Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 06, 2024

Vive la Volatility: The Rise of Short Interest Amid Political Upheaval In France

Short interest climbs across France as political uncertainty takes hold.

This week, French President Emmanuel Macron faced a significant setback as opposition lawmakers united to oust his government just nine weeks into its term, marking the first no-confidence vote success since 1962. Prime Minister Michel Barnier, appointed as a compromise to navigate a fragmented national assembly, failed to secure support for his budget, which included substantial tax increases and spending cuts. With the parliament evenly split among left, center, and far-right factions, Macron's ambitions for domestic reform seem stalled, as both opposition sides reject his fiscal strategies. The political landscape is tense, with the left demanding representation in the next government and the far-right, led by Marine Le Pen, remaining strategically positioned for future gains. As political deadlock looms, Macron's quest for stability appears increasingly elusive, leaving the future of French governance uncertain.

As a result of the political situation in France, investors have started to react to the news as market sentiment starts to shift across several securities finance data sets, notably those that show the degree of short Interest across the French market.

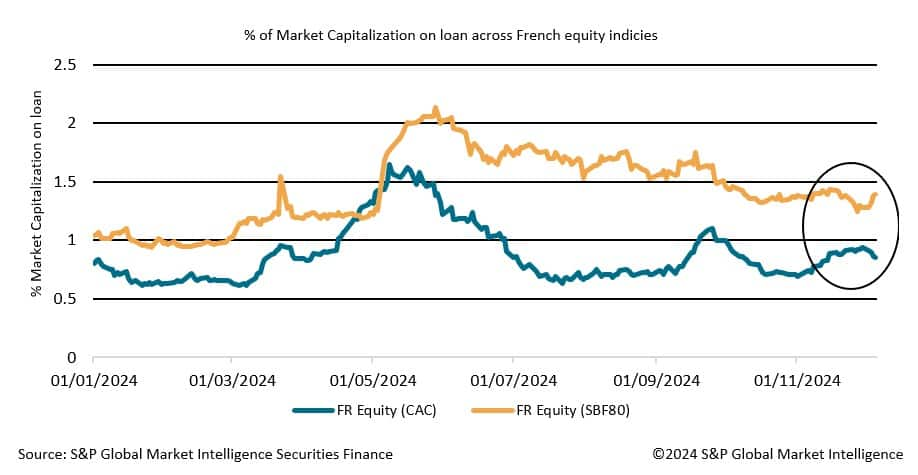

Examining the percentage of market capitalization on loan, it is clear to see an increase across both the CAC40 and the SBF80 since November. As the political situation has deteriorated, a recent rise in activity across the SBF80 can also be seen heading into December.

As equity markets continue to be impacted by the instability seen across the French political landscape, those short positions that have been growing have also started to become more profitable.

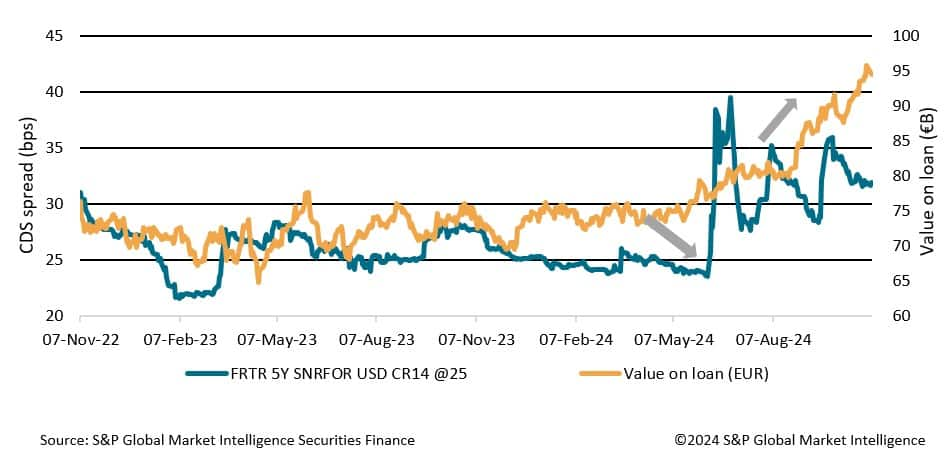

Across fixed income assets, a parallel trend is evident. Increased borrowing has been observed, driven by mounting concerns regarding the challenges of implementing the fiscal reforms necessary to address the rising French deficit. As political uncertainty intensified over the summer, this instability began to exert pressure on the credit default swap (CDS) spreads of French government bonds, leading to a corresponding increase in their value on loan. This dynamic highlights the market's reaction to the evolving political climate and its implications for sovereign credit risk.

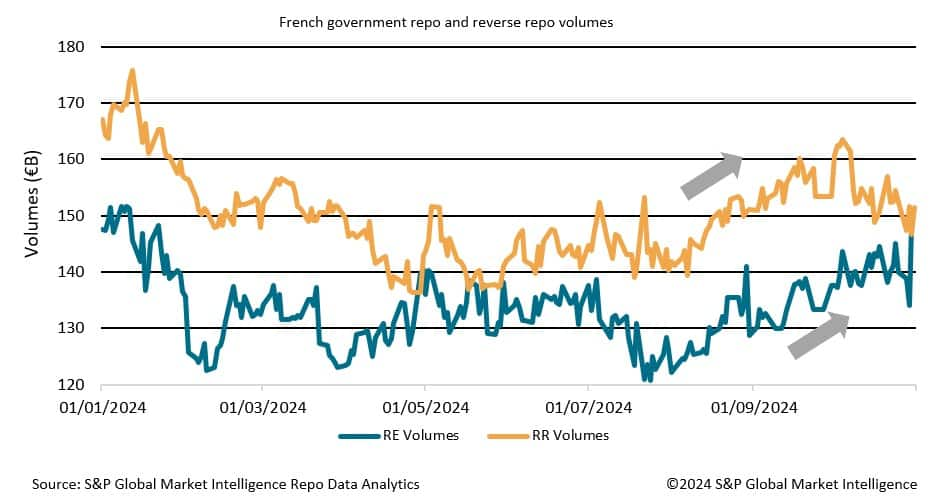

A similar picture can be seen in repo markets as volumes in both repo and reverse repo have been increasing since the summer months.

As President Emmanuel Macron prepares to appoint a new prime minister for the third time this year, the incoming candidate is anticipated to prioritize the establishment of a "government of general interest" focussing on the delivery of a new budget. In this context, investors are closely monitoring market developments that could influence French assets. The significance of this governmental appointment is underscored by National Assembly speaker Yael Braun-Pivet, who cautioned against allowing the administration to "drift" amid prevailing instability. Consequently, the potential for continued volatility affecting French assets remains elevated, particularly within the securities finance markets, as investors navigate the implications of political developments on sovereign risk and asset performance.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvive-la-volatility-the-rise-of-short-interest-amid-political-u.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvive-la-volatility-the-rise-of-short-interest-amid-political-u.html&text=Vive+la+Volatility%3a+The+Rise+of+Short+Interest+Amid+Political+Upheaval+In+France+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvive-la-volatility-the-rise-of-short-interest-amid-political-u.html","enabled":true},{"name":"email","url":"?subject=Vive la Volatility: The Rise of Short Interest Amid Political Upheaval In France | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvive-la-volatility-the-rise-of-short-interest-amid-political-u.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Vive+la+Volatility%3a+The+Rise+of+Short+Interest+Amid+Political+Upheaval+In+France+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvive-la-volatility-the-rise-of-short-interest-amid-political-u.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}