Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 05, 2024

Securities Finance November 2024

ETF revenues increase by an impressive 53% YoY

- Fixed income assets continue to generate strong returns

- Equity revenues grow YoY as markets rise

- Lendable tops an average of $41T

- Fixed income balances continue to grow heading into year-end

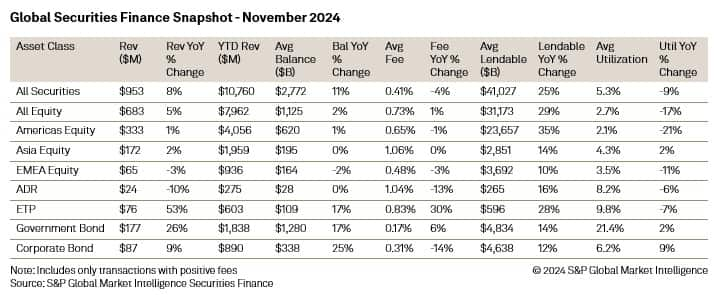

In November, the securities lending market generated revenues of $953 million, reflecting an 8% increase year-over-year but a 4% decline month-over-month. As market valuations continued to rise, the average lendable value exceeded $41 trillion, marking a significant 25% year-over-year increase. Additionally, total balances grew to $2.772 trillion, up 11% year-over-year. Notably, exchange-traded products (ETPs) stood out, generating $76 million, an impressive 53% increase year-over-year, making it their highest revenue month of the year thus far. Government bonds remained a strong performer amid increasing uncertainty regarding future interest rate movements, while corporate bonds are on track for another strong year following a month of solid revenues.

In the equity markets, total revenues across all equity classes increased by 5% year-over-year but saw a decline of just under 3% month-over-month. EMEA equities struggled to capitalize on prior growth, declining 3% year-over-year in November and generating $65 million. In contrast, Asia and the Americas equities experienced modest growth, with revenues increasing by 2% and 1% year-over-year, respectively. Average fees in the equity markets remained stable year-on-year; however, Americas equities saw a slight decline of 3 basis points compared to October, primarily due to a 13% year-over-year drop-in ADR fees and a more moderate 3% decline in US equity fees.

Fixed income assets continued to show strong performance as heightened uncertainty regarding future interest rates, growing political instability, and geopolitical challenges created opportunities for borrowers. Year-over-year revenue growth was robust across government bonds, with the Americas growing by 36%, Europe by 12%, and Asia by 5%. The only exception was emerging market government bonds, which experienced a 2% decline. Emerging markets are likely to face additional challenges entering the new year, as US interest rates are anticipated to remain higher for longer, and potential reforms in US trade policy from the new administration are expected to impact emerging market economies. Despite this, balances in emerging market bonds increased by 41% year-over-year, the highest growth rate across all regions.

Corporate bonds continued to see strong demand, fuelled by record issuance, and narrowing spreads, leading to a 10% year-over-year increase in revenues across conventional bonds, as balances grew by an impressive 25% year-over-year. Balances reached a year-high average of $335 billion, pushing utilization above 6% for the first time this year.

While revenues for 2024 started lower compared to the previous year, there has been a notable recovery in the final quarter. Following two exceptionally strong years in market revenues, the performance for 2024 will largely depend on the results from the final month, determining whether it will rank as the third or fourth highest revenue-generating year since our records began.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-september-november-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-september-november-2024.html&text=Securities+Finance+November+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-september-november-2024.html","enabled":true},{"name":"email","url":"?subject=Securities Finance November 2024 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-september-november-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Securities+Finance+November+2024+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-september-november-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}