier's share price declined by 27% in just the last month, but is still up 49% over the last year. Shares outstanding on loan are at 28%, up significantly from 5.7% from the same time last year.

Rail companies have seen less dramatic price movements compared to companies who supply into the industry but are seeing some pressure. Union Pacific and Kansas Southern share prices are both down 2%. Short sellers are for now, targeting suppliers into the industry as volume growth could stall. Greenbrier Freightcar America, is down 28% over the last month but sees less comparatively shares outstanding on loan at 2%, down 22% on the month and down 67% on the year.

Asia Pacific

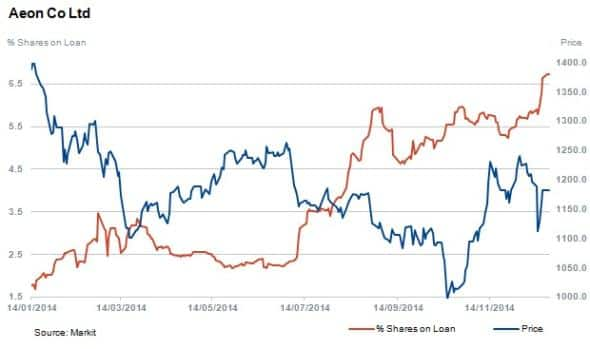

Two Japanese general merchandise retailers, Uny Group Holdings and Aeon Co, top the list of companies with the highest amount of shares outstanding on loan ahead of earnings. Both companies' shares outstanding on loan has increased over the year with Aeon's up by 27% in the last month to 6.7% while Uny Group is up 119% from 2.8% 12 months ago to 8.5%.

Earlier this year, short sellers had already focused on retailers as Japan's economic tightening put consumers under increased strain with added inflation and higher taxes.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02012015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02012015-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02012015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02012015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02012015-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}