Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 02, 2016

Value investing resurges as momentum stalls

Value has been a tough trade since 2007. Bouts of QE have lifted equities and their multiples higher with momentum strategies performing well into 2015. However, recent price swings seem to be bringing value investors back on trend.

- Top stocks of 2015 trim their gains as momentum stalls in 2016

- Weak value metrics help avoid 'falling knives' and drive majority of long short profits

- Shorts target poor value and price momentum but not prepared to broadly short high flyers

Momentum loses direction

The QE-fuelled rally of the past decade may be losing its potency - a boon for value styled investors whose strategies have largely underperformed with the surge in momentum in recent years. Momentum investors did well to follow rising stocks in 2015. However just a few months into 2016 and value investors are now reaping rewards or repairing wounds.

A long only strategy centred on value might have been a bitter pill to swallow in 2015 as the rally in FANG stocks helped the S&P 500 break even as the broader market stagnated. However, a long short strategy using Markit Research Signalsdeep value model* (DVM) has delivered some stellar returns over the last five years, even trumping its momentum peer by 14%.

The peer, the Price Momentum model* (PMM) has pulled back, while DVM has surged ahead. This phenomenon has been especially relevant in the last four months - explaining 96% of the current outperformance of the DVM model. However, high ranking value stocks (long positions) have not driven this outperformance and instead low ranking stocks are responsible for 80% of the models' returns (short positions).

This statistic highlights that investors have sold off low value stocks in the New Year as momentum stalled. This was exhibited perfectly by the PMMs models underperformance and underscored by high ranking price momentum names that sat idle with the model practically flat year to date.

Shorting momentum and value

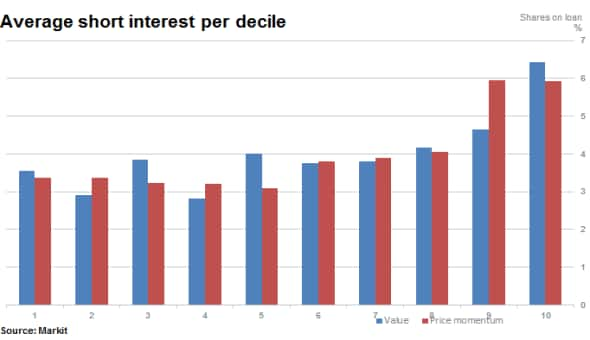

Although stocks were not targeted purely on price momentum versus value, short sellers are clearly akin with market sentiment and the equity models above. This is evident with increasing average short interest across ranked names (by decile) with deteriorating DVM and PPM ranks.

Average short interest across the bottom fifth of firms ranked according to value and price momentum (deciles 9 and 10 above) is 66% higher than those ranking in the top fifth.

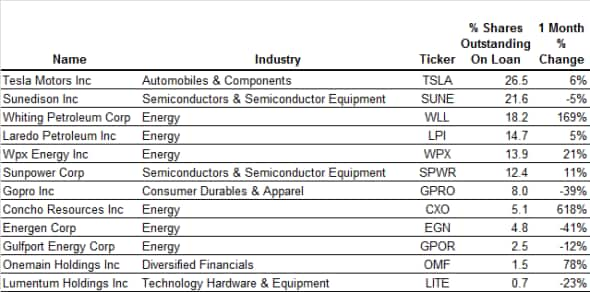

Shorts target value

Firms ranking the worst according to the DVM model (below) in the US are sold short twice as much as those who rank the highest. Most short sold currently is Tesla Motors with 26.5% of shares outstanding on loan.

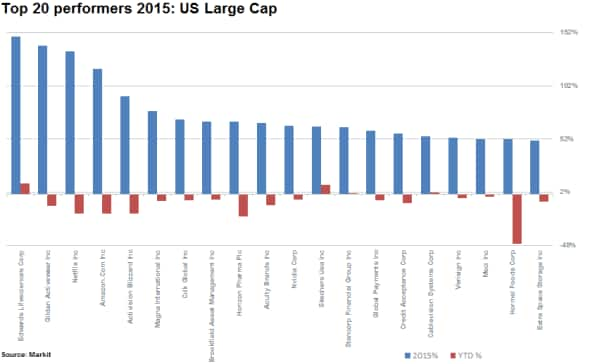

Role reversal in momentum

The pullback in price momentum year to date is shown across a large cap US universe of 1100 names as 75% of the top 20 performing stocks of 2015 have fallen 8% on average year to date. This includes two 'FANG' stocks Netflix and Amazon which have fallen 11% and 18% respectively.

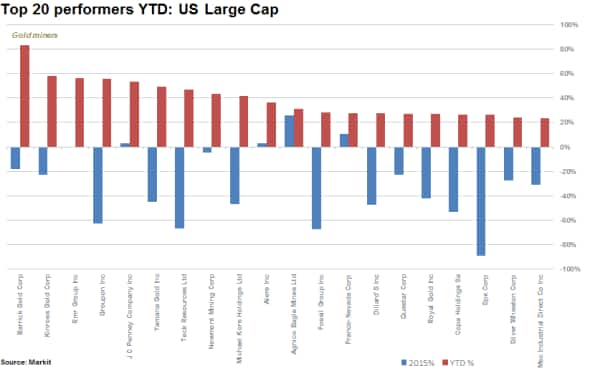

At the opposite end of the spectrum, the top performers year to date versus their respective 2015 performances reveal that on average the top twenty stocks are up by 40% ytd, despite falling on average by 32% in 2015.

Almost 50% of these stocks are materials firms, with the majority gold miners who have continued to benefit from a rise in gold prices as investors rush to invest in the precious metal. Gold ETFs have just recently recorded their largest ever monthly inflow.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032016-equities-value-investing-resurges-as-momentum-stalls.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032016-equities-value-investing-resurges-as-momentum-stalls.html&text=Value+investing+resurges+as+momentum+stalls","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032016-equities-value-investing-resurges-as-momentum-stalls.html","enabled":true},{"name":"email","url":"?subject=Value investing resurges as momentum stalls&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032016-equities-value-investing-resurges-as-momentum-stalls.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Value+investing+resurges+as+momentum+stalls http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032016-equities-value-investing-resurges-as-momentum-stalls.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}