Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 02, 2015

ECB QE boosts Reverse Yankee bond appeal

US corporations are rushing to take advantage of the yield environment that has sprung up in the wake of the ECB's QE decision.

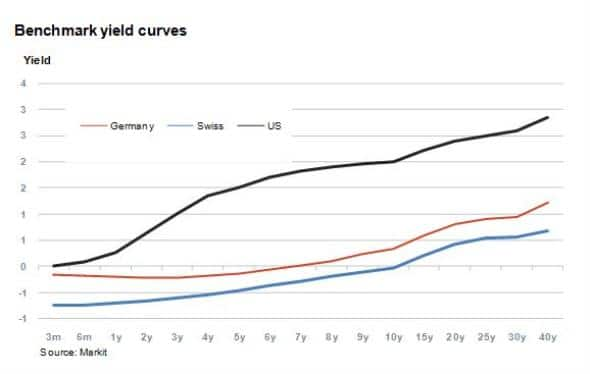

- Benchmark sovereign yields on the continent are negative up to a five year horizon

- Investment grade credit sees yields 200bps higher in the US than in Europe

- 10 year Procter and Gamble bonds issued in Europe yield 1.75% less than their US issued equivalents

For many years the US has been the most popular destination for foreign corporations and governments to raise funds. This has been largely due to its well-developed capital markets, which provide abundant liquidity, a varied investor base and a stable currency.

A Yankee bond is a bond issued in the US by a foreign corporation. Conversely, a Reverse Yankee bond denotes issuances from US-based firms into overseas jurisdictions. The latter have has been gaining traction this year as US companies look to take advantage of the cheap funding costs in Europe.

Negative yields

US firms have been flocking to the European debt capital markets where they are able to raise funds more cheaply than in the dollar market. With the ECB's QE programme due to start this month, the anticipated stimulus has already suppressed yields across Europe.

A closer look at the yield curves of three major transatlantic funding currencies (US dollar, euro and Swiss franc) highlights the difference in borrowing costs. German bunds, which are used as a benchmark for all corporate bonds issued in euros, provide yields in negative territory for the next six years. Swiss franc denominated bonds also see negative yields for a ten year window.

This environment allows investment grade corporations to issue at very low coupons, as seen last week when credit ratings agency Moody's issued 12 year bonds in euros at a notably low coupon of 1.75%.

European appeal

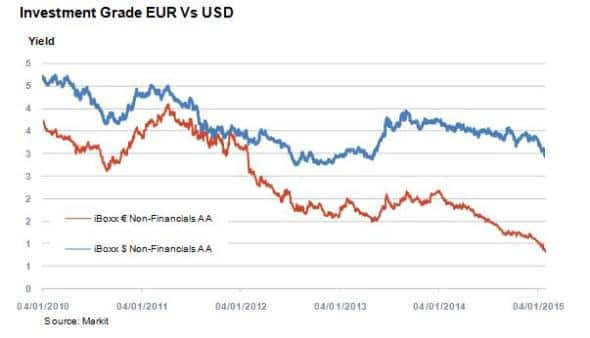

Despite a slight deterioration in the basis this year, euro credit still remains an attractive option, especially to high grade issuers. This is well illustrated by the iBoxx € Non-Financials AA, which includes US issuers such as Wal-Mart, Pfizer and Roche and currently yields around 2% less than the iBoxx $ Non-Financials AA.

This gap was non-existent in 2011, and widened to hit 2.3% in September last year.

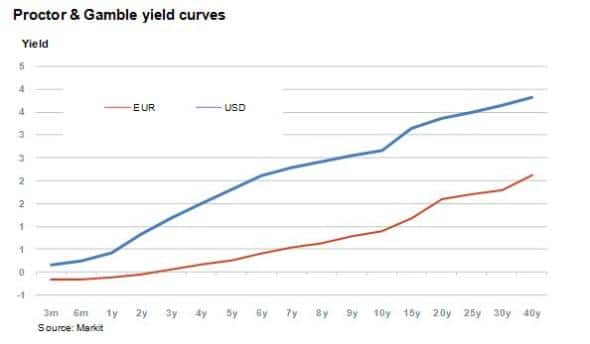

Proctor & Gamble, a consumer goods conglomerate and high grade US issuer that is prominent in both US and European markets, provides an interesting example of this developing trend.

If the company was to mandate a new 10 year offering then the current yield curve, driven by market supply and demand, implies it would have to provide a 0.9% coupon in euros and a 2.65% coupon in US dollars; a 1.75% difference. The difference is greatest at the 15 year point, standing at 1.95%.

The Reverse Yankee

A number of major US corporations have issued debt in the European markets on multiple occasions. Firms include Proctor & Gamble, AT&T and Apple with its much publicised issuance in Swiss francs earlier this year.

But Reverse Yankee bonds haven't only been popular among returning issuers; smaller investment grade issuers have also been taking advantage of the low yields and supply gap left by European issuers. There have also been several debut issuances from the likes of Whirlpool, an appliance manufacturer. Even governments such as Mexico, have made the most of the yield gap, printing €8.5bn worth of euro denominated debt last week.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032015-credit-ecb-qe-boosts-reverse-yankee-bond-appeal.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032015-credit-ecb-qe-boosts-reverse-yankee-bond-appeal.html&text=ECB+QE+boosts+Reverse+Yankee+bond+appeal","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032015-credit-ecb-qe-boosts-reverse-yankee-bond-appeal.html","enabled":true},{"name":"email","url":"?subject=ECB QE boosts Reverse Yankee bond appeal&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032015-credit-ecb-qe-boosts-reverse-yankee-bond-appeal.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=ECB+QE+boosts+Reverse+Yankee+bond+appeal http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032015-credit-ecb-qe-boosts-reverse-yankee-bond-appeal.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}