Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 02, 2017

Specials Dry up as Volatility Eases

The number of equity specials, and the fees they generate, has fallen significantly in Q1 compared to the same period last year which has negatively impacted the industry's overall revenues.

- Proportions of shares trading special now below 15%, worst since 2015

- Commodity names drive the fall in specials

- Specials now much cheaper to borrow which has further eroded revenues

This report features in the recently released Markit Securities Finance quarterly review. Please contact us if you want a full copy of the report.

Securities lending revenues earned by beneficial owners over the opening quarter of 2017 failed to match those earned in Q1 2016, when surging market volatility took the industry's profitability to levels not seen since the financial crisis. Overall industry revenues are down by over 6% from the same period last year and equities are the main culprit as the securities lending fees earned by the asset class came up short by a massive 21%. In dollar terms the overall revenue shortfall amounts to just over $113m for the entire group of beneficial owners that contribute to Markit Securities Finance's dataset.

As the broader report highlights, declining equities revenues have been a global phenomenon as Asian, American and European markets all failed to match the revenue tally earned over last year's opening quarter.

The relative calm in the equities market experienced in Q1 compared to the same period a year ago has played a large role in this revenue slump as short sellers gave up fighting the global bull market that has gripped equities in the months since the US election. Decreasing appetite to sell shares short in the current market is perhaps best highlighted by the fact that far fewer shares traded special over Q1 than during same time last year.

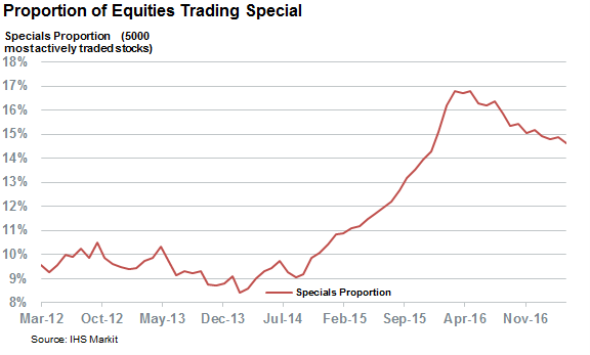

Specials, defined as the shares which trade with a fee of more than 100 basis points, used to make up 17% of the 5,000 most actively traded stocks at the end of Q1 last year. The recent calm has seen the proportion of specials shrink to 14.6% at the end of March, the smallest number since the end of 2015.

Not surprisingly, commodities related stocks, which were responsible for much of the market upheaval last year, have driven the specials retrenchment after commodities markets started to rebound from the lows set last February. Nearly a quarter of all energy names used to trade special in the first week of March 2016, the week after what turned out to be the lows set in oil prices. That number has since nearly halved as 15% of energy names traded north of 100 basis points at the end of Q1 which was the lowest proportion since the end of 2015.

The other commodities sector, materials, has also registered a material decline in the number of its shares trading special which has fallen from 19% to 15% over the last 12 months.

The story isn't entirely driven by the commodities sector however as the main protagonists of last year's volatility, a slowing growth in China and the threat of deflation in Europe, meant that pretty much every other sector registered a material rise in the number of shares trading special. The market rebound means that 18 of the 22 non-commodities related sectors traded with a smaller proportion of on specials at the end of March than the same period 12 months ago.

Telecommunication firms are one key holdout from this trend as 20% of the sector now trades special, up from 15% 12 months ago. This is only a small consolation for the industry however as the sector is only responsible for 83 of the 5,000 most actively traded equities in the securities lending market, less than a quarter of those in the energy sector.

Specials getting cheaper

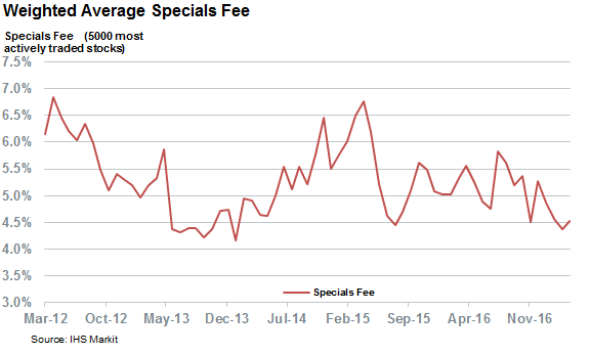

Borrowers are also less willing to pay up for the shrinking number of specials as the weighted average fee commanded by all special stocks fell to 4.5% at the end of Q1, down from 5.6% 12 months prior.

Both the falling proportion of specials and their increasing cheapness combined explain the near totality of the $299m revenue gap experienced in equities over Q1 as the average daily revenues from specials was $3m short of that delivered 12 months ago.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02052017-Equities-Specials-Dry-up-as-Volatility-Eases.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02052017-Equities-Specials-Dry-up-as-Volatility-Eases.html&text=Specials+Dry+up+as+Volatility+Eases","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02052017-Equities-Specials-Dry-up-as-Volatility-Eases.html","enabled":true},{"name":"email","url":"?subject=Specials Dry up as Volatility Eases&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02052017-Equities-Specials-Dry-up-as-Volatility-Eases.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Specials+Dry+up+as+Volatility+Eases http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02052017-Equities-Specials-Dry-up-as-Volatility-Eases.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}